Crypto Today: Bitcoin, Ethereum, XRP sell-off extends as extreme fear grips crypto market

- Bitcoin declines for the fifth consecutive day amid ETF outflows and sticky bearish sentiment.

- Ethereum falls below $3,000, undermined by bearish technical indicators and diminishing institutional interest.

- XRP fails to recover despite total ETF inflows hitting $1 billion milestone.

Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) are trading under pressure on Tuesday as bearish sentiment in the broader cryptocurrency market lingers.

Despite Bitcoin trading above $86,000, up from an intraday low of $85,266, the overall outlook remains bearish, characterised by "extreme fear", according to the Crypto Fear & Greed Index.

Ethereum is trading above $2,900, but its upside is capped below $3,000, while XRP is engulfed in selling pressure below $2.00.

The broader crypto market has faced extreme fear since last week, as shown in the image below. These conditions suggest that bearish sentiment is dominant and investors are likely realizing losses. However, extreme fear conditions can often precede quick rebounds, highlighting the potential for new market opportunities.

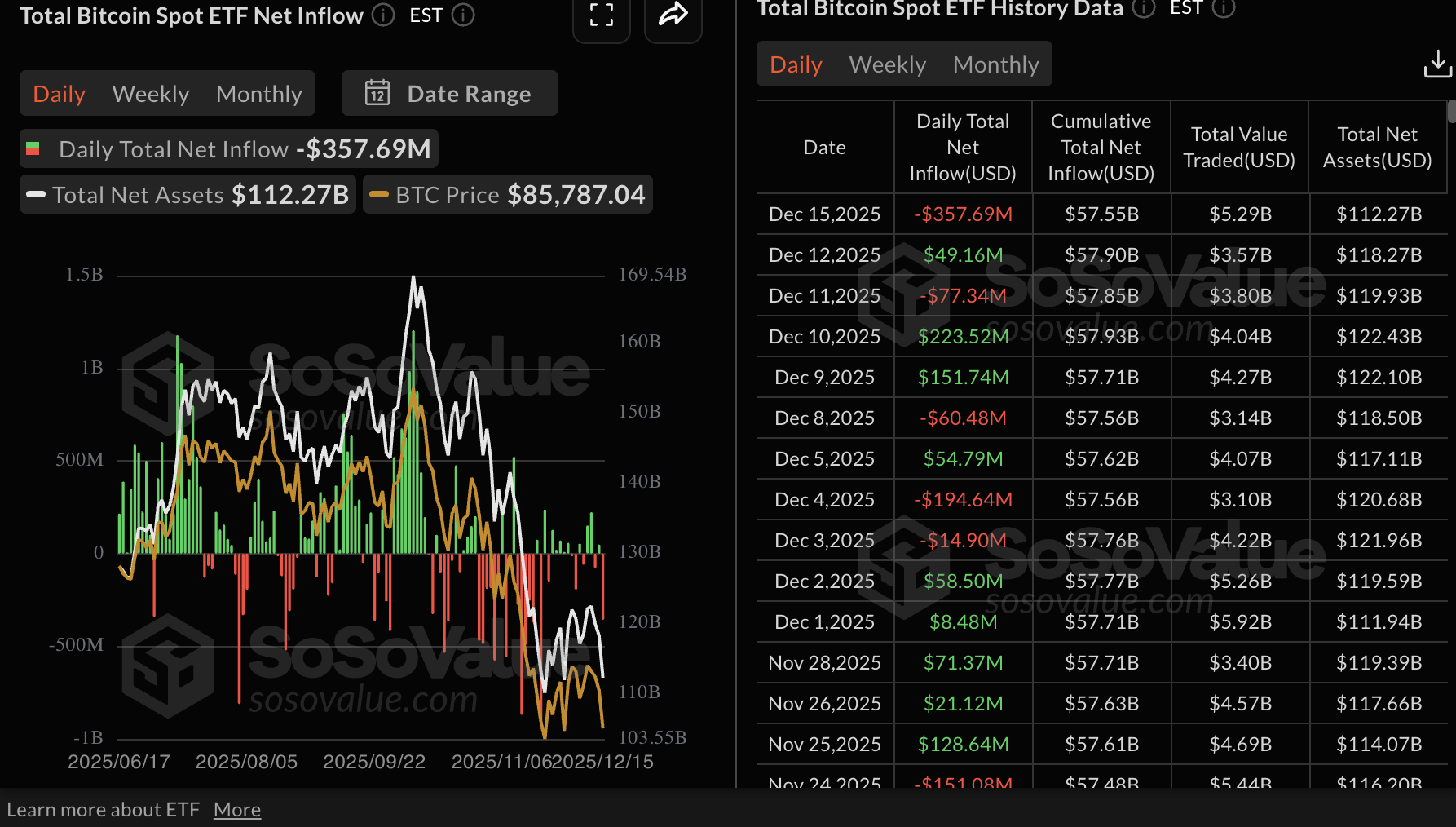

