Avalanche Price Forecast: Record high active addresses boosts AVAX whales interest

- Avalanche trades above $12, approaching the overhead trendline of a falling wedge pattern.

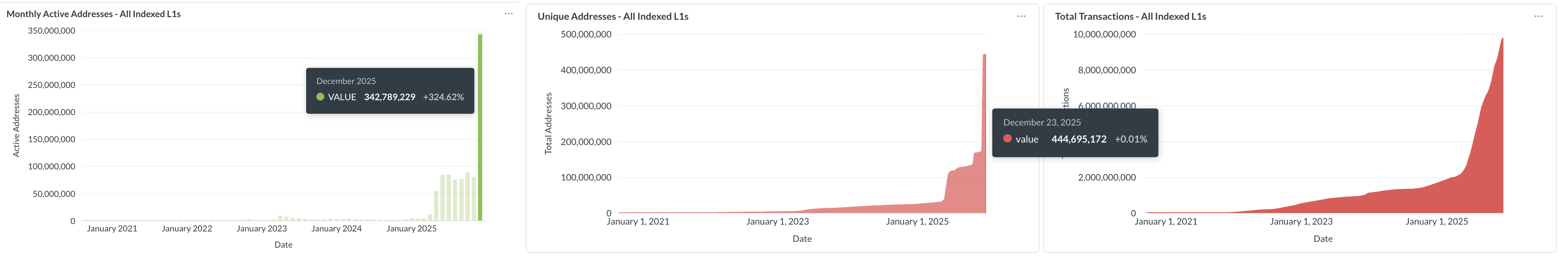

- Active addresses on Avalanche hit a record high of over 342 million so far in December, suggesting a surge in network activity.

- Derivatives data signals an increase in whales' risk appetite amid rising Open Interest.

Avalanche (AVAX) trades above $12 at press time on Tuesday, following a 2% rise on the previous day. The layer-1 blockchain token shows signs of recovery, with active addresses hitting a monthly record high in December, and large wallet investors, commonly referred to as whales, are backing the renewed risk-on sentiment in the derivatives market. Technically, AVAX upswings within a descending falling wedge pattern, with bulls eyeing a potential breakout rally.

Whales regain confidence amid record-high network activity

Avalanche network data reveals a surge in user activity in December, hitting a record high of over 342 million so far. This has boosted the total unique addresses on the network to over 444 million, and the total transaction count is closing in on 10 billion. A boost in overall network activity could increase the demand for its native token, AVAX, which is necessary for operations.

