Aave Price Forecast: AAVE extends losses as whale selling intensifies

- Aave continues to slide on Monday after shedding more than 12% over the previous week.

- Lookonchain data show that whale wallets are offloading AAVE tokens, adding to selling pressure.

- The technical outlook suggests growing bearish momentum, near-term correction could deepen.

Aave (AAVE) price continues to trade in the red below $162 on Monday after correcting by more than 12% in the last week. On-chain data indicate that whale wallets are increasing token sales, while AAVE’s momentum indicators are turning increasingly negative, suggesting further correction in the coming days.

Whale wallets and holders dump AAVE, selling pressure accelerates

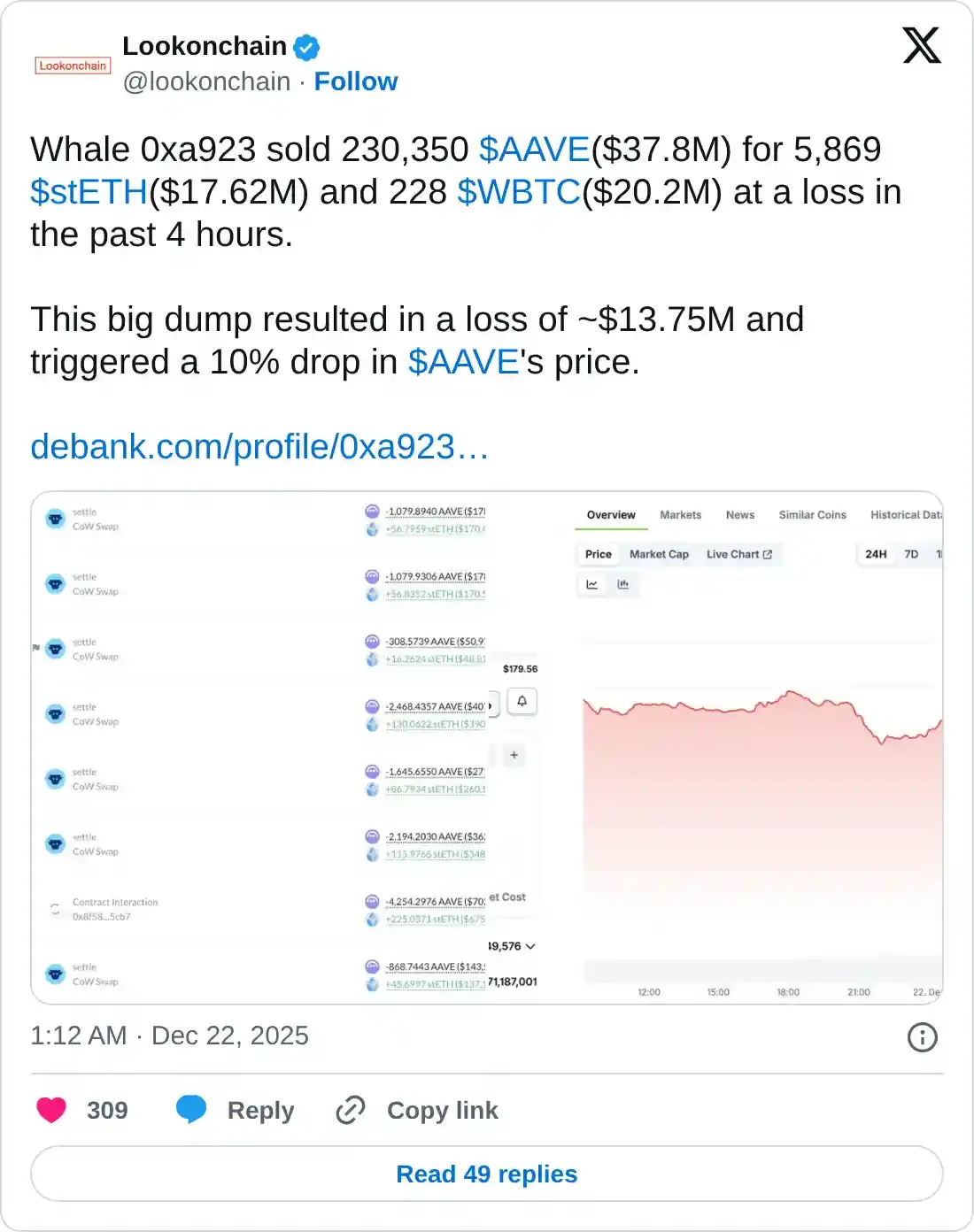

Lookonchain data on Monday shows that a whale wallet sold 230,350 AAVE worth $37.8 million, which increased the selling pressure in the AAVE token.

In addition, Santiment's Network Realized Profit/Loss (NPL) metric indicates that Aave's profit-taking activity reached the highest level since the end of November.

As shown in the chart below, the metric spiked on Monday, indicating that holders are, on average, selling their bags at significant profits, thereby further increasing selling pressure.

[12-1766391341516-1766391341517.18.19, 22 Dec, 2025].png)

Aave Price Forecast: AAVE bears are in control of the momentum

Aave price was rejected from the 50-day Exponential Moving Average (EMA) at $193.61 on December 10 and declined by over 18% by Sunday. As of Monday, AAVE continues to slide, trading below $161.

If AAVE continues its downtrend and closes below the weekly support at $160.51 on a daily basis, it could extend the decline toward the November 21 low of $147.13.

The Relative Strength Index (RSI) is at 36, below the neutral level of 50, indicating bearish momentum gaining traction. The Moving Average Convergence Divergence (MACD) showed a bearish crossover last week, which remains intact, further supporting the negative outlook.

However, if Aave recovers, it could extend the advance toward the daily resistance at $179.27.