Ripple Price Forecast: XRP extends decline as supply in profit falls to one-year low

- XRP falls for four consecutive days as a bearish wave weighs on the broader cryptocurrency market.

- The cross-border remittance token's supply in profit holds near its one-year low amid risk-off sentiment.

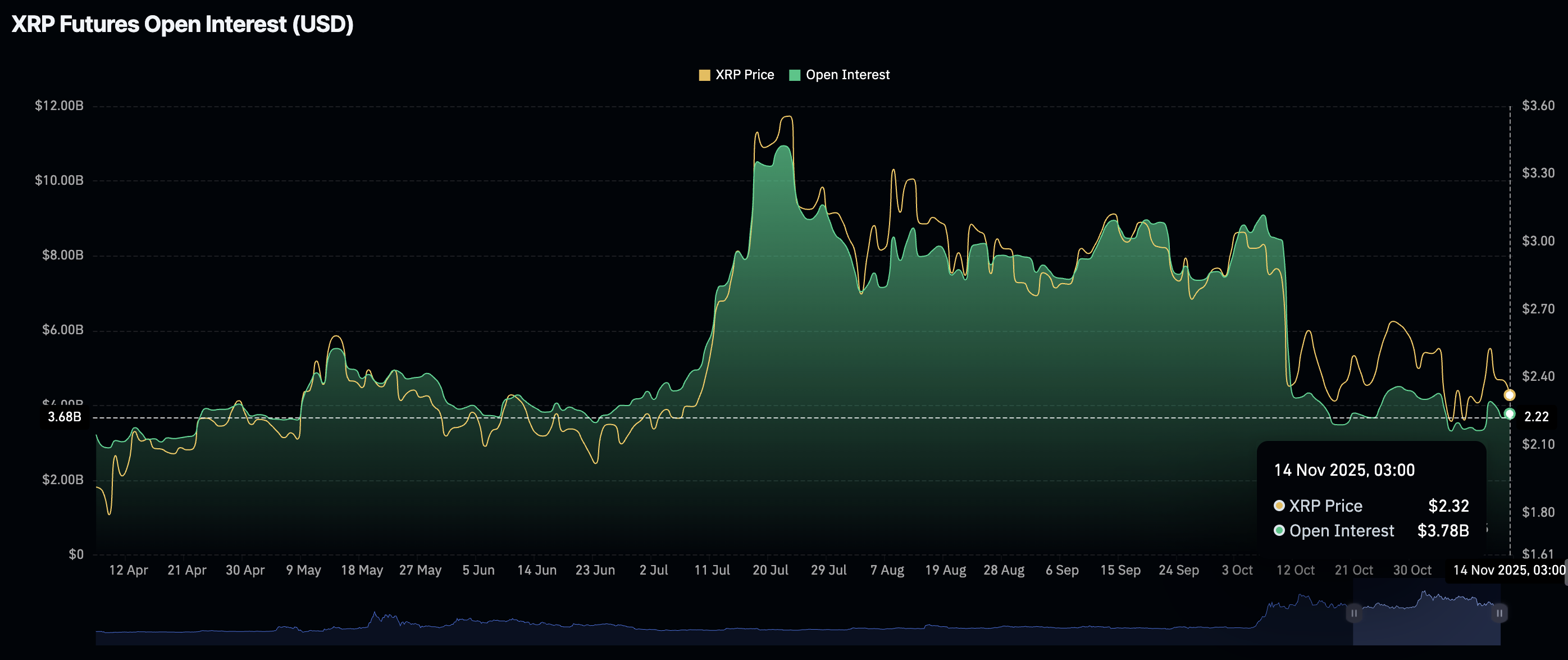

- XRP retail demand steadies, with the futures Open Interest rising slightly to $3.78 billion.

Ripple (XRP) edges lower, trading above $2.25 at the time of writing on Friday. The token's short-term outlook reflects a sticky risk-off sentiment in the broader cryptocurrency market.

Low retail demand continues to weigh on the token, shrugging off the launch of the first XRP spot Exchange Traded Fund (ETF) in the United States. XRPC ETF debuted on Thursday, clocking $59 million in volume on the first day of trading.

XRP supply in profit shrinks as risk-off sentiment prolongs

The Supply in Profit metric from Glassnode shows the absolute volume of XRP's circulating supply currently held at an unrealized profit. According to the chart below, this volume averages 44 million XRP on Friday, down from a peak of 64 million XRP in mid-July. XRP's supply in profit reached this level in early November 2024, highlighting a one-year low.

The steady decline from mid-July points to a broadening wave of unrealized losses among holders, affecting other factors such as sentiment, liquidity, and price performance.

Still, the decline could signal a turnaround, as the supply available for sale diminishes, suggesting sentiment is bottoming. Moreover, investors could begin seeking new opportunities, increasing demand for XRP and paving the way for a short to medium-term recovery.

Meanwhile, retail demand for XRP has not recovered since mid-October, characterised by a weak derivatives market. CoinGlass data shows the futures Open Interest (OI) averaging $3.78 billion on Friday, slightly up from $3.67 the previous day but down from $4.17 billion posted on November 1.

A steady increase in OI is required to support XRP's short-term recovery, indicating that investors have confidence in the token and the ecosystem and are willing to increase their risk exposure.

Technical outlook: XRP bulls defend key support

XRP is trading above $2.25 at the time of writing on Friday as bearish sentiment remains sticky across the cryptocurrency market. The token's position below key moving averages, including the 50-day Exponential Moving Average (EMA) at $2.53, the 200-day EMA at $2.57 and the 100-day EMA at $2.63, reinforces the bearish grip.

Sellers have the upper hand with the Relative Strength Index (RSI) at 43 and extending its decline. Lower RSI readings suggest that bearish momentum is building, increasing the odds of a prolonged downtrend.

A short-term support lies at $2.24, which was tested earlier in the day. If the decline extends, XRP will seek liquidity at $2.07 and $1.09, tested on November 4 and in mid-June, respectively. Still, a recovery could ensue if investors buy the dip, building a tailwind for XRP and eyeing highs above the 50-, 200-, and 100-day EMAs.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.