3 Altcoins That Can Benefit If Bitcoin Crashes Below $70,000

Bitcoin has slipped nearly 7% in the past 24 hours and is now drifting closer to the critical $70,000 mark, a psychological level that could deepen fear across the broader crypto market if it breaks. As traders prepare for a possible downturn, attention is shifting toward specific altcoins that can benefit. Ones that may stay resilient if Bitcoin crashes below $70,000.

While most tokens tend to fall alongside BTC during major sell-offs, BeInCrypto analysts have identified three cryptocurrencies that are showing strong negative correlation, healthier chart structures, and improving capital flows. These signals suggest they could possibly outperform during market stress, making them potential opportunities even in a risk-off environment.

The White Whale (WHITEWHALE)

The White Whale (WHITEWHALE) is emerging as one of the few altcoins that can benefit if Bitcoin crashes under $70,000. All thanks to its growing independence from broader market trends. While most tokens have followed Bitcoin lower, the Solana-based WHITEWHALE has remained resilient.

It gained nearly 17% over the past seven days and rose close to 20% in the past 24 hours. This relative strength suggests that traders are possibly rotating into the token despite wider market weakness.

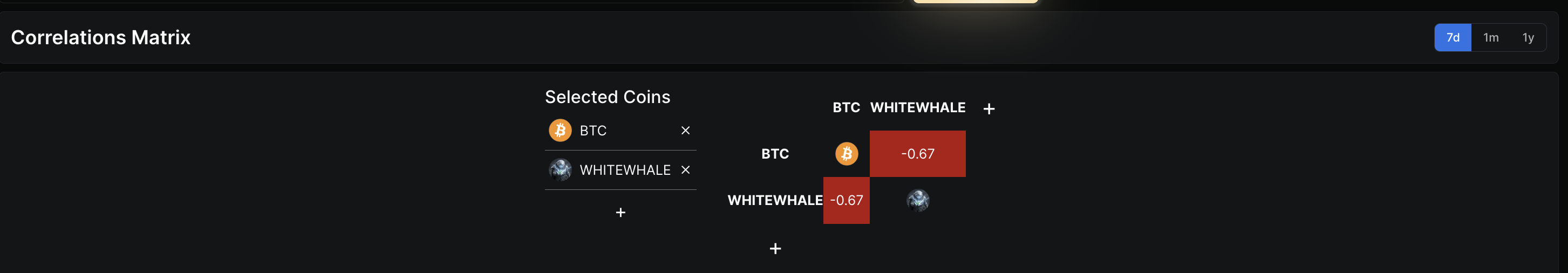

Over the last week, The White Whale has posted a strong negative correlation of –0.67 with Bitcoin. This means it has often moved in the opposite direction. This decoupling is important in a risk-off environment.

Negative Correlation With BTC: DeFillama

Negative Correlation With BTC: DeFillama

If Bitcoin crashes below $70,000, assets with low or negative correlation tend to attract speculative capital. And that makes WHITEWHALE one of the altcoins that can benefit from such a move. At the same time, the token is trading inside a bullish ascending channel on the 4-hour chart.

From a technical view, resistance sits near $0.127 and $0.143. A sustained move above this zone would confirm a breakout and open the path toward $0.226, implying upside of nearly 58% and a potential move into price discovery. On the downside, support lies at $0.098, with a deeper invalidation below $0.087. A break under these levels would weaken the bullish case and expose the price to a pullback toward $0.070.

WHITEWHALE Price Analysis: TradingView

WHITEWHALE Price Analysis: TradingView

Overall, The White Whale’s negative correlation, strong short-term performance, and bullish chart structure position it as a high-risk, high-reward candidate if Bitcoin enters a deeper correction.

Bitcoin Cash (BCH)

Bitcoin Cash is emerging as one of the altcoins that can benefit if Bitcoin crashes below $70,000, especially as it continues to show relative strength during broader market weakness. While the wider crypto market has slipped nearly 7% in recent sessions, BCH is down just over 1%, highlighting early signs of resilience. Over the past three months, it has also been up nearly 8%, making it one of the few large-cap altcoins still holding gains on a medium-term basis.