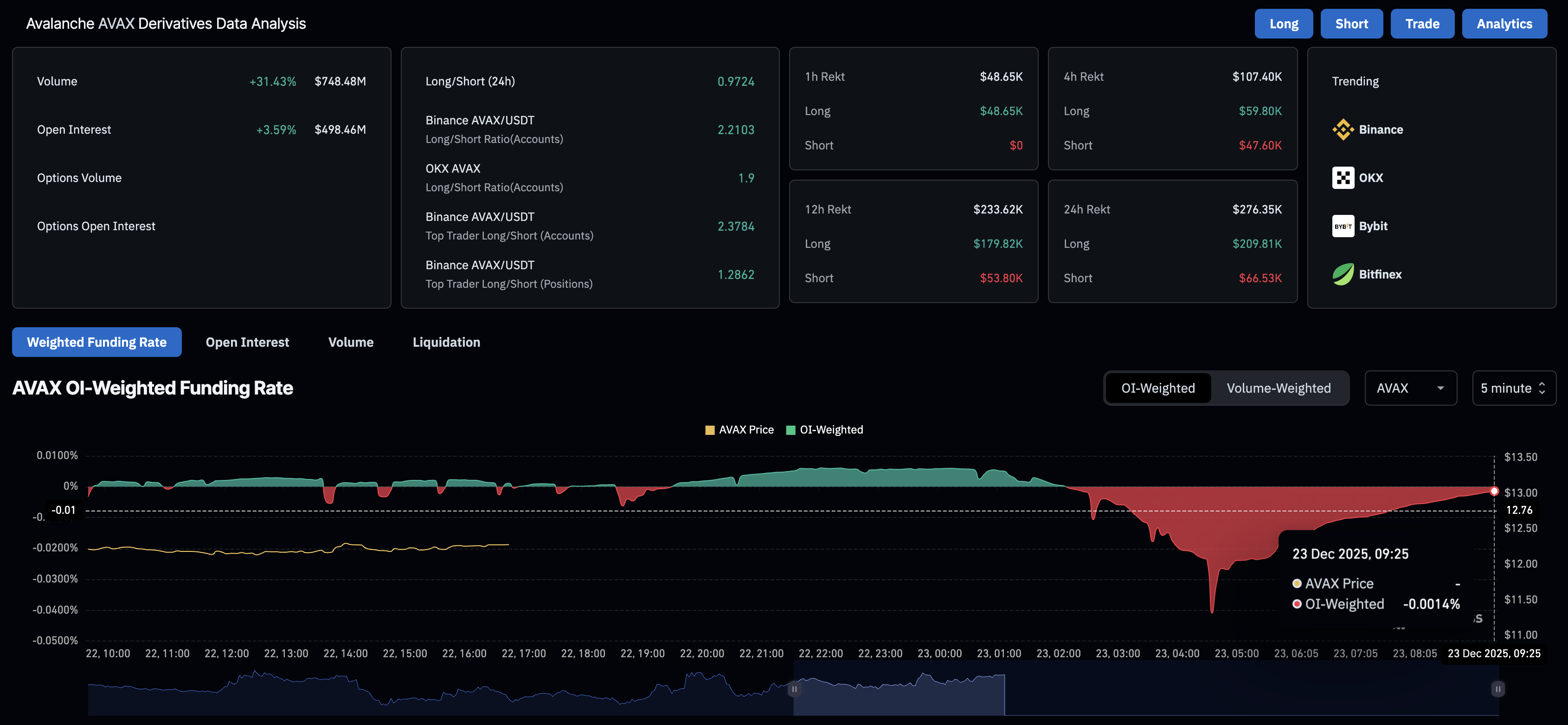

In the derivatives market, CoinGlass data shows that AVAX futures Open Interest (OI) is up 3.59% in the last 24 hours to $498.46 million. This suggests a boost in capital allocation as traders open new positions, both long and short.

However, a steep rise in OI-weighted funding rate to -0.0014% from -0.0409% earlier on the day indicates a gradual bullish interest as the premium paid for holding short positions declines.

