Cardano on-chain indicators flash buy signals

- Cardano holders have consistently realized losses and shed ADA holdings nearly every day in April.

- On-chain metrics show 40% of the wallets holding ADA are currently profitable, nearly 60% remain underwater.

- ADA has seen an increase in large wallet transactions alongside a price decline, whales are likely buying the dip.

Cardano (ADA) investors have shed their holdings at a loss throughout April 2024, with the exception of a few days where profits were realized. On-chain metrics paint a bullish picture for Cardano price and generate buy signals.

Cardano on-chain metrics turn bullish

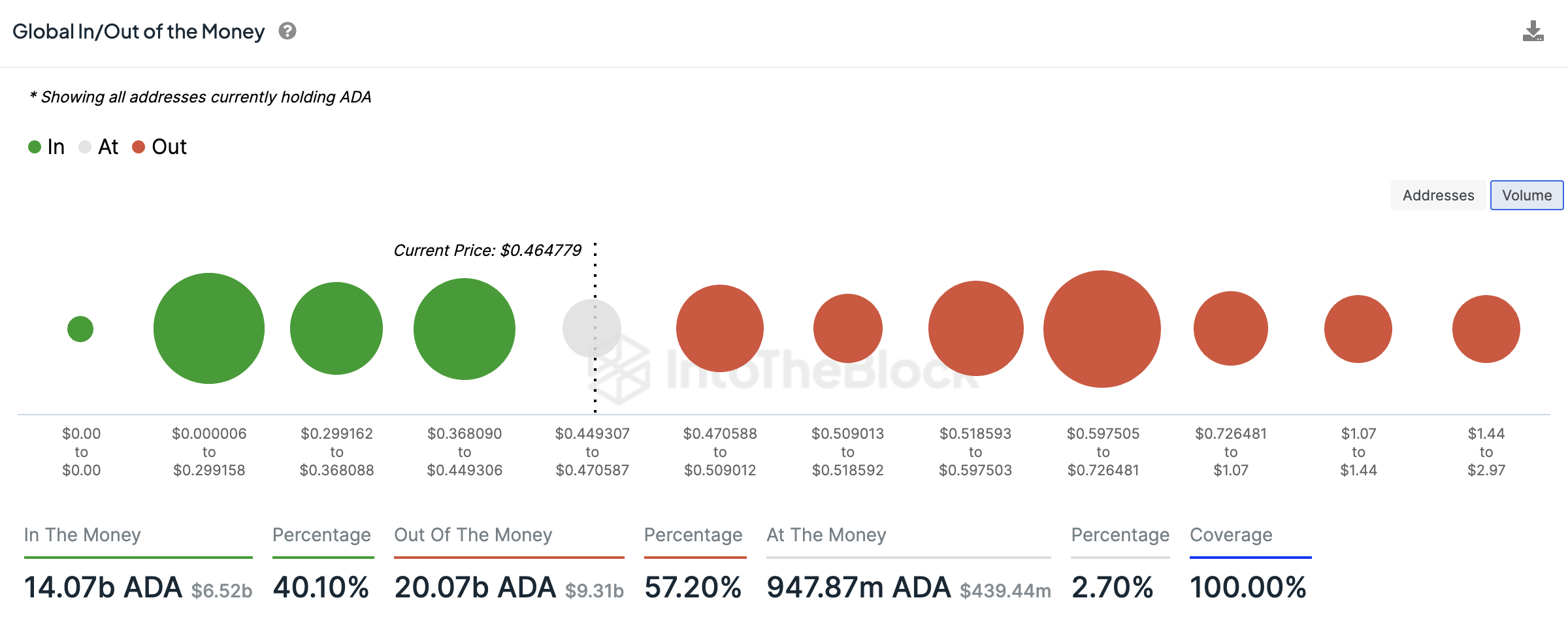

The Global In/Out of the Money (GIOM) indicator from crypto intelligence tracker IntoTheBlock that classifies addresses based on whether they are profiting (in the money), breaking even (at the money) or losing money (out of the money) on their positions at current price.

The GIOM for Cardano reveals that 40.10% of the wallet addresses holding ADA are currently profitable. Close to 60% wallet addresses are underwater or sitting on unrealized losses. Typically, when a large cohort of wallets (a higher percentage of addresses) is underwater, there is less likelihood of these entities shedding their ADA holdings.