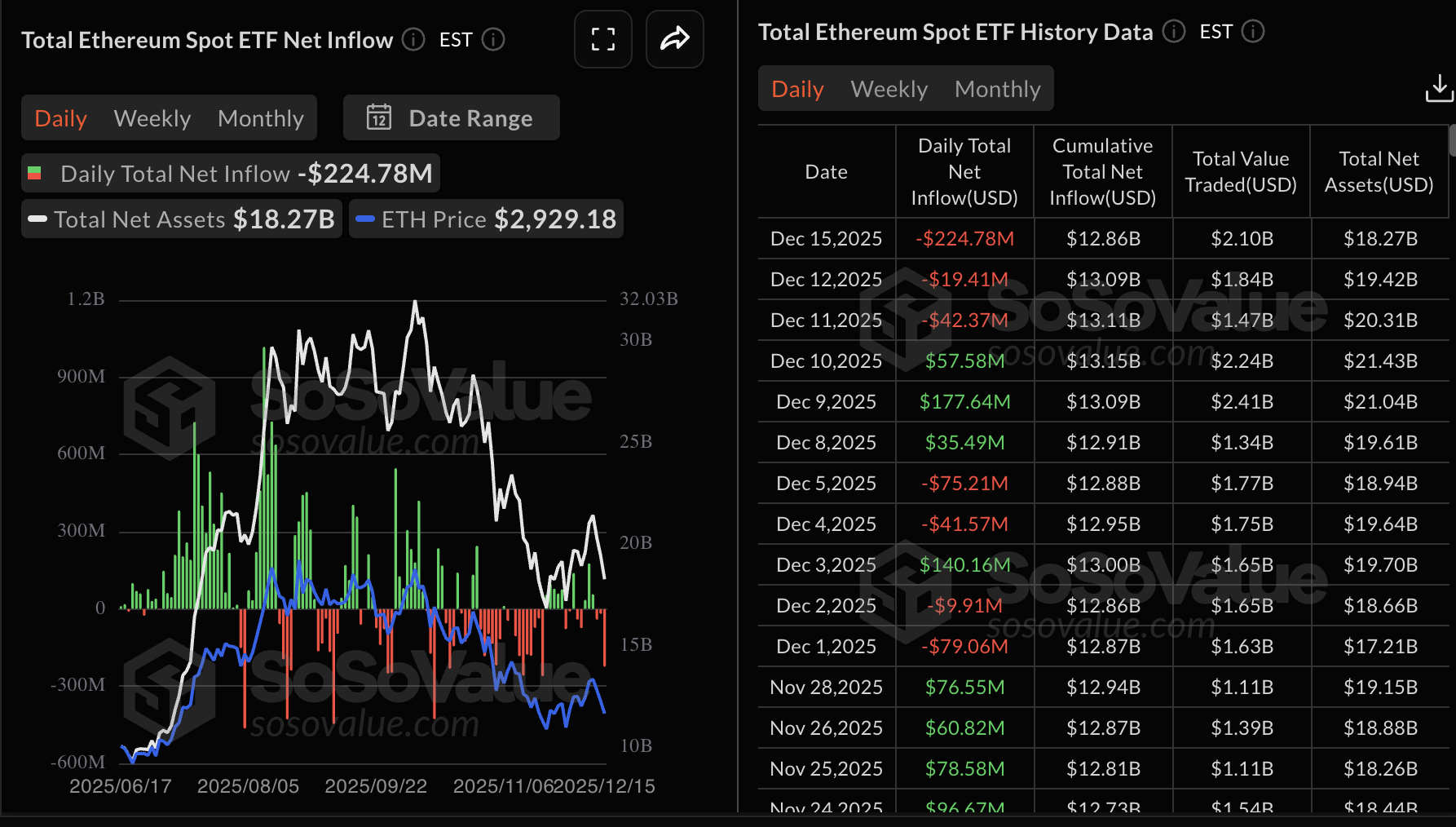

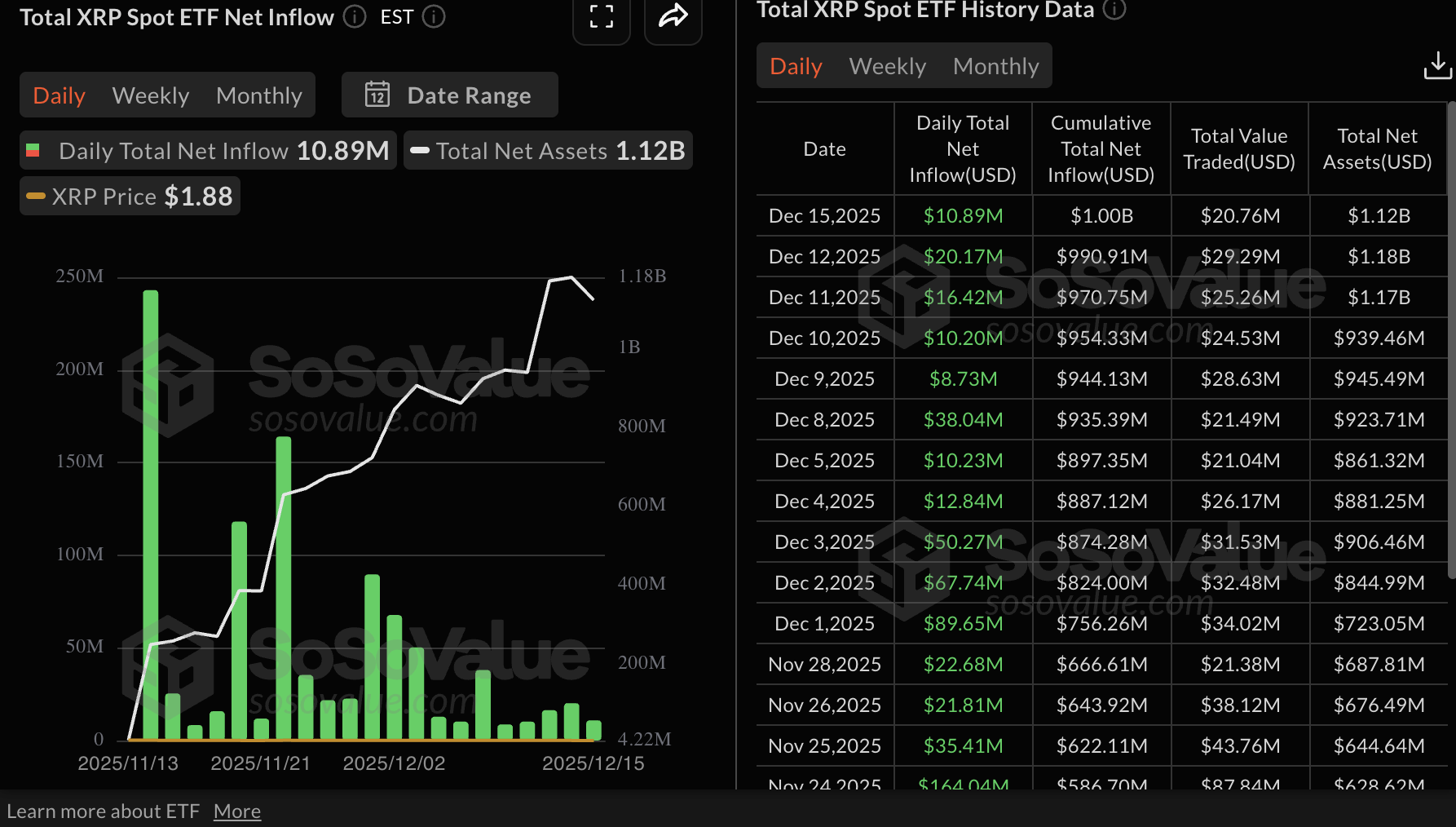

Data spotlight: BTC, ETH ETFs post outflows as XRP inflows hit $1 billion

Bitcoin Exchange Traded Funds (ETFs) recorded nearly $358 million in outflows on Monday amid persistent risk-off sentiment among institutional investors.

Fidelity’s FBTC posted the largest outflow of $230 million, followed by Bitwise’s BITB with approximately $44 million and 21Shares’ ARKB with $34.5 million. The cumulative net inflow volume currently stands at $57.55 billion, and net assets are at $112.27 billion.

Ethereum ETFs extended their outflow streak for the third consecutive day, with nearly $225 million withdrawn on Monday. SoSoValue data shows cumulative inflow volume at $12.86 billion and net assets of $18.27 billion. BlackRock’s ETHA ETF posted the largest outflows of $139 million, followed by Grayscale’s ETHE with $35 million.

XRP ETFs, unlike Bitcoin and Ethereum, extended their inflow streak to 21 consecutive days, with almost $11 million deposited on Monday. The cumulative inflow volume has exceeded $1 billion, boosting net assets to $1.12 billion. This steady uptake of XRP ETFs highlights growing interest in altcoin-based crypto investment products.

