XRP Price To End 2-Year Streak As It Prepares To Close 2025 At Loss

XRP entered the final quarter under heavy pressure after a sharp sell-off erased much of its earlier gains. The Q4 decline has placed the altcoin on track to close 2025 in negative territory.

Despite this setback, the hope lingers that buying activity from investors could attempt to reverse momentum before the year ends.

XRP Holders Sold At A Loss

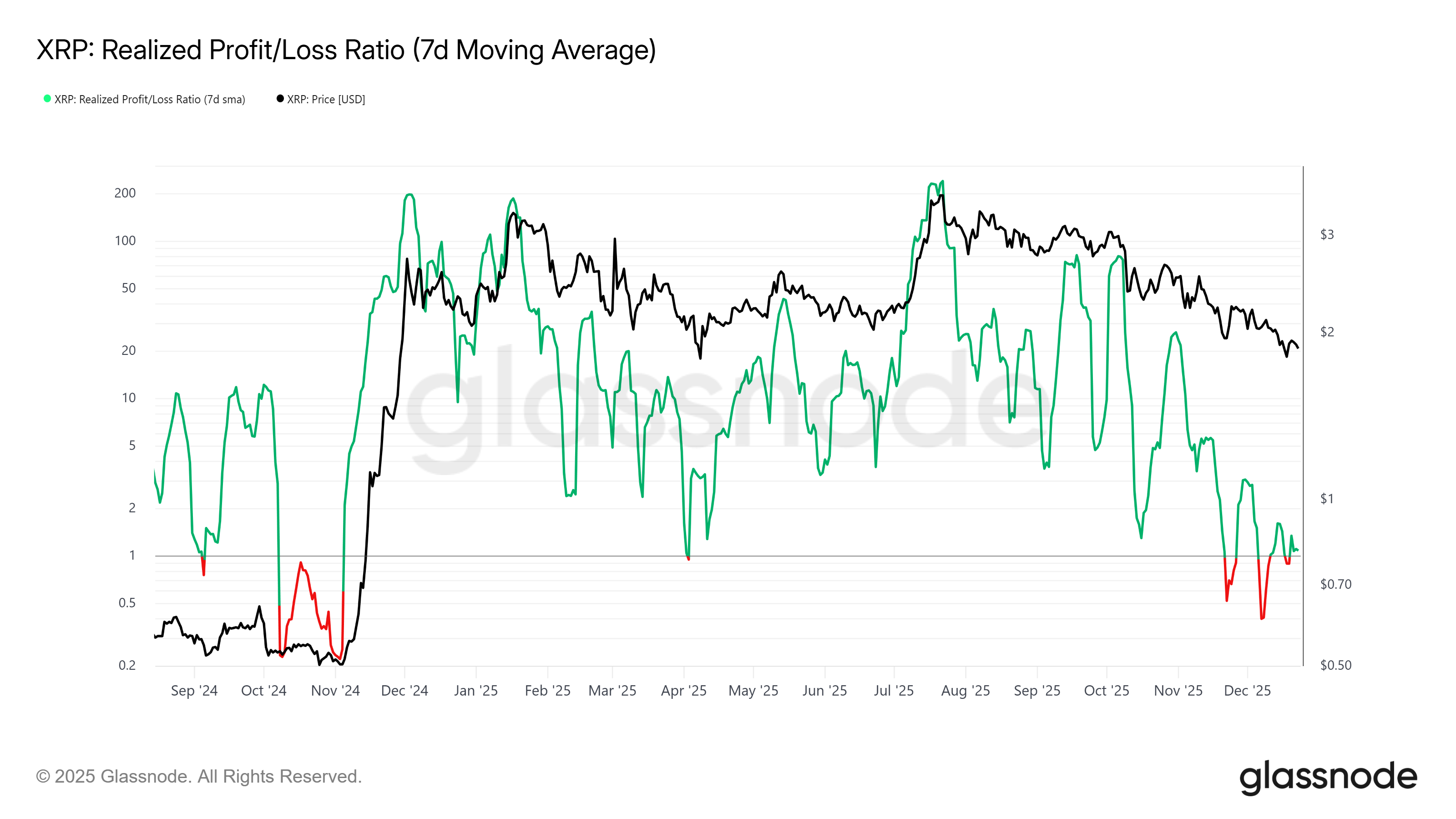

On-chain realized profit and loss data show Q4 selling was unusually aggressive. XRP holders exited positions at a loss, signaling deteriorating confidence. Historically, investors in large-cap tokens tend to hold through drawdowns, expecting eventual recovery rather than crystallizing losses.

