MINA price down nearly 4% on eve of final test for Berkeley upgrade

- Mina Protocol’s devnet upgrade, the final test before Berkeley, is lined up for April 9.

- The upgrade will bring three key features to the community, likely to boost the protocol’s utility.

- MINA price is losing nearly 4% of its value on Tuesday.

MINA Protocol (MINA) price is preparing for the final step before Berkeley, a major mainnet upgrade for the project. The devnet upgrade is planned for April 9, and the focus is on three key features that are likely to boost MINA’s utility among users.

MINA price is down nearly 4% on Tuesday.

MINA prepares for devnet upgrade on April 9

MINA protocol, considered one of the lightest blockchains, is currently counting down to the devnet upgrade. The devnet upgrade on April 9 is the final step in the process to launch Mina’s major upgrade, Berkeley.

Here’s the latest progress towards Mina’s major mainnet upgrade!

— Mina Protocol (httpz) (@MinaProtocol) April 5, 2024

Preparations for the Devnet upgrade, set to take place on April 9th, are underway!

This final milestone before the mainnet upgrade will provide the ecosystem with one last opportunity to test the Berkeley features… pic.twitter.com/qlxP5tF0wC

The technical enhancement is focused on three features voted on by the community:

- Easier zero-knowledge application programmability (Mina Improvement Proposal (MIP) 4)

- Introduction of a powerful proof system (MIP 3)

- Removal of a short-term incentive, Supercharged Rewards (MIP 1)

The protocol’s official blog post outlines how contributors have extensively tested and pushed the network to its limit, and MINA is ready for its final stage of testing on April 9. The devnet is an environment designed for experimentation before technical upgrades go live on the project’s mainnet.

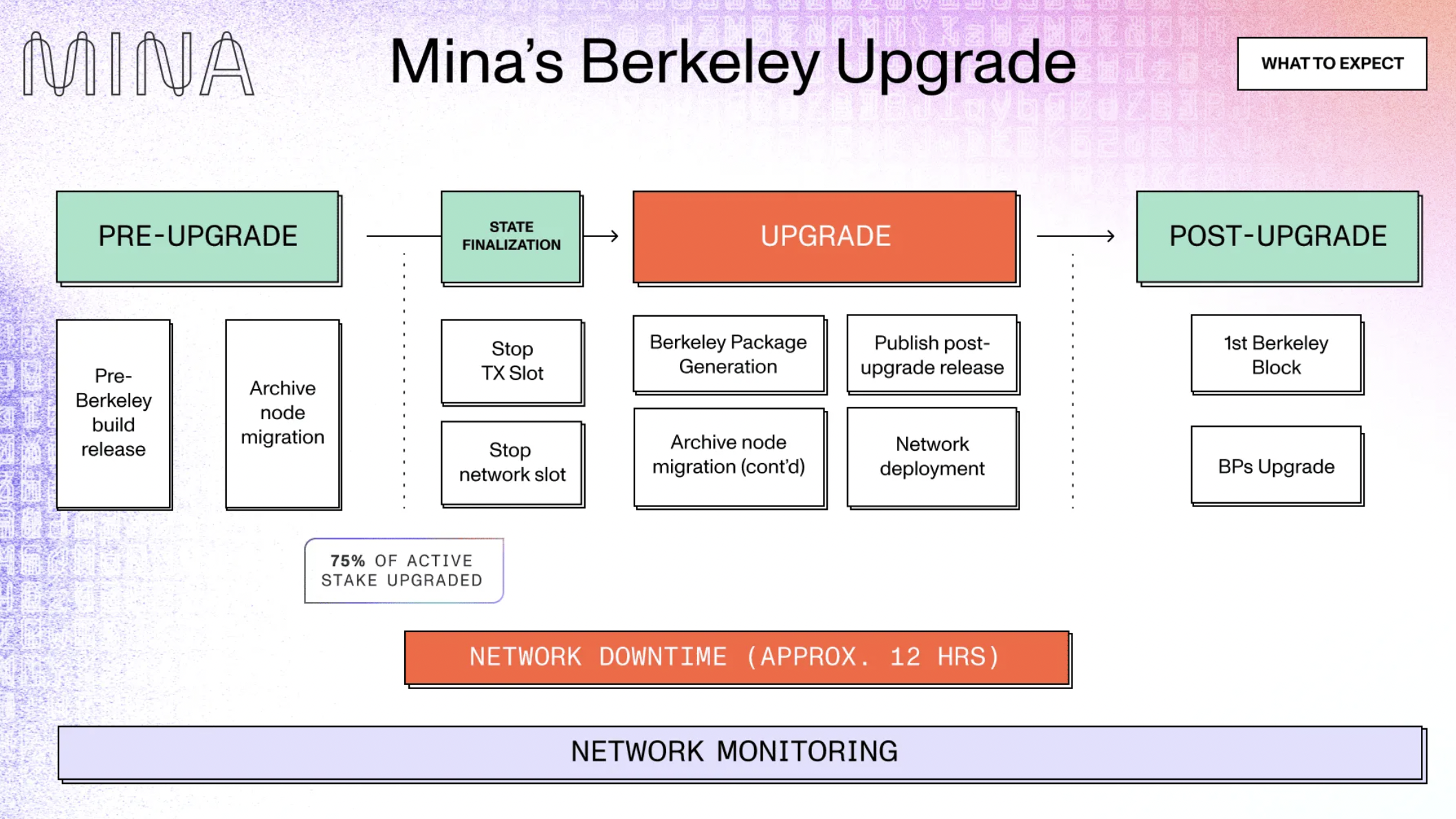

Mina’s Berkeley Upgrade plan

MINA price corrects ahead of key upgrade

MINA price is down nearly 4% on Tuesday, as the project prepares to take its Berkeley upgrade live on the devnet. MINA is trading at $1.0866 on Binance, down nearly 7% on the monthly time frame.

MINA price has been in a downtrend since its March 12 local top of $1.7226, consistently forming lower highs and lower lows on the daily timeframe.