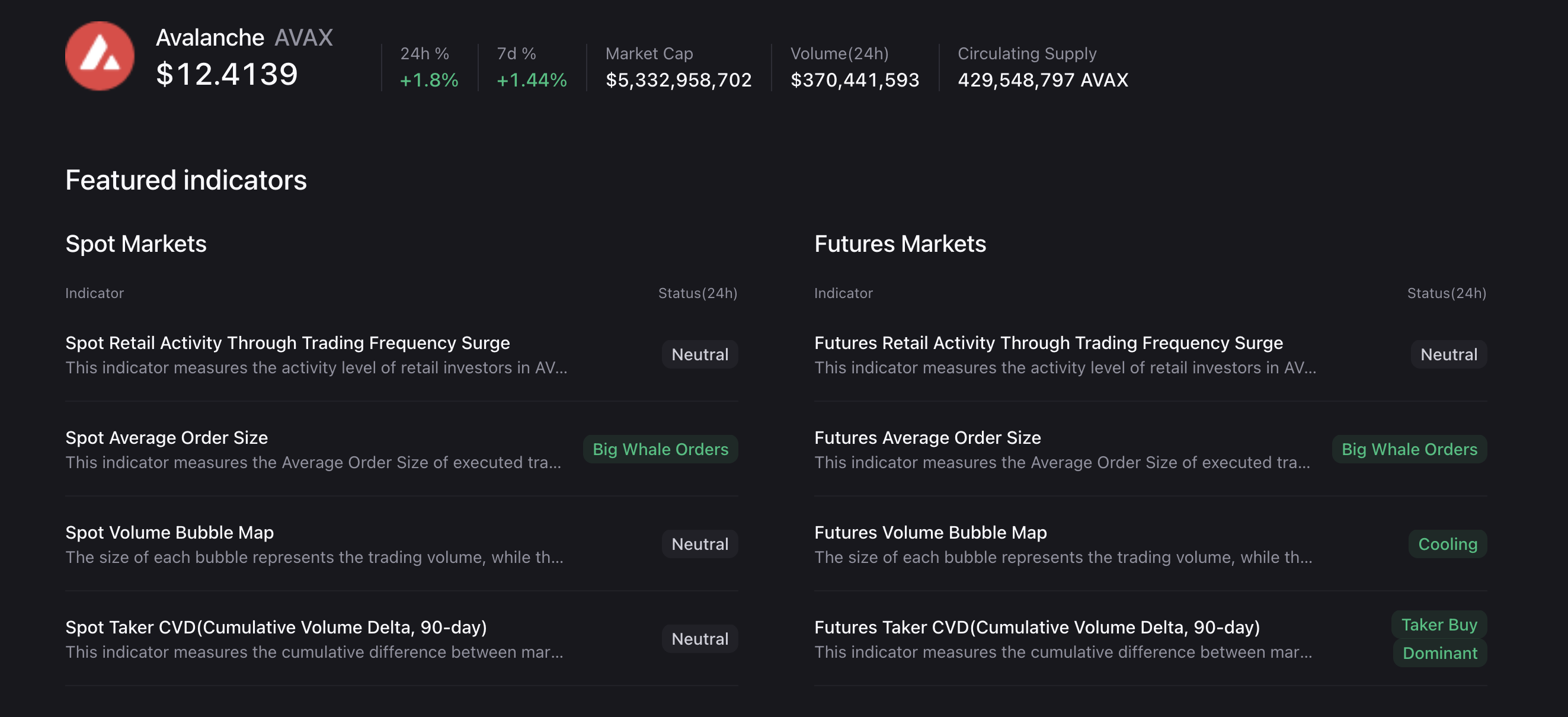

Additionally, the CryptoQuant data shows that whale demand is driving up the average order size in spot and futures markets, with the Cumulative Volume Delta (CVD) over the last 90 days – the market buy and sell volume difference over the previous 3 months – suggesting a buy-side dominance in the derivatives market.

Technical outlook: Is Avalanche ready for a breakout rally?

Avalanche steadies above $12, struggling to extend an upswing within a descending wedge pattern, after bouncing off 7% on Friday from the S1 Pivot Point at $11.18. A potential upswing could target the overhead trendline connecting the highs of October 29 and November 11, near $13.00.

A decisive close above this level would confirm the wedge pattern breakout, potentially targeting the 50-day Exponential Moving Average (EMA) at $14.79. Beyond this, the R1 Pivot Point and the 200-day EMA at $17.62 and $20.23 could serve as secondary targets.

The Relative Strength Index (RSI) at 41 indicates a decrease in selling pressure as it bounces off the oversold boundary. Additionally, the RSI remains roughly flat above 30 while AVAX forms lower lows between December 1 and 18, signaling a hidden bullish divergence.

Meanwhile, the Moving Average Convergence Divergence (MACD) crosses above the signal line, catalyzing a fresh rise of green histogram bars and indicating a renewed bullish momentum.

However, if AVAX slips below $11.18, it could nullify the wedge pattern, risking a steeper correction to the S2 Pivot Point at $8.66.