This cycle appears different. Selling at a loss indicates heightened uncertainty around XRP’s near-term outlook. The behavior suggests risk aversion has outweighed long-term conviction, contributing to sustained downside pressure during the quarter.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Realized Profit/Loss. Source: Glassnode

XRP Realized Profit/Loss. Source: Glassnode

The Past Comes To An End

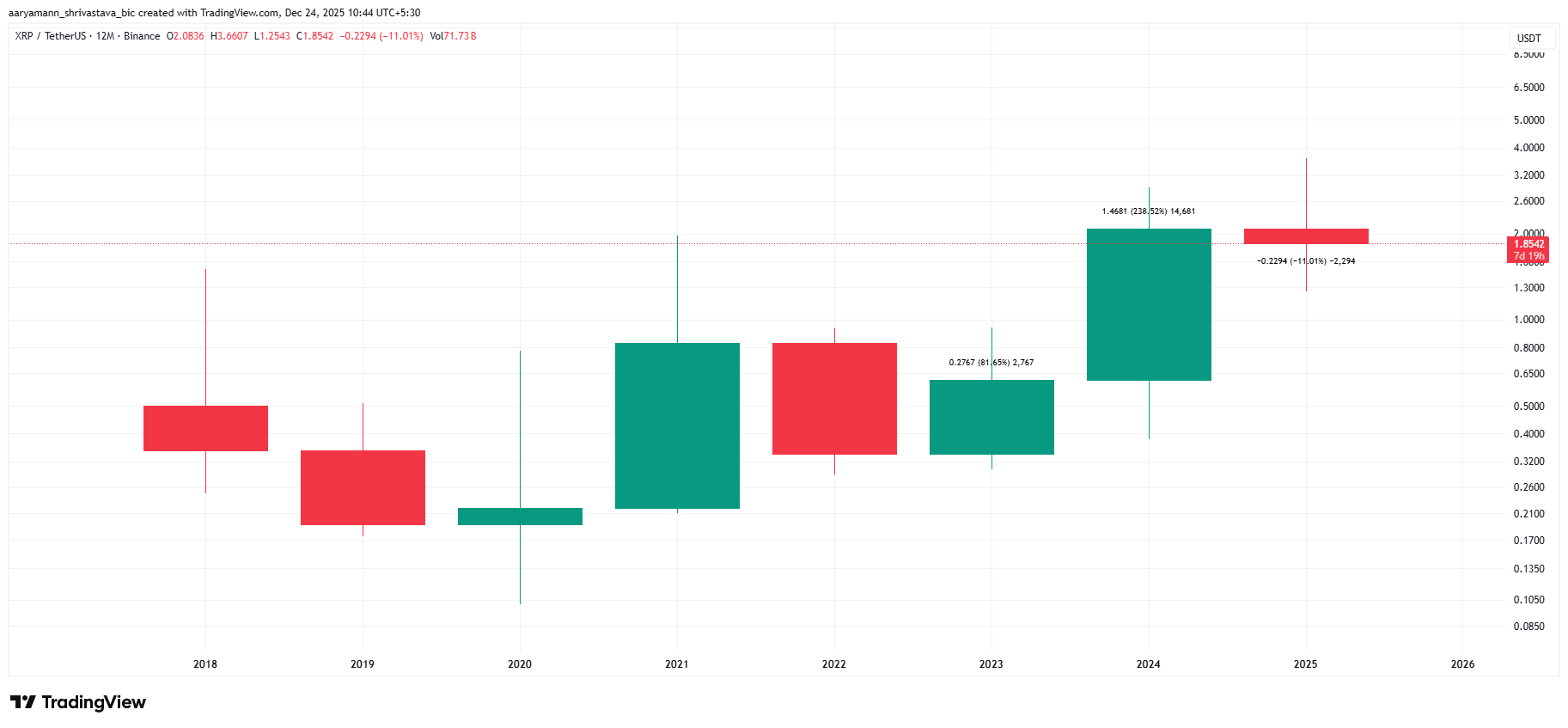

XRP’s broader performance context highlights the challenge. The current market cycle threatens to end a two-year streak of positive annual returns. In 2023, XRP rallied 81%, followed by a 238% surge in 2024, driven by improving regulatory clarity and speculative demand.

