Ripple Price Forecast: XRP losses deepen despite signs of growing institutional and whale interest

- XRP is struggling to hold above $1.90, reflecting bearish sentiment in the broader crypto market.

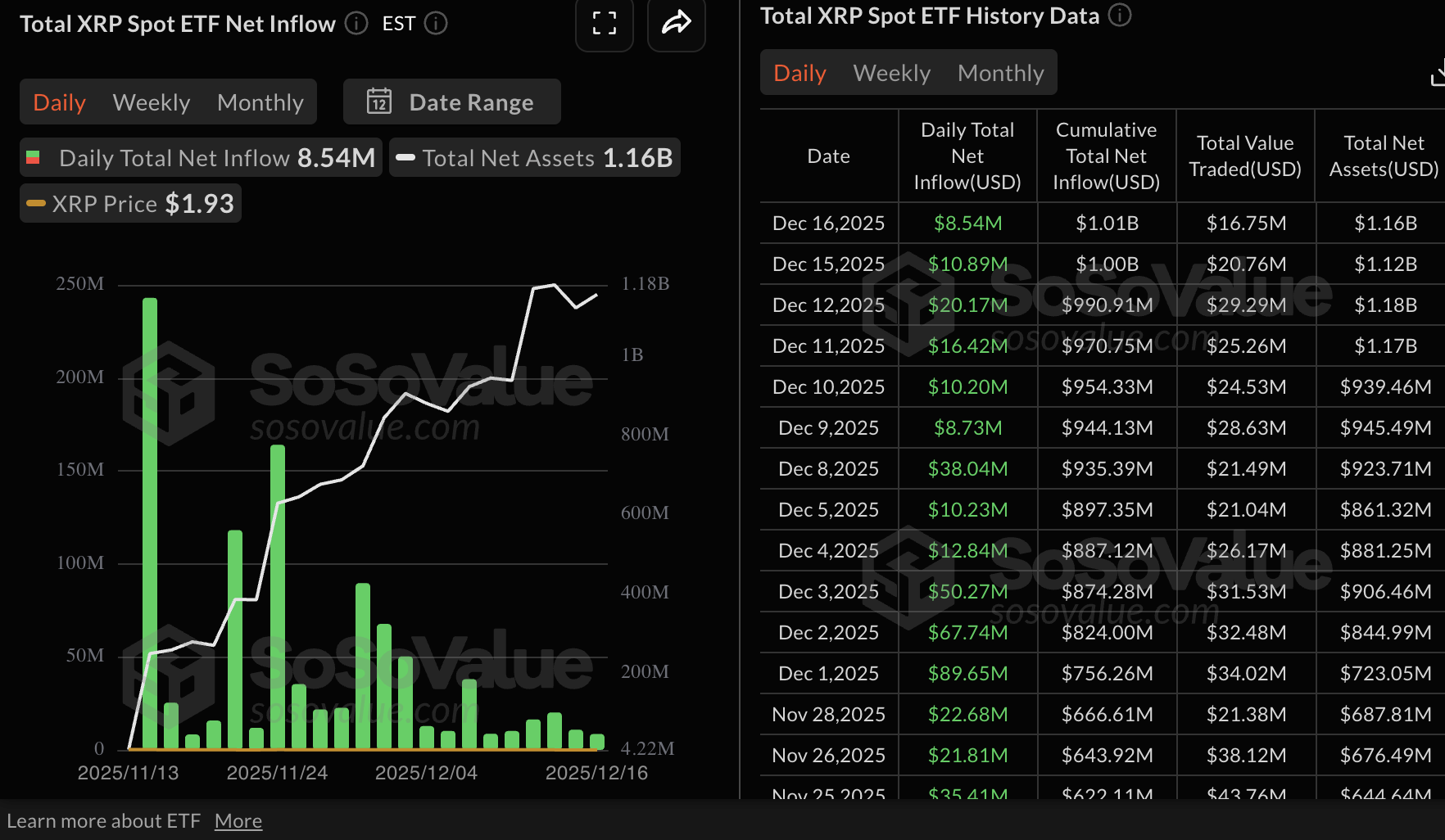

- XRP records mild but steady ETF inflows, while the cumulative net inflow exceeds $1 billion.

- Large-volume traders scoop up more XRP but fail to push prices higher amid dwindling retail demand.

Ripple (XRP) is holding above $1.90, a short-term support, as headwinds intensify in the broader crypto market on Wednesday. Low retail interest and bearish technical signals continue to overwhelm mild inflows into XRP spot Exchange Trade Funds (ETFs), keeping recovery a pipe dream.

A daily close below the $1.90 support could result in an extended correction below toward November’s low of $1.82, with the next demand zone holding at April’s low of $1.61.

XRP ETF inflows signal steady institutional interest

XRP spot ETFs extended their inflow streak, with approximately $8.5 million deposited on Tuesday. Bitwise’s XRP ETF led with approximately $6.2 million in inflows, followed by Franklin Templeton’s XRPZ with nearly $2.1 million. The cumulative inflow stands at $1.01 billion and net assets at $1.16 billion, according to SoSoValue data.

Since their debut on November 13, XRP ETFs have not experienced outflows, underscoring the growing institutional interest in altcoin-based crypto investment products.

Meanwhile, large-volume holders, also known as whales, are increasingly piling into XRP as prices falter. Wallets holding between 10,000 and 100,000 XRP currently account for 11.92% of the total supply, up from 11.88% on December 1 and 11.74% on November 4. The supply head by this cohort of investors has increased by 0.8% since early February, underscoring growing risk appetite despite volatility being dominant this year.