Selling ADA at the current price of $0.4647 would result in a loss for 57.20% of the wallet addresses holding the altcoin, thus reducing the likelihood of a sell-off. This may be considered a good time for sidelined buyers to “buy the dip,” preparing for the altcoin’s recovery.

Global In/Out of the Money Cardano

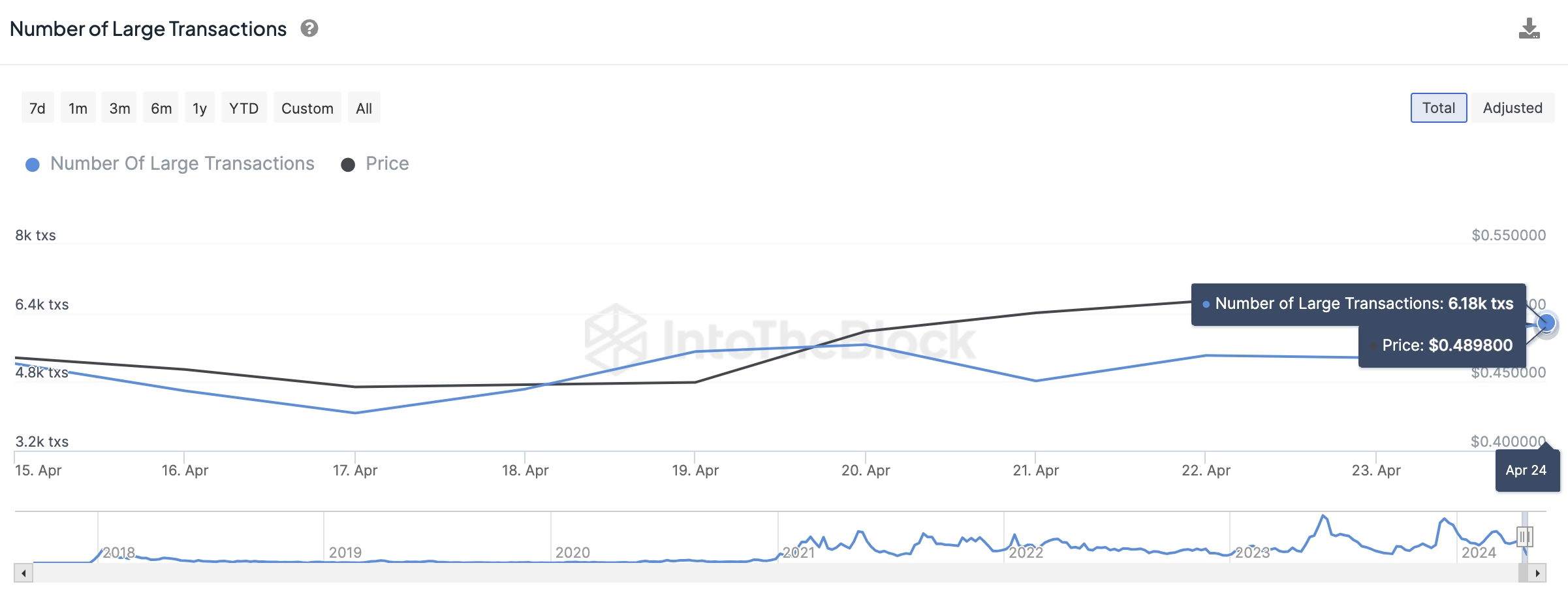

Additionally, the number of large transactions from IntoTheBlock is a metric that tracks transactions with a value greater than $100,000 on the Cardano blockchain. This helps identify whale activity. When combined with the asset’s price, the metric helps identify whale movements.

The number of large transactions climbed to 6,180 on April 24, a single-day increase of 15%. At the same time, ADA price dropped nearly 4% to $0.4898. An increase in the count of large transactions combined with a price decrease signals the possibility of large wallet investors “buying the dip” or accumulating ADA.

Number of Large Transactions

Cardano holders have consistently shed ADA tokens at a loss throughout April 2024, with the exception of a few days when net profit was realized by traders. The Network Realized Profit/Loss metric on Santiment calculates the net profit or loss (USD value) for all coins that were transacted over a fixed period of time.

When combined with price, the metric provides a reflection of the aggregate market sentiment, capital inflows or outflows, and points towards capitulation or related events.

This is in line with capitulation in the altcoin, generating a buy signal for Cardano.

%20[18.44.54,%2025%20Apr,%202024]-638496551564631785.png)

Network Realized Profit/Loss

At the time of writing, Cardano price is $0.4679 on Binance, down nearly 2% on the day.