Starknet jumps 2% after notice inviting specific groups to claim STRK airdrop

- Starknet invited pooled stakers, StarkEx and VeVe users to claim their STRK airdrop through a portal.

- The Foundation has identified a list of eligible stakers on protocols like LidoFinance and RocketPool, inviting them to claim.

- STRK price increases by 2% on Wednesday.

Starknet Foundation addressed the groups within the STRK community that were unable to receive the token’s airdrop during the first round. The Layer 2 chain organized an airdrop event in February. Due to mislabeling of user groups and staking assets on chains like LidoFinance and RocketPool, several eligible participants were unable to receive the airdrop.

Starknet has revealed a plan to complete the airdrop to these user groups, citing the step by step process for participants to claim their STRK tokens.

In the latest announcement, the Validity-Rollup Layer 2 chain shared a provision for those who faced trouble claiming STRK.

Starknet invites eligible groups to claim STRK airdrop

The Ethereum Layer 2 network made an official announcement in a recent tweet, sharing an update on when eligible groups can claim STRK tokens across staking protocols like LidoFinance and RocketPool.

Dear Starknet community,

— Starknet Foundation (@StarknetFndn) April 24, 2024

Last month, we updated you about the efforts to assist three sub-categories that were eligible for Round #1 of Starknet Provisions but had trouble claiming.

These groups are:

1. Pooled stakers

2. StarkEx users who were mislabeled as VeVe users:

3.… pic.twitter.com/QptZrkD3a7

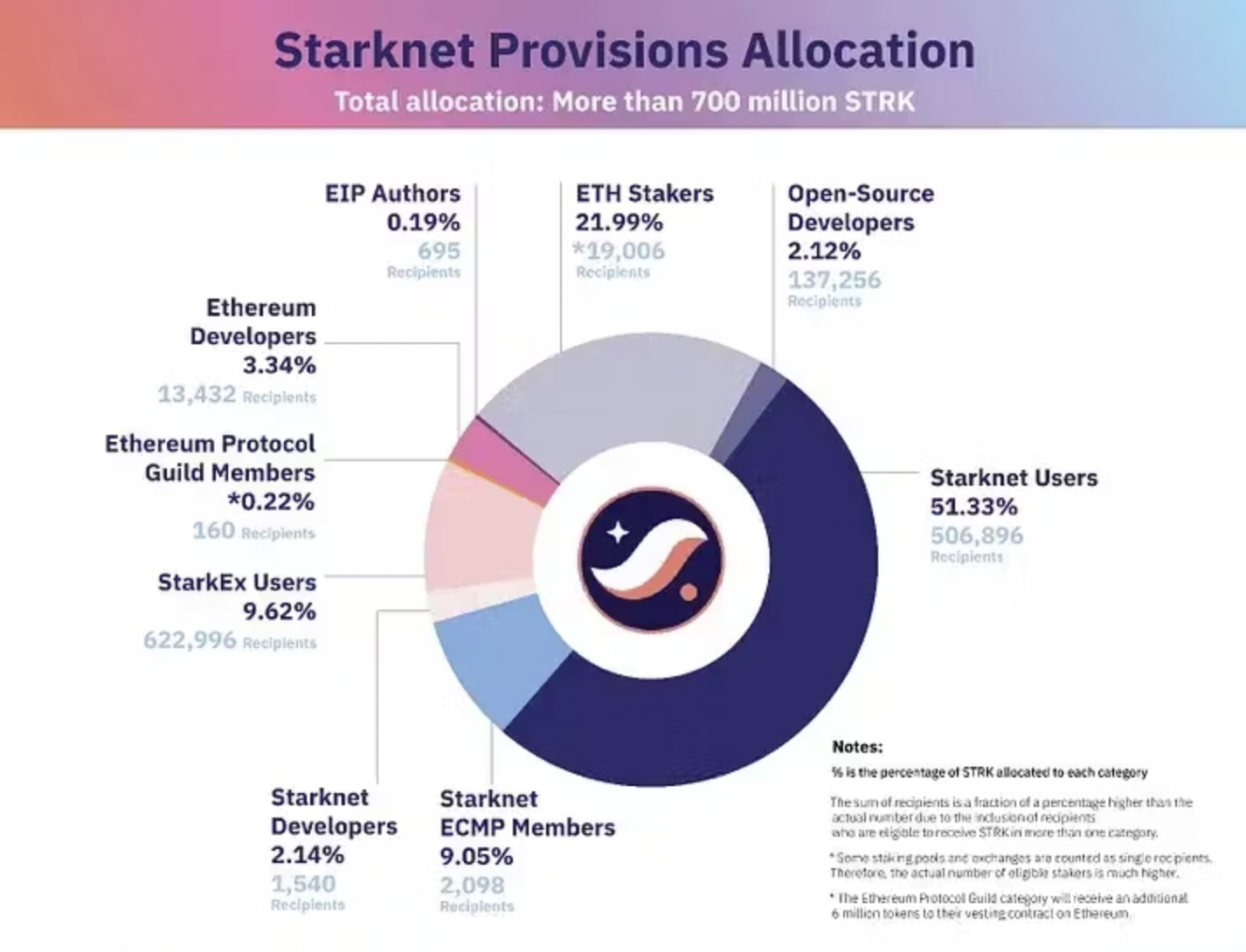

The protocol organized its airdrop on February 20, and the eligibility criteria were released a week prior. The claim window for STRK tokens is four months and ends on June 20. The following chart shows the allocation of tokens for different eligible groups.

Starknet Allocation

The three groups are: pooled stakers, StarkEx users (who were previously mislabeled) and VeVe users. StarkEx is a scaling engine and VeVe is a licensed digital collectibles platform. The Layer 2 chain invited the groups to directly claim their tokens from the Provisions Portal, instead of a conventional airdrop to their respective wallets.

The complete list of protocols where Starknet has identified eligible users is LidoFinance, RocketPool, BloxStaking, SharedStake, Stakefish, Consensys, and Ankrstaking.

STRK price clims 2% on Wednesday. The Layer 2 token is trading at $1.344 on Binance, at the time of writing.