Hedge Funds Are Heavily Shorting the USD – What Does It Mean for Crypto?

Hedge funds are piling into one of their biggest anti-dollar bets in years, just as macro signals hint the USD may be nearing a rebound.

If the crowded trade snaps, the ripple effects could hit crypto markets faster than investors expect.

Hedge Funds Build Extreme USD Shorts—A Repeatable Pattern?

Hedge funds are aggressively shorting the US dollar, reaching one of the most lopsided positioning levels in two decades.

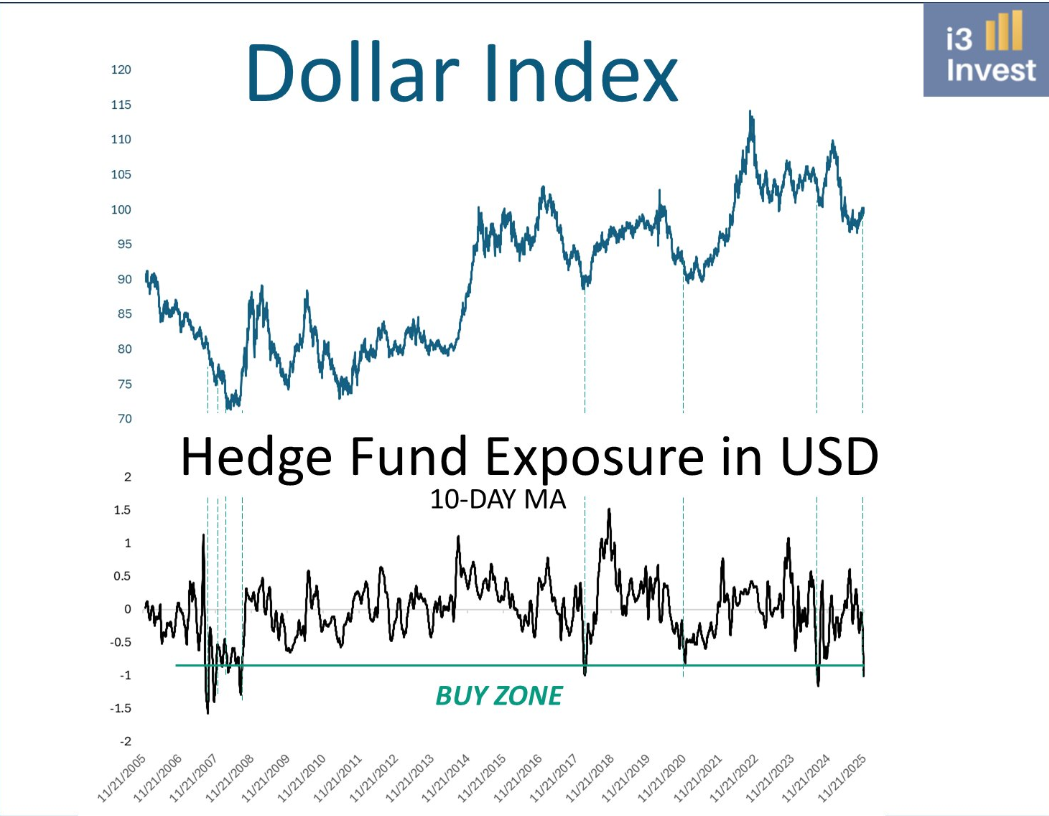

The Positioning Index indicates that funds are deeply entrenched in “extreme short” territory, a zone that has historically preceded a USD recovery rather than a prolonged decline.

Analyst Guilherme Tavares highlighted this setup, noting that the trade has become dangerously crowded.

“Hedge funds are holding significant short positions in the DXY, and historically, similar levels have often preceded solid buying opportunities—at least for a short-term rebound. When a trade becomes too crowded, it’s usually worth considering the opposite side,” he wrote.

Across the past 20 years, every major episode of heavy USD shorting has ended the same way: a dollar bounce that forces fast-money traders to unwind positions.

Hedge Fund Exposure to DXY. Source: Tavares on X

Hedge Fund Exposure to DXY. Source: Tavares on X

Macro Tone Doesn’t Support the Anti-Dollar Hype

A similar warning came from EndGame Macro, who pointed out that extreme short positioning rarely appears in calm markets.

They explained that hedge funds are “shorting a weak dollar,” which historically makes the market more vulnerable to even a small shift in sentiment or liquidity.

According to analysts, the broader environment is not as supportive of ongoing USD weakness as traders assume. Treasury markets are pricing future Fed cuts, growth is slowing, and dollar funding markets are tightening, all conditions that make sudden reversals more likely.

“This setup doesn’t guarantee a major dollar bull run, but it does tell you that the downside is probably limited,” said analyst EndGame Macro.

Why Crypto Should Care: A Rising Dollar Is a Threat

Crypto market analysts continue stressing the direct inverse relationship between the DXY and digital assets.

“Dollar up = bad for crypto. Dollar down = good for crypto. If the dollar keeps grinding higher into 2026… you may have to kiss that beloved bull market goodbye,” analyst As Milk Road warned.

The risk is that if the USD rebounds strongly from these crowded shorts, as history suggests, crypto could face sustained pressure during a period when investors were expecting a multi-year bull cycle.

Technical Signals Now Support a USD Reversal

Market technicians are tracking fresh breakout signals on the US Dollar Index. According to Daan Crypto, the DXY has closed above its 200-day moving average for the first time in nearly nine months, positioning the index to break a 7–8 month downtrend.

“This isn’t ideal for risk assets and has been putting pressure on as well… Good to keep an eye on,” he said.

Combined with the yen’s weakness and general derisking behavior after recent market volatility, technical momentum may now be aligning with positioning data to fuel a potential USD resurgence.

If hedge funds are forced to unwind their extreme short positions, the USD could stage a sharp rebound. This could pressure Bitcoin, Ethereum, and risk assets broadly.

The next few weeks of DXY price action, funding conditions, and Fed communication will determine whether crypto’s bullish narrative survives or enters a more defensive phase.