Ethereum Price Forecast: BitMine continues buying spree as ETH drops below $2,800

Ethereum price today: $2,740

- Ethereum treasury firm BitMine Immersion announces it acquired 96,798 ETH last week.

- The company's latest purchase comes as ETH began December on a bearish note, declining by 8% on Monday.

- ETH could reclaim $2,850 if it bounces off the short-term support at $2,620.

Ethereum (ETH) is down 8% on Monday despite BitMine's announcement that it grew its holdings to 3.72 million ETH last week.

BitMine scoops additional ETH despite large unrealized losses

Ethereum treasury company BitMine Immersion continued its ETH buying spree following another round of weekly acquisitions.

The Nevada-based firm announced that it purchased 96,798 ETH last week, growing its Ethereum stash to over 3.72 million ETH or 3% of the entire ETH circulation. BitMine plans to acquire 5% of ETH's circulating supply.

The company cited the upcoming Ethereum Fusaka upgrade, quantitative tightening and a potential Fed rate cut on December 10 as reasons for scooping more ETH. "Collectively, we see these acting as positive tailwinds for ETH prices and thus, we stepped up our weekly purchases of ETH by 39%," said BitMine's chairman, Thomas Lee, in a Monday statement.

BitMine also reported holdings of 192 Bitcoin (BTC), a $36 million stake in Worldcoin (WLD) treasury Eightco Holdings, and unencumbered cash of $882 million.

The company's latest purchase comes as ETH ended November on a bearish note, recording a 22.3% decline. The trend has extended into December, with the top altcoin plunging by over 8% on Monday. As a result, BitMine is sitting on about $3.9 billion in losses, according to CryptoQuant data.

The firm ranks as the largest ETH treasury behind SharpLink Gaming, which holds 859,395 ETH.

BitMine stock is down 12% on Monday, reversing much of its gains from last week.

Ethereum Price Forecast: ETH dives below $2,850, eyes support near $2,620

Ethereum recorded $228.6 million in futures liquidations over the past 24 hours, spearheaded by $209.9 million in long liquidations, per Coinglass data.

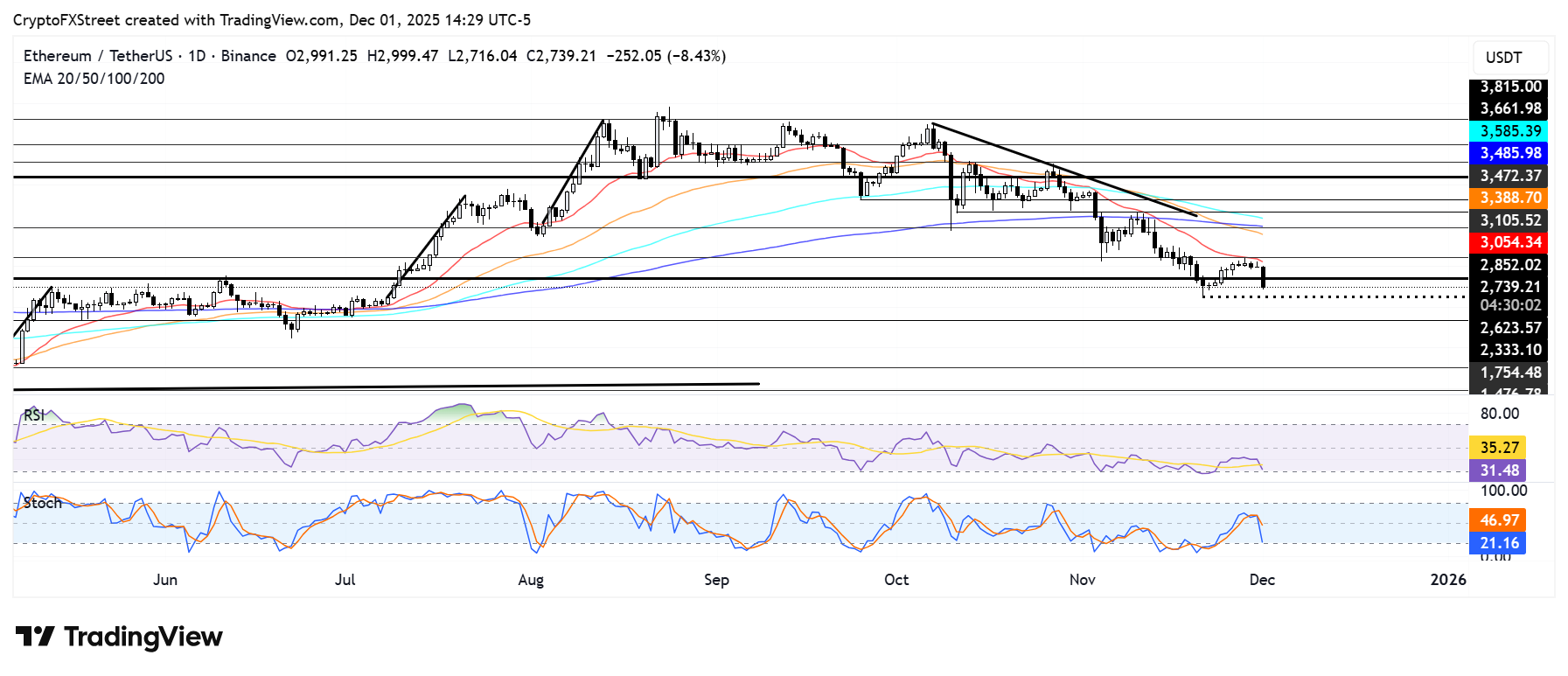

ETH has crossed below the $2,850 key level and is approaching the short-term support at $2,623. The decline follows a rejection at the $3,100 resistance level last week. The resistance is strengthened by the 20-day Exponential Moving Average (EMA), which has proven a critical hurdle since the October 10 leverage flush.

ETH could reclaim $2,850 if it bounces off the $2,623 support. However, a breach of $2,623 could push the top altcoin toward the $2,330 support level, which is around the average cost basis of all ETH investors.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are declining toward oversold territory, indicating rising bearish momentum.