Bitcoin Price Prediction: Recovery to $100,000 Could Be Tainted by These Holders

Bitcoin’s recent price action shows continued weakness as the asset struggles to find direction amid muted macro signals, presenting a bullish-neutral prediction.

The lack of momentum has kept BTC drifting downward for several days, but the Federal Open Market Committee’s expected 25 basis point rate cut on Wednesday could shift sentiment. Whether this becomes a catalyst depends heavily on how short-term holders behave.

Bitcoin Holders Might Present Some Challenge

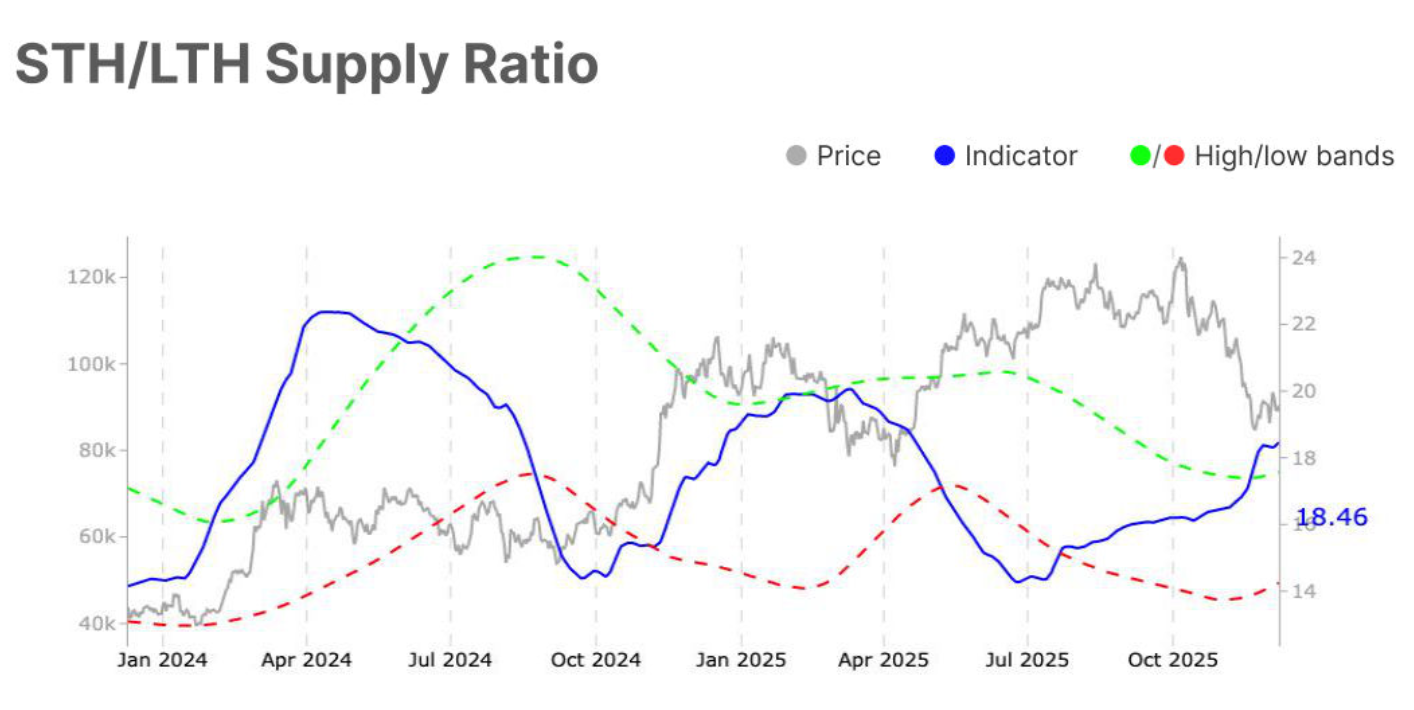

The STH to LTH Supply Ratio recently rose from 18.3% to 18.5%, breaking above the 17.6% upper band. This signals a growing presence of short-term holders within Bitcoin’s supply mix.

Their presence increases speculative activity, which can boost liquidity but also create sharper intraday swings. The shift highlights a market poised for volatility if conditions change quickly.