On-chain data supports this defensive setup. The Spent Coins Age Band metric, which tracks how many previously dormant coins are being moved, shows a sharp decline in activity.

Since early February, this figure has fallen from around 18,900 coins to roughly 8,278, a drop of nearly 56% in just a few days. This means far fewer long-held BCH tokens are being sold, even as prices remain under pressure. When coins stay inactive during market stress, it often reflects growing holder confidence.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Coin Activity Dips: Santiment

Coin Activity Dips: Santiment

At the same time, the Chaikin Money Flow (CMF) indicator, which measures whether large capital is entering or leaving an asset using price and volume, has risen steadily between January 29 and February 5. CMF has climbed back toward, and briefly above, the zero line, showing that large buyers are quietly increasing exposure despite weak sentiment elsewhere.

From a technical perspective, BCH needs to hold above $523 to maintain this structure. A daily close above $558 would strengthen the bullish case and open the path toward $615 and $655, with $707 as an extended target if conditions improve.

BCH Price Analysis: TradingView

BCH Price Analysis: TradingView

However, failure to reclaim $523 could expose the price to a deeper pullback toward $466.

Hyperliquid (HYPE)

Hyperliquid’s native token, HYPE, stands out as one of the altcoins that can benefit if Bitcoin crashes below $70,000. It is mainly because it has been moving in the opposite direction to BTC. Over the past month, HYPE is up nearly 28%, while Bitcoin has dropped around 24%.

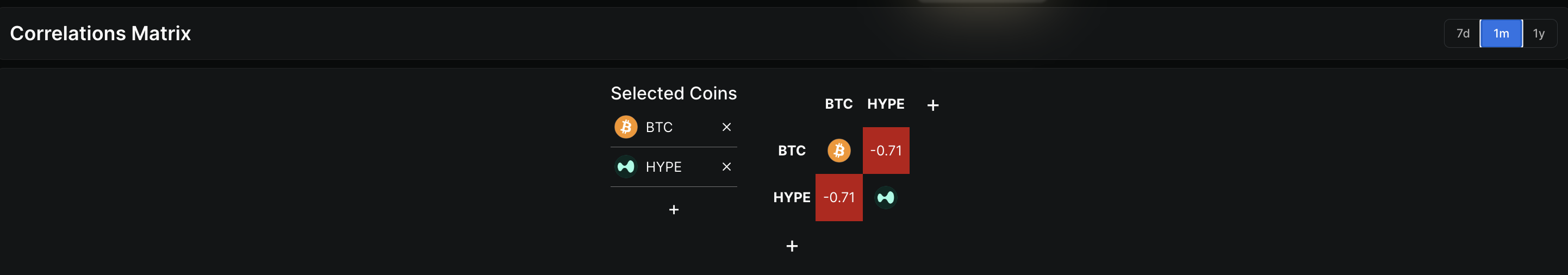

During the same period, its correlation with BTC stands at –0.71, showing a strong inverse relationship. This means that when Bitcoin weakens, HYPE has recently tended to rise, making it a candidate for traders looking for relative strength during market stress.

