SOL rises 5% as transaction activity becomes long-standing highlight of Solana Network’s performance

- Solana price is up 5% after landmark fourth Bitcoin halving.

- SOL has dominated daily transactions, boasting 30% across layer 1 and layer 2 networks.

- After completing a rounding bottom pattern, Solana price could rally as bulls hold $130.45 support.

Solana (SOL) price is among the top gainers among the large market capitalization-sized tokens following the successful conclusion of the fourth Bitcoin halving. The token has been a top performer throughout the fourth quarter (Q4) of 2023, with the sentiment extending across the most part of Q1 of 2024.

Also Read: Solana rolls out update to tackle network congestion

Solana network performance puts SOL on a pedestal

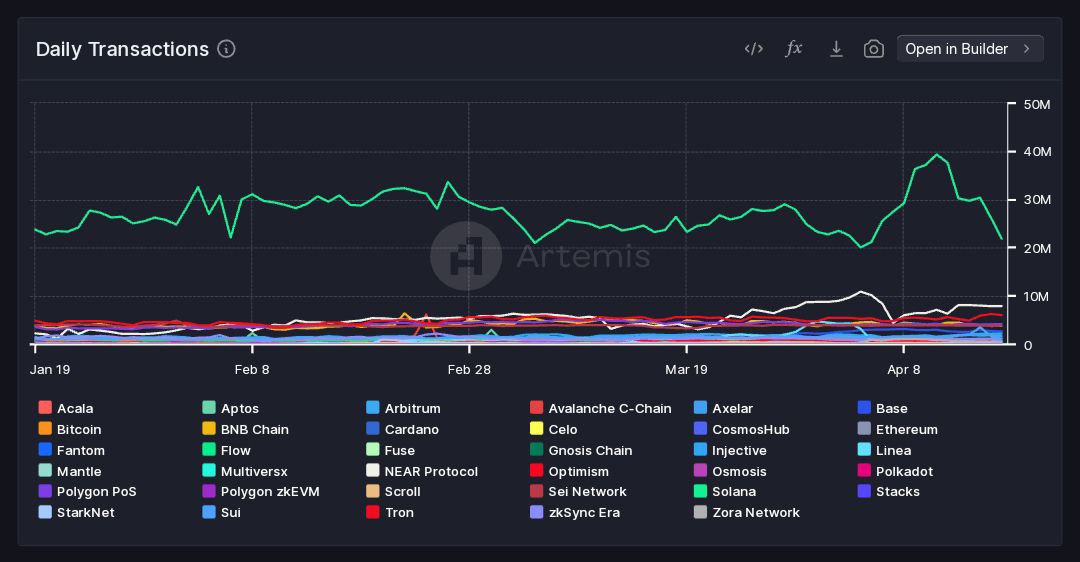

As Solana continues to be a powerhouse in the cryptocurrency playing field, institutional data platform for digital assets Artemis shows that Solana is dominating daily transactions, accounting for over 30% across layer 1 (L1) and layer 2 (L2) networks.

Data according to this dashboard showcases the heft of Solana as a powerhouse in transaction activity, which has for the longest time highlighted Solana's performance.

Daily transactions

Solana is a high-performance blockchain platform known for its fast transaction speeds and low fees. Transaction activity on the Solana network refers to the volume of transactions being processed on the blockchain at any given time.

This activity can include various interactions such as transferring SOL, executing smart contracts, decentralized applications (dApps) interactions, and more. Solana has emerged as the leading platform for on-chain financial activity, with its total transaction fees surging by approx. 417%. With this, it surpassed BNB Chain and Tron as meme coins on the blockchain continue to raise hundreds of millions.

The activity was so much that recently the network suffered a slowdown, ascribed to the current software system being unable to handle the overwhelming traffic volume. Head of communications for Solana Labs had addressed the issue in an X post.

Developers from Anza, Firedancer, Jito, and other core contributors are working diligently (and not sleeping much) to shore up Solana's networking stack to meet the unprecedented demand the network is seeing today.

— Austin Federa | (@Austin_Federa) April 10, 2024

There's been a lot of threads on what exactly is causing the…

Solana price recently completed a rounding bottom pattern, which is a bullish reversal pattern that happens after a prolonged downtrend. With the $130.45 support holding, Solana looks primed for a rally, which could be activated by a bullish reaction from altcoins following the BTC halving.

Also Read: Solana price primed for a breakout as it completes a rounding bottom pattern