Wallets holding between 10 million and 100 million coins have grown to account for 16.99% of XRP’s total supply, from 15.98% on December 1 and 13.21% on November 1. The supply held by this cohort of investors has increased by 6.39% from 10.6% in early February. If the uptake of XRP continues, a strong tailwind would support price increases after the dust from volatility triggered by macroeconomic uncertainty settles.

[14-1765980732788-1765980732789.22.10, 17 Dec, 2025].png)

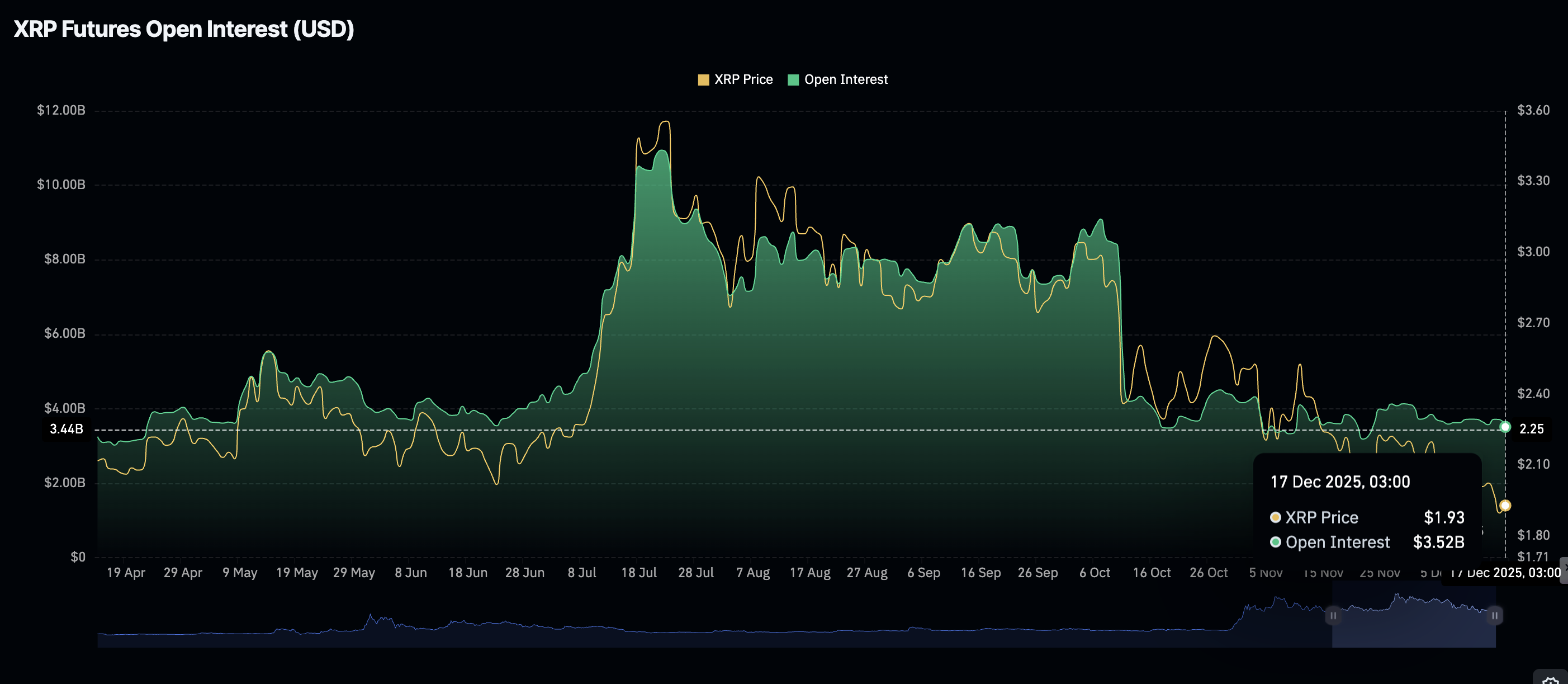

On the contrary, retail interest in XRP remains significantly low, with the futures Open Interest (OI) at $3.56 billion on Wednesday, down from $3.71 billion the previous day.

OI peaked at $10.94 billion on July 22, after XRP hit a new record high of $3.66 on July 18 but dropped significantly following the October 10 flash crash.

Low retail interest is often reflected in OI remaining subdued, suggesting that investors have lost confidence in XRP’s ability to maintain an uptrend. A sustained recovery in OI is required to support price advance beyond the $2.00 key level in the short term.

Technical outlook: XRP consolidates losses as key support holds

XRP is trading at $1.92 at the time of writing on Wednesday, held down by the down-trending 50-day Exponential Moving Average (EMA), the 100-day EMA and the 200-day EMA, all of which continue to keep bears in control.

The Moving Average Convergence Divergence (MACD) indicator's blue line slips below the red signal line, and a shallow negative histogram suggests increasing bearish momentum. The Relative Strength Index (RSI) sits at 37, indicating that trading conditions remain bearish but not oversold.

The descending trend line from $3.09 limits gains, with resistance at $2.09. A close above this barrier could open the path toward the 50-day EMA at $2.18.

Looking ahead, the bearish structure persists as XRP trades well beneath the 100-day EMA at $2.36 and the 200-day EMA at $2.43, which continue to weigh on rebounds. The rising trend line from $1.45 underpins the setup, offering support near $1.87. A break lower could extend the slide, while holding above would expand the scope for a test of the broader descending trendline at $2.52.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

(The technical analysis of this story was written with the help of an AI tool)