Ripple Price Forecast: XRP poised for $2.00 breakout amid steady weekly fund inflows

- XRP steadies above $1.90 support but holds below the $2.00 key resistance.

- XRP continued to attract fund inflows, drawing nearly $63 million last week.

- Mild but steady XRP ETF inflows and rising retail demand signal a potential bullish outlook.

Ripple (XRP) is stable above support at $1.90 at the time of writing on Monday, after several attempts to break above the $2.00 hurdle failed to materialize last week.

Meanwhile, institutional interest in the cross-border remittance token has remained steady, with inflows into related investment products increasing. If retail demand increases in the days leading up to the New Year, it may shape XRP’s outlook and its recovery potential above $2.00.

XRP draws fund inflows as retail demand shows signs of a comeback

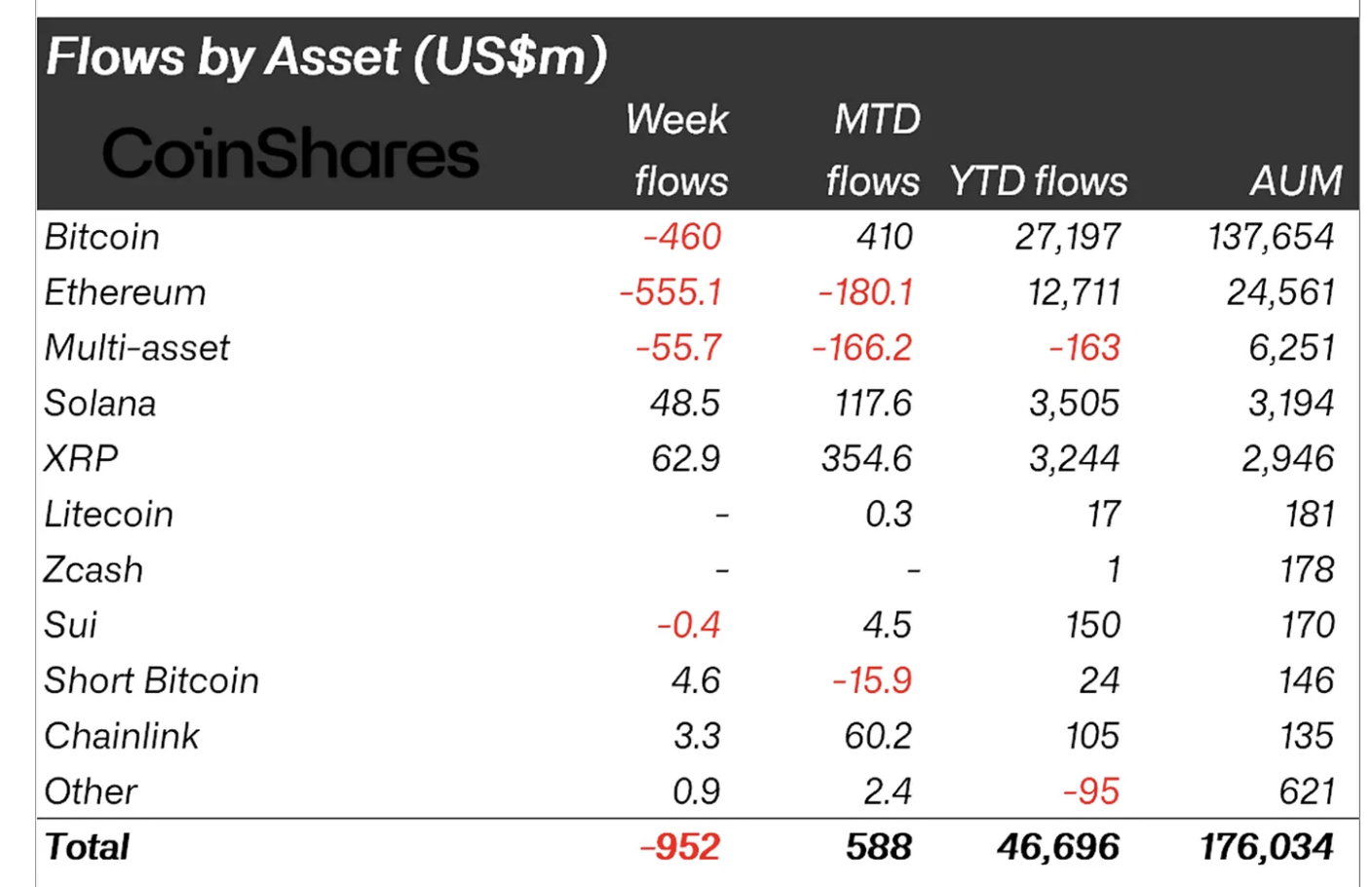

Digital asset investment products saw $952 million in outflows, led by Ethereum (ETH) with $555 million and Bitcoin (BTC) with $460 million. However, XRP maintained a bullish outlook, attracting nearly $63 million in inflows, according to a report by CoinShares. XRP investment products have a total of $2.95 billion in assets under management.

