Ripple Price Prediction: Why Is XRP Price Falling? Can It Rise to $10 in the Future?

XRP Current Price

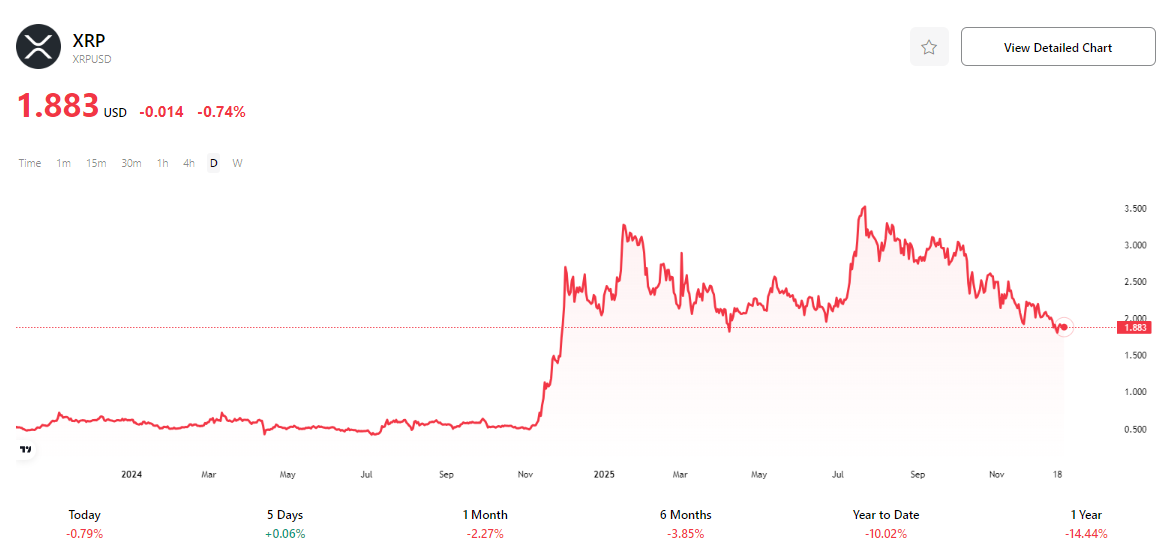

TradingKey - As 2025 draws to a close, Ripple's (XRP) price performance has been underwhelming. Year-to-date, XRP's price has cumulatively declined over 10%, currently standing at $1.88, exhibiting a classic "double top" pattern, with market sentiment predominantly bearish.

Ahead of Trump's presidential inauguration, bullish sentiment surged across the crypto market, leading to widespread gains among major cryptocurrencies. XRP's price followed suit, rallying to approximately $3.3 and breaking historical records. On January 20, 2025, as the U.S. held its presidential inauguration and Trump officially assumed office as the 47th President, XRP's price briefly spiked before retreating on the same day. It subsequently experienced a three-month continuous decline, bottoming out at $1.6 on April 7, representing a cumulative drop of over 50%.

XRP Price Chart, Source: TradingView.

XRP Price Chart, Source: TradingView.

On April 10, the SEC announced that Paul Atkins would replace Gary Gensler as its new chairman, which ignited widespread jubilation across the crypto market, prompting XRP's price to halt its decline and rebound. Subsequently, regulatory bodies such as the SEC and CFTC signaled a relaxation of regulations, XRP's price surged to $3.62 on July 21, setting a new all-time high.

Why is XRP price falling?

In the first half of 2025, the reasons for the decline in XRP's price are relatively easy to understand, as Trump's presidential election victory signaled the realization of positive news, and profit-taking suppressed XRP's price. However, what puzzled many was, despite the Federal Reserve's three interest rate cuts in the second half of the year, XRP's price fell instead of rising. Why exactly did this happen?

From XRP's own standpoint, there was no significant negative news; on the contrary, there was a positive development. On November 13, the first spot XRP ETF in the U.S. (Canary Capital's XRP ETF) was officially launched, attracting over $250 million in inflows on its first day of trading. In early December, Ripple CEO Brad Garlinghouse posted that 'the total assets under management for listed XRP spot ETFs surpassed the $1 billion mark, making XRP the fastest cryptocurrency to reach this milestone since the launch of the ETH spot ETF.'