Chart of the day: Bitcoin bears tighten grip as headwinds intensify

Bitcoin is trading above $86,000 at the time of writing on Tuesday, undermined by increasing sell-side pressure. The downtrending 50-day Exponential Moving Average (EMA) at $95,111, the 100-day EMA at $100,667 and the 200-day EMA at $102,850 support the bearish outlook.

The Relative Strength Index (RSI) on the daily chart has declined to 36, which signals increasing bearish momentum. If the Moving Average Convergence Divergence (MACD) indicator on the same chart confirms a sell signal with the blue line crossing below the red signal line, the downtrend will likely extend to test support at $80,000.

Traders should temper their bullish expectations until Bitcoin’s price rises above the descending trendline resistance and flips the 50-day EMA at $95,112 into support.

Altcoins update: Ethereum, XRP sellers in control

Ethereum (ETH) is trading above $2,900 at the time of writing on Tuesday, as bulls fight to uphold the short-term support at $2,880. However, sellers remain largely in control, as evidenced by the RSI on the daily chart dropping to 41, within the bearish region.

The MACD indicator on the same chart is poised to confirm a sell signal if the blue line crosses and settles below the red signal line. Investors may be prompted to reduce their risk exposure if the red histogram bars continue to expand below the mean line.

If ETH's price rises above $3,000, that could help refocus the trend back to the upside. However, the overall outlook may remain bearish until Ethereum rises above the 50-day EMA at $3,261 and the descending trendline.

As for XRP, the token is extending the decline for the third consecutive day, hovering at $1.88 at the time of writing on Tuesday. The downward-trending 50-day EMA at $2.19, the 100-day EMA at $2.36 and the 200-day EMA at $2.44 suggest that bears may stay in control in the short term.

The MACD indicator has confirmed a sell signal on the daily chart, with the blue line currently below the red signal line. The RSI on the same chart is at 33 and approaching oversold territory, which emphasises the bearish outlook.

A break below the short-term support at $1.82 (November 21 low) could accelerate the decline to April’s low of $1.61. For bulls to flip the trend strongly upward, they will have to breach the 50-day EMA hurdle at $2.19 and break above the descending trendline resistance.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.