Vitalik Buterin slams controversial gambling project ZKasino following scam allegations

- Vitalik Buterin condemned ZKasino’s use of the Zero-Knowledge or ZK in its name.

- Buterin warned that ZK is a mainstream buzzword adopted by scammers.

- The project has been criticized heavily on X, related firms have allegedly distanced themselves from the controversy.

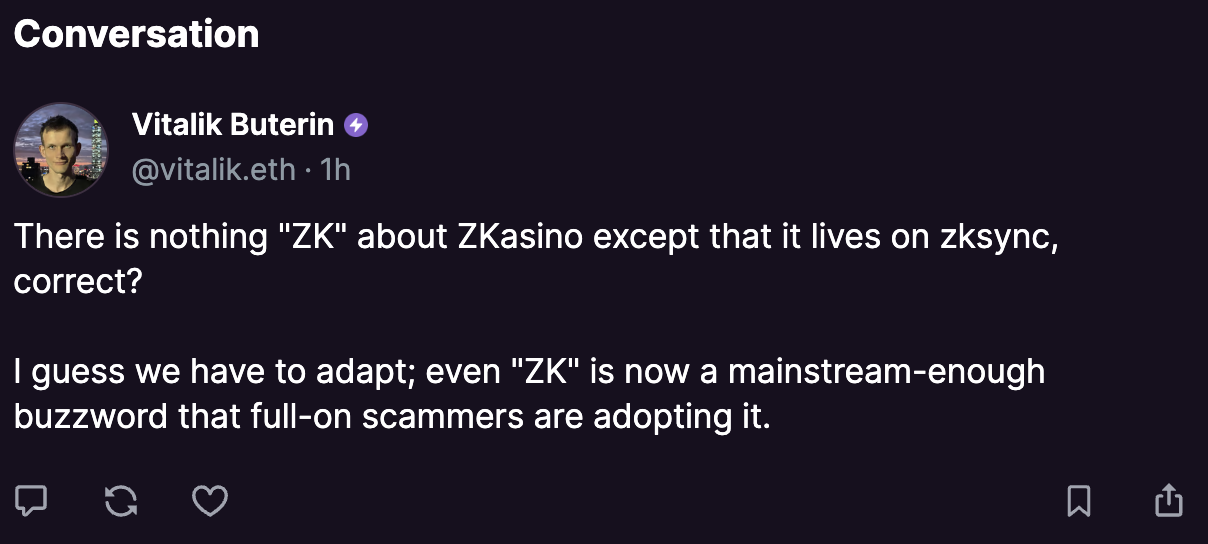

Ethereum founder Vitalik Buterin took to Warpcaster, a new type of social network, to condemn ZKasino, a decentralized gambling platform based on Layer 2 Ethereum protocol zkSync. Buterin has warned market participants against scammers adopting buzzwords like Zero Knowledge (ZK) in its names.

Controversial gambling project on Buterin’s radar

ZKasino is being criticized on X for moving investor and user funds to the staking protocol Lido. In a blog post dated April 20, the blockchain gambling project announced that ZKasino mainnet is live and over 10,000 users bridged nearly 10,500 Ether.

The project changed its initial plan to return Ether and staked it on Lido instead, citing a “seamless transition” for users since the chain doesn’t use Ether. Users shared concerns about the change of policy on X, alleging “rug pull” and “scam.”

Buterin chimed in, through a Warpcast post, expressing his concerns regarding the use of ZK as a buzzword, rather than the technology that powers a project. The Ethereum boss warned users against scammers.

Buterin’s Warpcast post

X user @arndxt_xo said in a tweet: “We might have just witnessed the biggest rug in 2024. Investing early in Zkasino cost us over $33M. Official Telegram's gone, they dumped a massive amount of ETH on Lido, and the founders vanished.”

11/ To make matters worse, ZKasino had also initially announced that anyone could lock ETH and farm $ZKAS, and their ETH would be returned

— arndxt (@arndxt_xo) April 22, 2024

However, after no approval whatso-ever, they decided to convert this ETH into $ZKAS at $500M FDV pic.twitter.com/fNfBj12rFm

Co-founder of Rollbit, another crypto casino slammed ZKasino:

Can we short $ZKAS?

— Lucky (@Lucky_Rollbit) April 20, 2024

Study the grifters continuously FUD'ing Rollbit, they're often the dirtiest scammers of them all.

Sucks to see these fuckers successfully steal tens of millions from our industry even after countless warnings from notable figures in this space.

The only… pic.twitter.com/az9ibEXn77

ZKasino parent firm ZigZag Labs and investor MEXC exchange didn’t immediately respond to FXStreet’s request for comment about the scam allegations. According to a Cointelegraph report, Big Brain Holdings, an investor of ZigZag Exchange has distanced itself from the controversy.

Big Brain Holdings invested into the @zigzagexchange project in 2022, which subsequently resulted in financial losses for us. Some of the previous founders of that project are now part of the @ZKasino_io team, which appears to be fraudulent.

— Big Brain Holdings (@BigBrainVC) April 21, 2024

We have never invested in ZKasino…