MANTA suffers 4% pullback after unlocking tokens worth $40 million

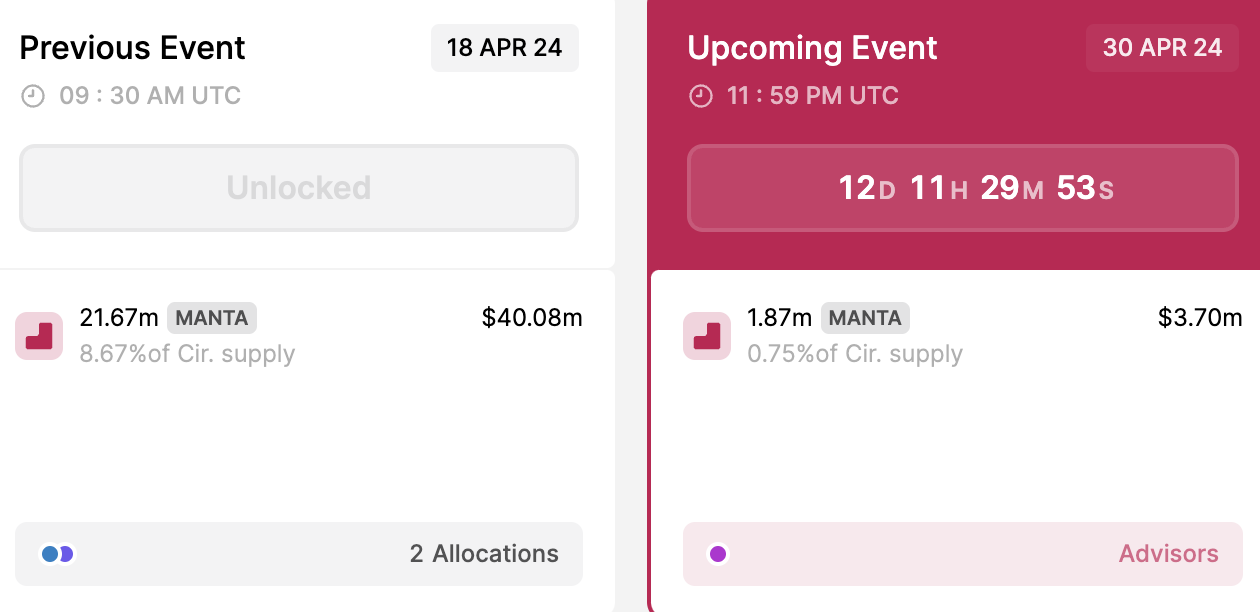

- Manta Network unlocked 21.67 million MANTA tokens worth $40.08 million early on Thursday.

- The tokens were allocated to airdrop and public sale and represent over 8% of MANTA’s circulating supply.

- MANTA price erased 4% of its value on Thursday.

Manta Network (MANTA) unlocked over 8% of its circulating supply on Thursday. The unlocked tokens were airdropped and distributed in public sale, according to data from Tokenunlocks.

MANTA price wiped out 4% of its value on April 18.

MANTA price reacts negatively to token unlock

Data from Tokenunlocks shows that Manta Network unlocked 21.67 tokens worth $40.08 million on Thursday, April 18. The modular blockchain network has scheduled its next token unlock on April 30. The project will unlock 1.87 MANTA tokens worth $3.70 million.

MANTA token unlock

The decline of Bitcoin price to $61,000 on Thursday, alongside anticipation surrounding the upcoming halving, are two catalysts responsible for the market-wide correction in crypto. MANTA price could experience further losses in response to selling pressure from airdrop recipients cashing in their holdings across exchange platforms.

MANTA holders need to watch out for a rise in the token’s supply on exchanges, this could signal that there is likely profit-taking by investors. A total of 31% of MANTA’s supply is unlocked as of Thursday, April 18.

The modular blockchain’s price is $1.767 on Binance, down nearly 4% on Thursday.

No trend reversal in sight, MANTA price could sweep lows at $1.51

MANTA price has been in a downward trend since its March 12 top of $4.086. MANTA has formed lower highs and lower lows ever since. MANTA is trading at $1.767 at the time of writing and the asset is likely to find support at $1.518 ( April 13 low) in the event it sweeps liquidity at the current level.

The On Balance Volume (OBV) indicator, used to measure buying and selling pressure on an asset in a cumulative manner, reads 247.18 million on Thursday. OBV is in a downtrend, confirming MANTA’s price trend in the same timeframe from March 12 to April 18.

MANTA/USDT 1-day chart

If MANTA price sees a trend reversal, it could test resistance at $2.633, a level that acted as steady support throughout March and the first week of April 2024.