MicroStrategy’s Market Cap Falls Billions Below Its Bitcoin Holdings

MicroStrategy suffered a catastrophic start to December as its market cap briefly fell below the net value of its Bitcoin holdings, exposing the company to renewed concerns about leverage, liquidity, and investor confidence.

Shares collapsed early Monday, dropping to $156, which pushed MicroStrategy’s valuation to $45 billion.

Wall Street Nightmare For MicroStrategy?

The company currently holds 650,000 BTC worth roughly $55.2 billion, making this drop a rare moment where Wall Street valued the business at less than its underlying assets.

However, MicroStrategy also carries $8.2 billion in debt. After subtracting that debt and adding the firm’s $1.4 billion cash reserve, the company still holds about $48.4 billion in net Bitcoin value.

This means the stock fell $3.4 billion below its Bitcoin-adjusted worth at the session low.

The disconnect shocked traders. MicroStrategy normally trades at a premium because markets price in Michael Saylor’s aggressive Bitcoin strategy, future BTC purchases, and the stock’s role as a regulated Bitcoin proxy.

Yet Monday’s sell-off forced the premium into one of its tightest ranges of the year.

By midday, the company’s mNAV ratio—which measures how far the stock trades above or below Bitcoin net asset value—recovered to 1.16, far below the levels seen earlier in 2025.

The reading shows the market now values MicroStrategy only 16% above its Bitcoin holdings, compared with premiums exceeding 50% during the year’s rally.

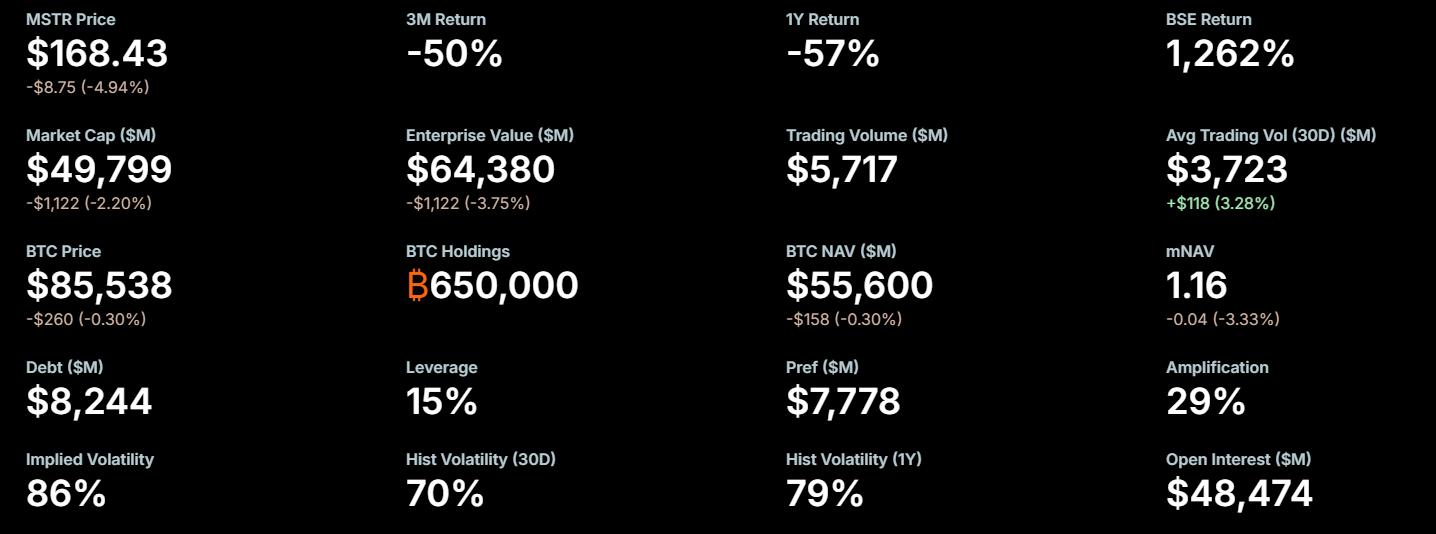

MSTR Key Stats on December 1. Source: Strategy

MSTR Key Stats on December 1. Source: Strategy

A Critical Risk Period for MicroStrategy and Bitcoin

The sharp repricing reflects rising investor fears. Bitcoin has dropped from $125,000 to $85,500 since October, erasing tens of billions in paper value from MicroStrategy’s balance sheet.

The decline coincided with tightening liquidity, falling ETF inflows, and an industry-wide reset in risk appetite.

Concerns about Saylor’s long-term strategy also resurfaced. Critics argue the company’s debt must be serviced regardless of Bitcoin’s performance, increasing pressure to raise new capital or sell more shares.

Others warn that MicroStrategy’s position is now so large that Saylor cannot reduce risk without destabilizing the market.

Still, the company remains the largest corporate Bitcoin holder in the world, and its holdings continue to exceed its market cap.

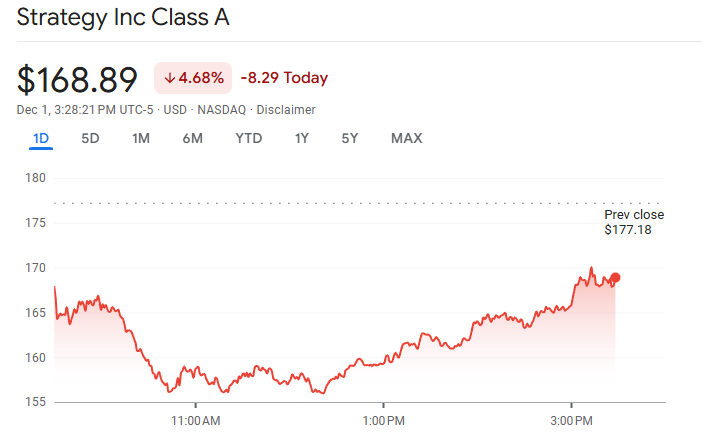

MSTR Stock Price Chart On December 1. Source: Google Finance

MSTR Stock Price Chart On December 1. Source: Google Finance

The rebound later in the day shows investors are not abandoning the stock, but they are reassessing the risks more aggressively than at any point this year.

MicroStrategy begins December with its tightest valuation gap in years, signaling a turning point in how markets view the company’s leveraged Bitcoin strategy.

Whether this marks a temporary panic or the start of a deeper correction will depend on Bitcoin’s stability and the company’s next moves.