In 2025, the Federal Reserve held a total of eight monetary policy meetings, with interest rates remaining unchanged in the first five meetings, and then cutting rates by 25 basis points in the final three meetings, specifically in September, October, and December. However, these three rate cuts did not reverse XRP's downward price trend. The most crucial reason was that the dot plot indicated significant internal disagreement within the Federal Reserve regarding further rate cuts next year, severely undermining cryptocurrency market confidence, with the weakening price of Bitcoin being the most typical manifestation of this.

As shown in the chart below, XRP's price trend is highly similar to Bitcoin's, with similar declines this year, and both exhibiting a 'double top' price pattern. This suggests that XRP's price weakness is not internally driven, but rather a flight of capital caused by expectations of the Federal Reserve tightening liquidity. Furthermore, it cannot be overlooked that the cryptocurrency market is facing a four-year cycle restrictive cycle, limiting the inflow of speculative capital.

Bitcoin Price Chart, Source: TradingView.

Bitcoin Price Chart, Source: TradingView.

XRP Price Prediction: Will it Rise or Fall in 2026?

In 2025, XRP's price performance was less than satisfactory, leading investors to anticipate a significant improvement in 2026. However, market sentiment regarding XRP's price outlook is mixed. Overall, the market broadly anticipates XRP's price to fluctuate widely, maintaining a range between $1.8 and $3; pessimistic forecasts project a drop to $0.5, while optimists predict a surge to $9.

Among these projections, Lacie Zhang, a research analyst at Bitget Wallet, believes XRP's price will experience more intense volatility in 2026, potentially falling to $1.4 on the downside. On the upside, it could rise above $4, setting a new all-time high.

Ripple CEO Brad Garlinghouse believes the bull market is not yet over, suggesting XRP could still reach new highs. Garlinghouse forecasts that in 2026, Bitcoin will surge to $180,000, and XRP's price will consequently challenge the $5 mark.

Standard Chartered Bank is even more bullish on XRP, with its analyst, Geoffrey Kendrick, predicting that XRP will rise to $8 in 2026, driven by U.S. regulatory clarity and the approval of a spot XRP ETF.

How high can XRP rise in the future?

Currently, the market's outlook on XRP's price trend is inconsistent, with significant divergence in price predictions, suggesting both upward and downward movements are possible, and the driving forces also vary considerably. Among these, Brad Garlinghouse's prediction logic and target price appear relatively more reasonable.

From the above, it can be seen that XRP's price movements are no longer driven by internal factors but primarily follow Bitcoin's price fluctuations. This keeps its volatility direction, magnitude, and timing largely consistent with Bitcoin. This is also the general pattern for most major cryptocurrencies, which tend to correlate with Bitcoin's price movements, thereby substantiating the rationality of Brad Garlinghouse's analytical framework.

If Bitcoin were to rise to $180,000, as Brad Garlinghouse suggested, this would represent an increase of over 100% from its current level. Based on this appreciation and XRP's current price of $1.88, its future price should exceed $3.76. Furthermore, if an "altcoin season" were to occur, XRP's gains could surpass Bitcoin's; therefore, its price could potentially reach $5.

However, Can XRP reach $10 in the future? Solely from the perspective of its correlation with Bitcoin, the likelihood of XRP's price reaching $10 within the next two years is relatively low, unless Bitcoin surges over 400% to $500,000, or XRP itself experiences a significant positive catalyst, such as the United States or another major nation directly purchasing and reserving XRP.

Is now a good time to buy XRP?

Despite the high uncertainty surrounding XRP's future price trajectory, from a technical analysis perspective, XRP is currently flashing a buy signal. As of this writing, XRP is trading at $1.877, situated within a strong support zone that it tested multiple times in April, June, and October 2025 without breaking below. Nevertheless, if it breaches $1.6, a prompt stop-loss should be implemented, given the absence of significant support below that level.

XRP Price Chart, Source: TradingView.

XRP Price Chart, Source: TradingView.

Looking at the next five years, the current price level also represents a relatively low-priced area, assuming that the peak of a new bull market typically far exceeds that of the previous one. Therefore, if one currently holds no position, a modest allocation to XRP (recommended below 10%) could be considered to avoid missing out on a prolonged cryptocurrency bull run.

Conclusion

XRP has weakened this year due to profit-taking, capital outflows, and its correlation with Bitcoin. Despite support from potential spot ETFs and favorable regulatory developments, significant market divergence, liquidity concerns, and macroeconomic uncertainties persist. XRP's price is expected to experience short-term volatility. While a rise to $10 within the next two years is an extreme and unlikely scenario, a relatively attractive buying opportunity is currently emerging.