In contrast, 2025 has been marked by weaker momentum. If current levels persist, XRP may close the year down approximately 11%. This reversal highlights how shifting macro conditions and investor sentiment can disrupt even strong historical trends.

XRP Annual Returns. Source: TradingView

XRP Annual Returns. Source: TradingView

Does XRP Have A Chance?

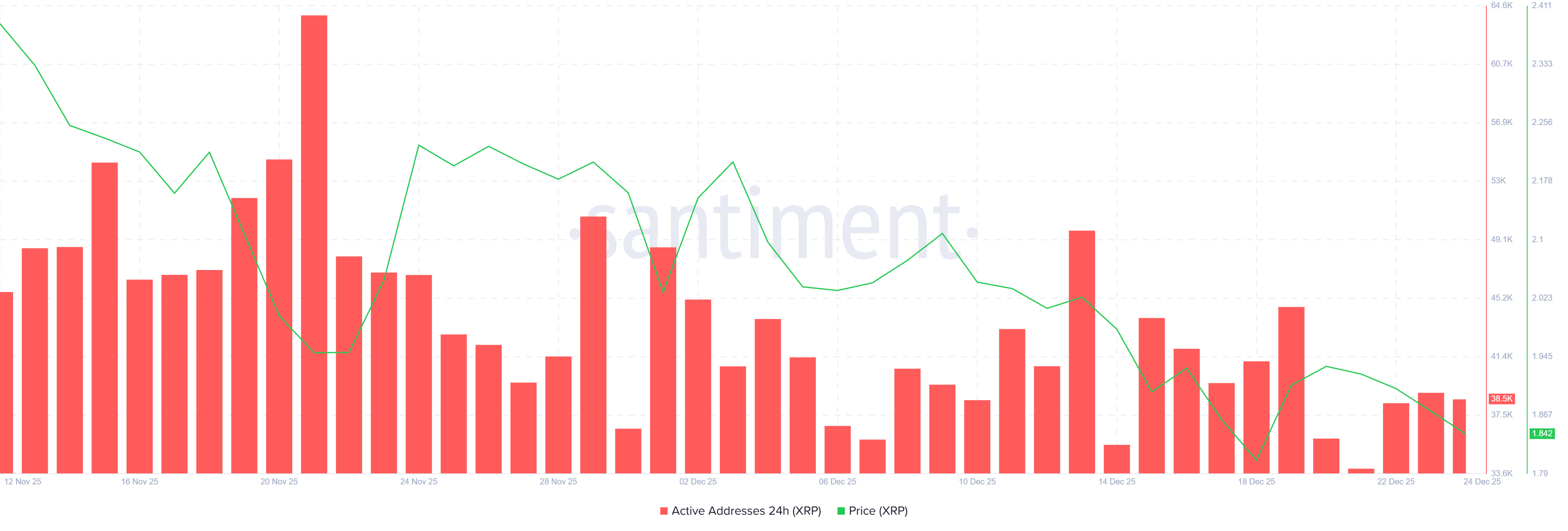

Despite the drawdown, activity on the XRP Ledger has decreased in late December. Network data shows the number of active transacting addresses reached a monthly low of 34,005. Declining participation suggests renewed engagement from both retail and institutional users is weak.

Higher transaction activity often correlates with improving demand. Low usage can support price decline by affecting liquidity and losing reinforcing utility-driven interest. This late-year decline may reflect strategic positioning ahead of 2026 rather than short-term speculation.

XRP Active Addresses. Source: Santiment

XRP Active Addresses. Source: Santiment

XRP Price Might Change Its Direction

XRP trades near $1.85 at the time of writing, down 11% since the start of 2025. To neutralize annual losses, the token must recover to $2.10. Achieving this level would allow XRP to close the year flat, preserving its long-term performance record.

However, for now, downside risk remains if market conditions deteriorate. Failure to hold $1.85 could trigger a slide toward $1.70. Such a move would invalidate the bullish thesis and confirm a negative annual close, extending uncertainty into early 2026.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

A recovery path depends on defending the $1.85 support, with the help of rising participation. Holding this level could enable a rebound toward $1.94. Breaching that resistance is critical for flipping $2.00 into support, clearing the final hurdle toward the $2.10 target.