Hyperliquid Token Hits 7-Month Low as Market Share Collapses

Hyperliquid’s HYPE token slid to a seven-month low as the market reacted to a steep decline in the protocol’s dominance and renewed concern over recent token movements.

According to BeInCrypto data, the token dropped more than 4% in the past 24 hours to $29.24, its weakest level since May.

Why is HYPE Price Falling?

CoinGlass data showed that the drop triggered more than $11 million in liquidations, adding to pressure on a market already turning cautious.

The shift marks a stark reversal for a protocol that once controlled the on-chain perpetuals market. Earlier in the year, Hyperliquid dominated the decentralized perpetuals market with near-total authority. However, that edge has faded.

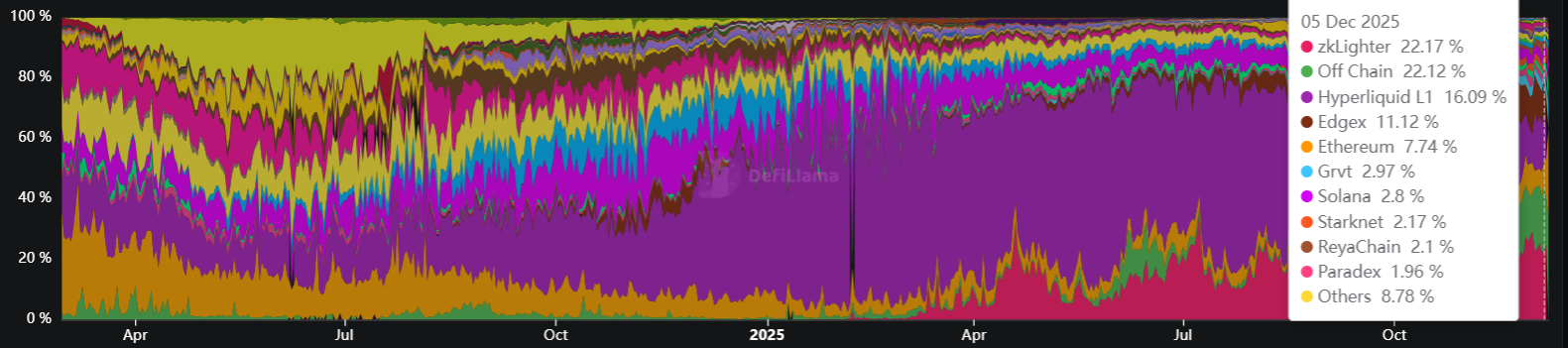

Data from DeFiLlama reveals a staggering erosion of its dominance, with the protocol’s share of the perpetuals market cratering from a peak of nearly 70% to less than 20% at press time.

Hyperliquid’s Falling Market Dominance. Source: DeFiLlama

Hyperliquid’s Falling Market Dominance. Source: DeFiLlama

This can be linked to the emergence of more aggressive rivals, such as Aster and Lighter, which have successfully siphoned volume through superior incentive programs.

As a result, investors are rapidly repricing HYPE and are no longer viewing it as the sector’s inevitable winner but as a legacy incumbent bleeding users.

Simultaneously, internal token movements have rattled confidence.

Blockchain analytics firm Lookonchain reported last month that team-controlled wallets unstaked 2.6 million HYPE, valued at roughly $89 million.

While the team restaked roughly 1.08 million tokens, the market fixated on the outflows.

A total of 900,869 HYPE remained liquid in the wallet, and another 609,108 HYPE, worth about $20.9 million, moved to Flowdesk, a prominent market maker. The project also sold an additional 1,200 tokens for about $41,193 in USDC.

These events have had a psychological toll on the community.

As a result, HYPE has shed nearly 30% of its value over the last 30 days, ranking as the worst-performing asset among the top 20 digital currencies by market capitalization.

Considering this, crypto traders have become significantly bearish on the token. Crypto trader Duo Nine has suggested that the token’s value could drop to as low as $10.

“Prepare mentally for such a scenario if you want to survive what’s coming,” the analyst stated.