HYPE-BTC Correlation: DeFillama

HYPE-BTC Correlation: DeFillama

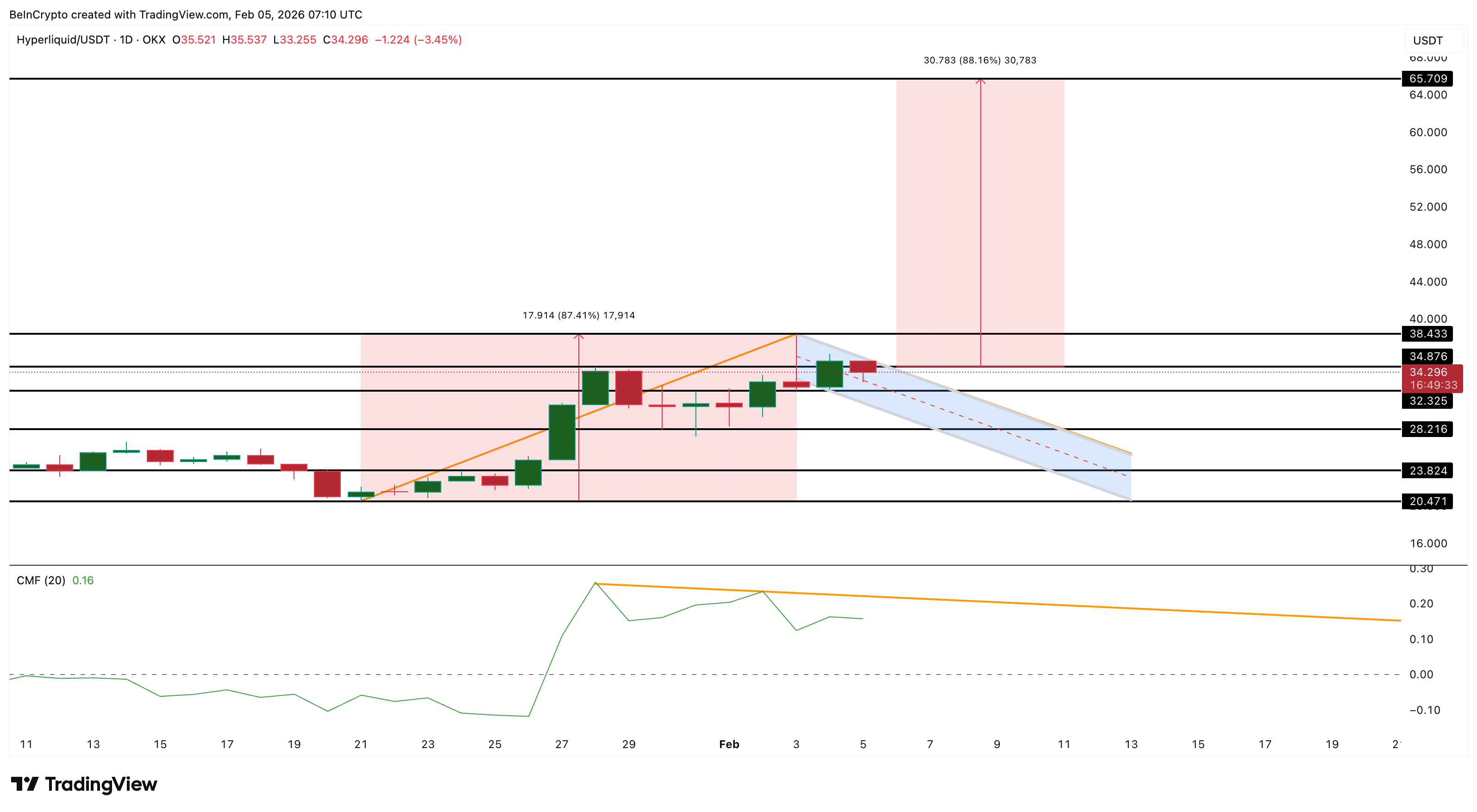

The HYPE price chart supports this divergence. After rallying toward the $38.43 zone earlier, HYPE entered a consolidation phase that now resembles a bullish flag-and-pole pattern. This structure usually forms when an asset pauses after a strong rally before attempting another upward move. If the upper trendline breaks, the pattern projects a potential upside of around 87%.

Capital flow data also remains supportive. The Chaikin Money Flow (CMF) is still positive, showing that large buyers are active. However, CMF is moving below a descending trendline, meaning stronger inflows are still needed to confirm a new flag breakout.

For bullish confirmation, HYPE needs a clean daily close above $34.87. Clearing this level would open the path toward $38.43 first, and potentially toward the $65.70 zone if momentum builds. On the downside, weakness below $28.21 would damage the setup, while a fall under $23.82 would invalidate the bullish structure.

HYPE Price Analysis: TradingView

HYPE Price Analysis: TradingView

If Bitcoin crashes under $70,000 and HYPE maintains its negative correlation, strong structure, and inflow support, it remains one of the altcoins that can benefit from market stress rather than suffer from it.