This higher ratio also suggests that STHs hold greater influence over Bitcoin’s immediate trajectory. Their tendency to sell when in profit has historically capped recoveries. If the FOMC rate decision triggers a rally, STH behavior will determine whether the momentum sustains or fades.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin STH/LTH Supply Ratio. Source: Glassnode

Bitcoin STH/LTH Supply Ratio. Source: Glassnode

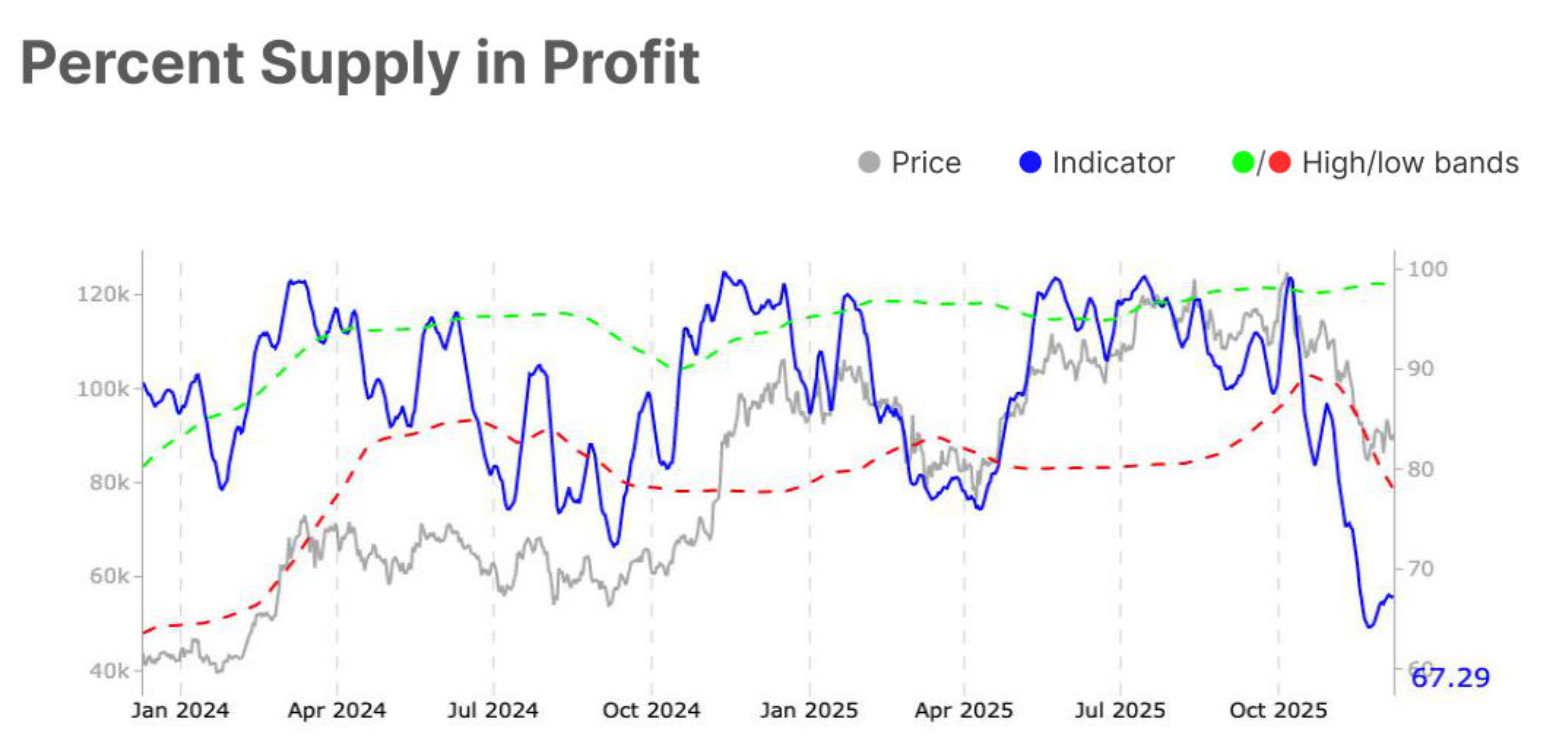

Bitcoin’s Percent Supply in Profit has increased from 66.5% to 67.3%, a modest 1.2% gain. While upward movement is positive, the metric remains far below the 98.4% high band typically seen in strong bull phases. This shows that a significant portion of supply is still underwater, reflecting a cautious environment rather than euphoric strength.

Such subdued profitability aligns with early-stage accumulation behavior. Investors appear selective and patient, waiting for stronger macro cues before committing. If the FOMC cut boosts risk appetite, this profitability gap leaves room for expansion and stronger follow-through.

Bitcoin Supply In Profit. Source: Glassnode

Bitcoin Supply In Profit. Source: Glassnode

BTC Price Awaits An Escape

Bitcoin’s price is at $90,399 at the time of writing, sitting just below a downtrend that has persisted for one and a half months. BTC is attempting to flip $90,400 into a support level, which would mark the first step toward reversing the trend.

If macro conditions align and rate cuts revive broader market optimism, BTC could rebound sharply. A clean bounce from $90,400 may drive a retest of $95,000, and breaking that resistance would open a clear path toward the long-anticipated $100,000 level, proving Bitcoin’s price prediction true.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, if short-term holders sell into strength, Bitcoin may struggle to maintain upward pressure. A rejection from $95,000 or failure to break the downtrend could send BTC back toward $86,822, invalidating the bullish scenario.