CoinShares stated that the outflows “reflected a negative market reaction to delays in passing the United States (US) Clarity Act, which has prolonged regulatory uncertainty for the asset class, alongside concerns over continued selling by whale investors.”

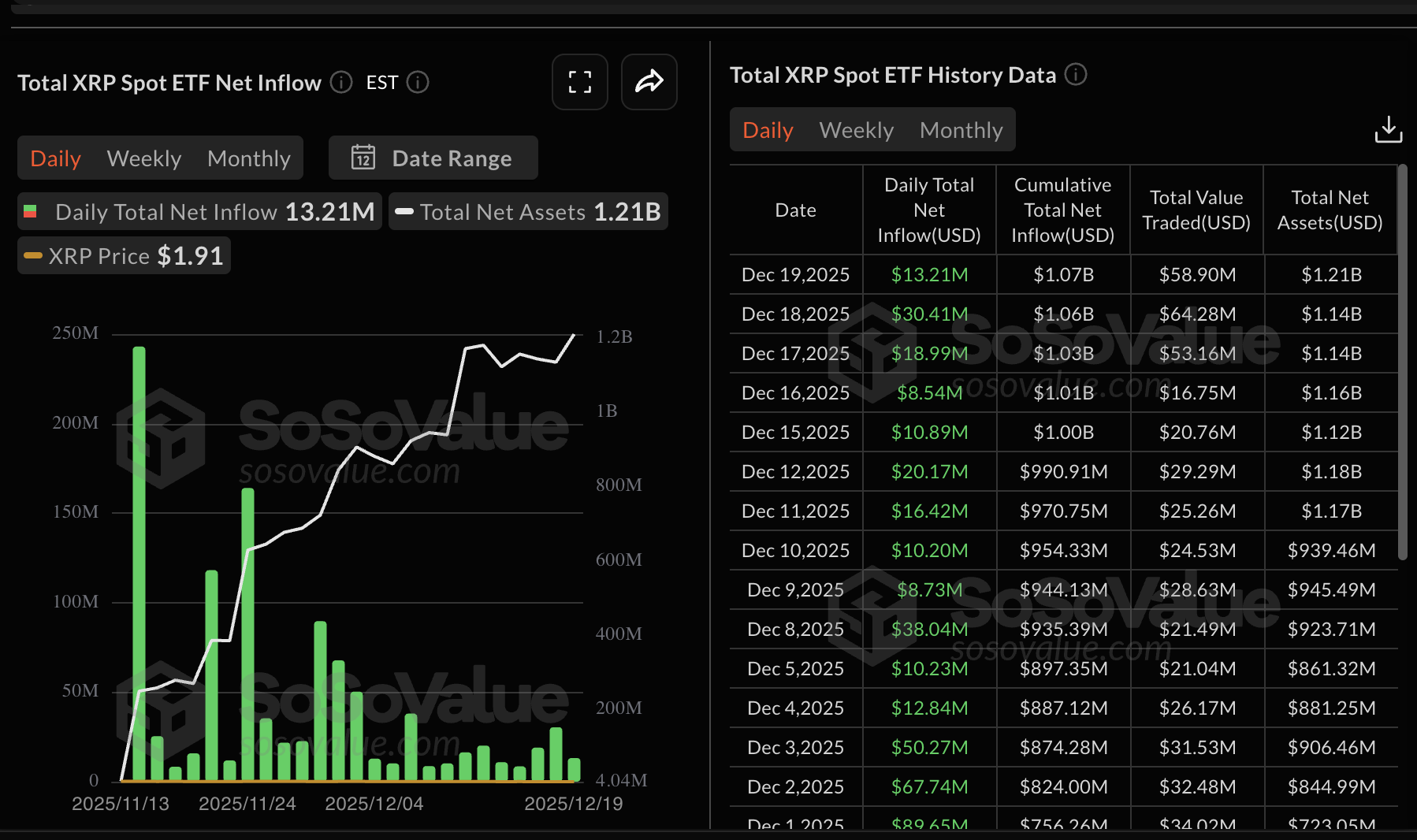

XRP spot Exchange Traded Funds (ETFs) extended their inflow streak, with approximately $13 million deposited last week. XRP ETFs’ cumulative inflow volume stands at $1.07 billion, with net assets averaging $1.21 billion.

