Are Israel and China Threatening the US Stablecoin Plan?

Two major economies are tightening control over digital currencies just as the US pushes to cement its leadership in the stablecoin sector. Israel is accelerating its digital shekel plans while China continues to expand the digital yuan.

These moves signal a broader global shift toward sovereign digital money that could challenge the reach and influence of US dollar–based stablecoins.

Israel Tightens Rules, Advances Digital Shekel

Stablecoins have become a central pillar of the digital asset market, moving well beyond their early role as a trading convenience.

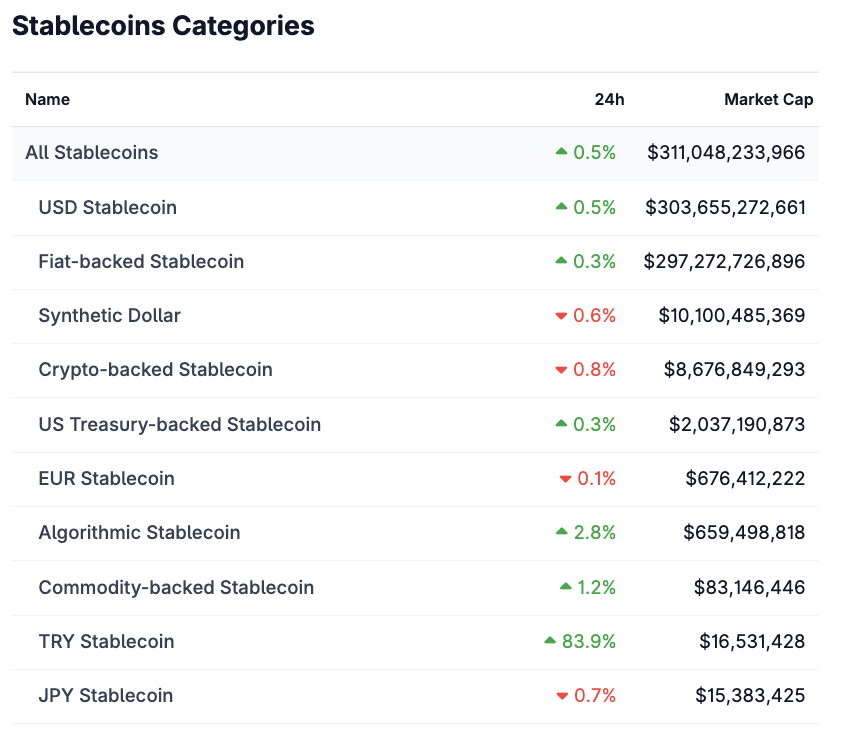

The sector now processes more than $2 trillion in monthly volume and holds a market cap above $310 billion, almost all of it in dollars. That growth has prompted private companies to assume a leading role in operating key components of global payment infrastructure.

Stablecoin market capitalization exceeds $310 billion. Source: CoinGecko.

Stablecoin market capitalization exceeds $310 billion. Source: CoinGecko.

As their influence expands, governments are stepping back in. Many are introducing new rules aimed at limiting the reach of USD-linked tokens.

During a recent conference in Tel Aviv, Bank of Israel Governor Amir Yaron stated that the country is preparing to implement much stricter oversight of stablecoins, citing growing concerns over the sector’s concentration.

With most activity dominated by Tether and Circle, he warned that any issue with their reserves or backing could spill into the wider financial system.

Yaron also noted that stablecoins are now so embedded in global money flows that they can no longer be treated as a niche market, adding that the sector’s scale already rivals that of a mid-tier international bank.

Alongside these warnings, Israel is also accelerating its digital shekel initiative, its proposed central bank digital currency.

The Bank of Israel recently published a detailed design document outlining user journeys, technical architecture, and key policy considerations. Officials say the project aims to strengthen the country’s payment infrastructure and reduce reliance on private digital assets.

As Israel builds its regulatory and technological framework, China is taking a far more forceful path.

Beijing Shuts Out Stablecoin Influence

China’s central bank has doubled down on its broad crypto ban, working with different government bodies to target stablecoin activity and close remaining loopholes. Officials say digital assets fuel money laundering and capital flight, and they stress that these tokens carry no legal currency status.

The crackdown is also unfolding alongside the rapid growth of the digital yuan.

According to Ledger Insights, the People’s Bank of China recently reported that e-CNY transaction volumes nearly doubled in the past 14 months, reaching $2 trillion by September.

Pilot programs are now operational across major cities, public-sector payment systems, and select commercial routes. This push is embedding the state-issued currency deeper into daily financial activity.

By walling off stablecoins and accelerating the digital yuan, China aims to cut dependence on foreign currency rails, especially those tied to the US dollar. The strategy also helps preserve tight control over data, capital flows, and payment infrastructure.

Together with Israel’s more measured but still sovereignty-driven approach, China’s escalation highlights a clear global shift.

Major economies are no longer willing to let USD stablecoins define the future of payments. Many are now building or enforcing their own digital systems and challenging the US’s ambitions for stablecoin dominance.