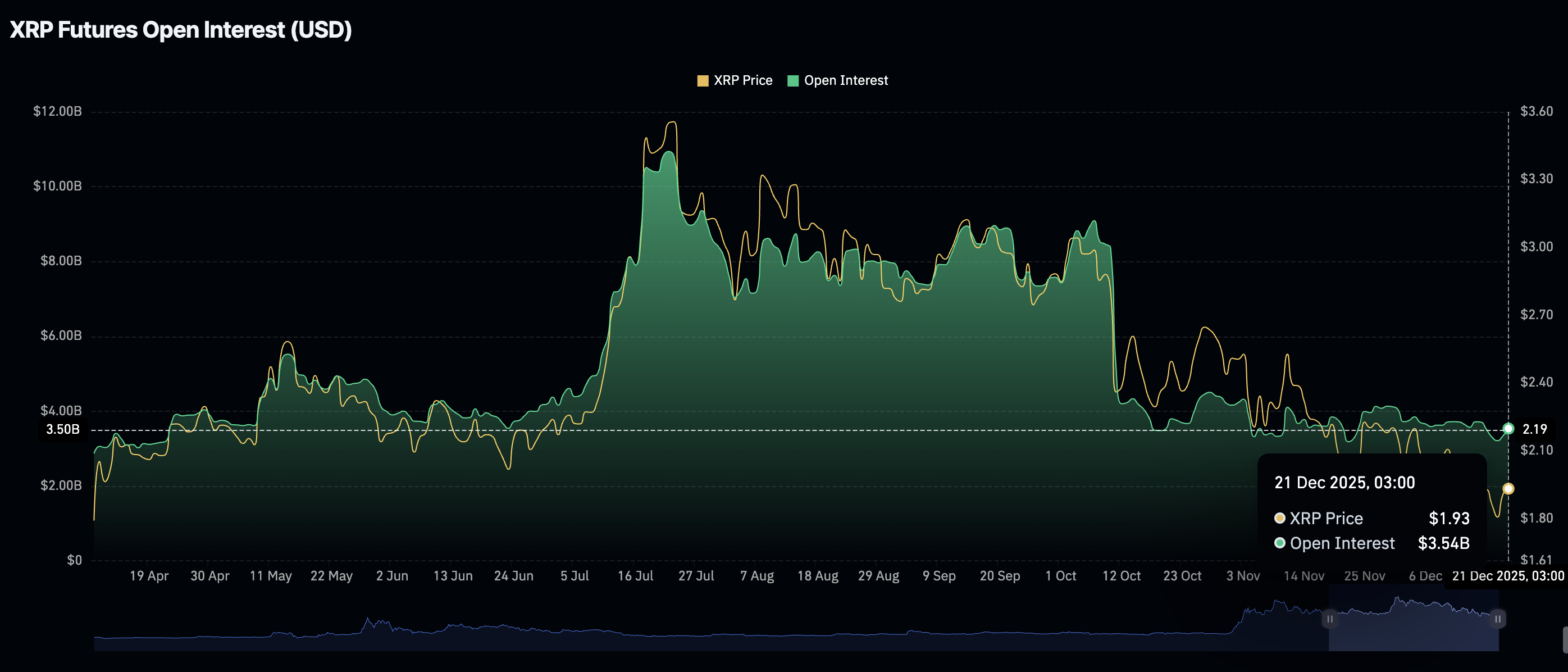

The XRP derivatives market, on the other hand, has experienced a mild resurgence in retail demand, as evidenced by futures Open Interest (OI) rising to $3.54 billion as of Sunday from $3.34 billion recorded on Saturday. The OI had dropped to $3.21 billion on Friday as volatility spiked across the cryptocurrency market, pushing retail investors to the sidelines.

Technical outlook: XRP consolidates ahead of potential breakout

XRP is trading above short-term support at $1.90 at the time of writing on Monday. The Relative Strength Index (RSI) has stabilized at 42 on the daily chart, suggesting that sideways trading may extend.

However, the token also sits below the 50-day Exponential Moving Average (EMA) at $2.13, the 100-day EMA at $2.31 and the 200-day EMA at $2.41, which highlights a bearish outlook.

Still, the Moving Average Convergence Divergence (MACD) indicator has confirmed a buy signal on the same chart, characterised by the blue MACD line crossing above the red signal line.

Traders will consider increasing exposure if green histogram bars grow above the mean line while the indicator generally rises into the bullish region. However, failure to break above $2.00 and the 50-day EMA may keep rebounds limited and possibly increase the odds of a reversal toward support at $1.77, tested on Friday, and April’s low of $1.61.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.