Crypto Today: Bitcoin, Ethereum, XRP pare losses ahead of Fed interest rate decision

- Bitcoin reclaims $113,000 as risk appetite increases ahead of the Fed's monetary policy.

- Ethereum rebounds above $4,000, building on the 100-day EMA support.

- XRP gains momentum as traders increase exposure, piling into long positions.

Bitcoin (BTC) is showing signs of recovery, trading above $113,000 on Wednesday as interest in cryptocurrencies increases ahead of the Federal Reserve's (Fed) interest rate decision.

Altcoins, including Ethereum (ETH) and Ripple (XRP), lean bullishly, underscoring positive market sentiment. Ethereum holds marginally above $4,000, while XRP edges higher, trading above $2.64.

Market overview: BTC, ETH, XRP stable ahead of Fed interest rate decision

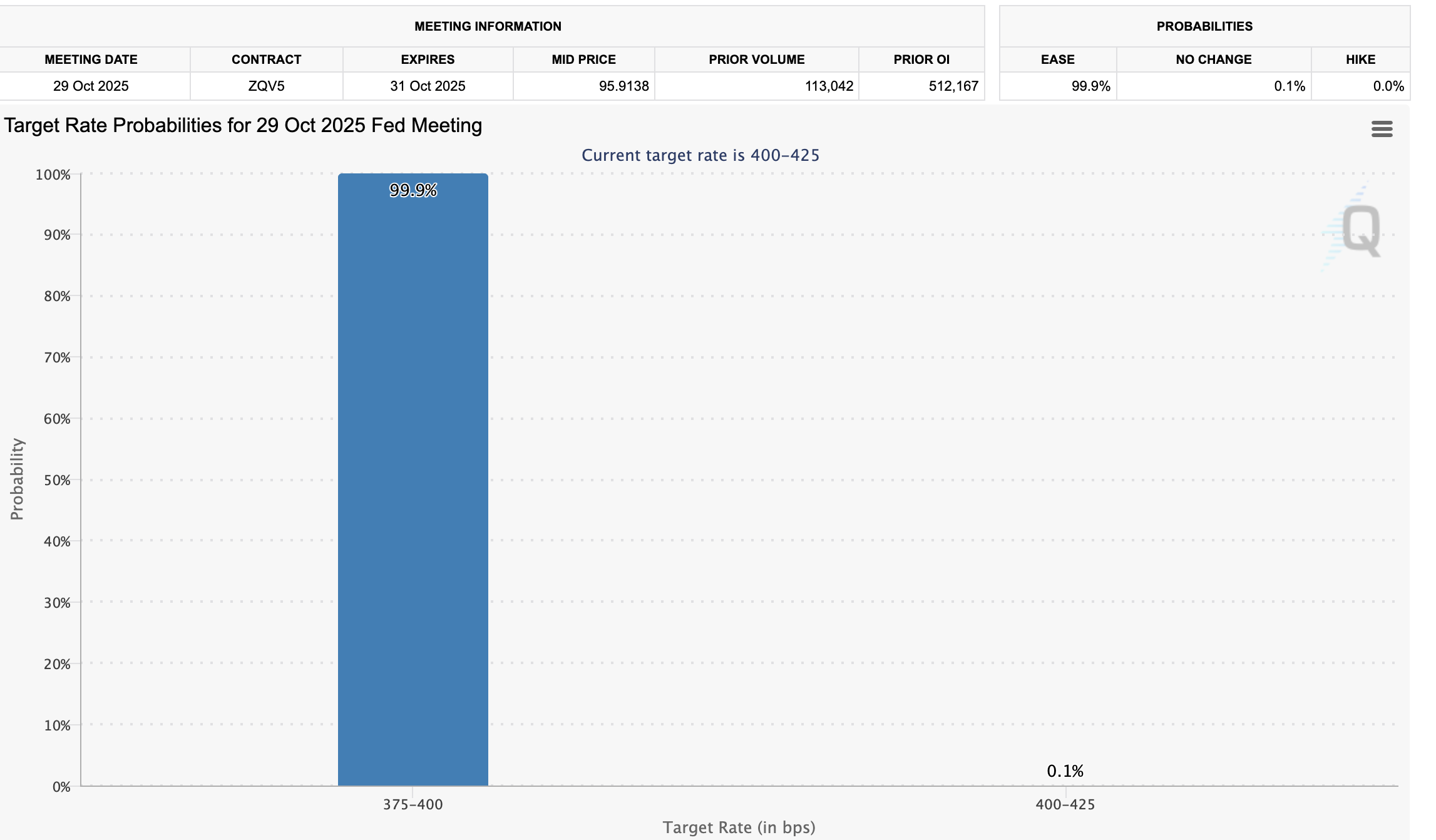

The Federal Open Market Committee (FOMC) meeting is expected to culminate in a decision on interest rates. According to the CME Group's FedWatch tool, there is a 99.9% chance the central bank will cut interest rates by 25 basis points, bringing the target benchmark rate to a range of 3.75% to 4.00%.

FedWatch tool | Source: CME Group

Riskier assets such as Bitcoin, Ethereum and XRP could benefit from lower interest rates amid increasing risk appetite. Cheaper borrowing reduces the appeal of low-yield safe assets like bonds, pushing investors toward riskier assets with higher returns.

Chart of the day: Bitcoin steadies, signaling as risk-on sentiment returns

Bitcoin is trading above $113,000 at the time of writing on Wednesday, supported by the 100-day Exponential Moving Average (EMA) at $112,731. The Money Flow Index (MFI) on the daily chart has risen to 57, suggesting more money is entering Bitcoin, which supports the short-term bullish potential.

The Relative Strength Index (RSI) has stabilized above the midline, indicating steady bullish momentum. Higher RSI readings approaching overbought territory would bolster the short-term bullish picture, increasing the odds of a breakout above the critical $116,000 level.

Traders will watch for a daily close above the 50-day EMA at $113,337 to validate Bitcoin's bullish potential this week. Still, losing the immediate 100-day EMA support at $112,731 could accelerate the decline toward the next key support area at the 200-day EMA around $108,364.

BTC/USDT daily chart

Altcoins update: Ethereum, XRP uphold bullish case

Ethereum remains above $4,000 at the time of writing, supported by the 100-day EMA at $3,971 on the daily chart. A buy signal from the Moving Average Convergence Divergence (MACD) indicator since Sunday reinforces Ethereum's recovery potential.

Traders will likely increase risk exposure if the blue MACD line remains above the red signal line while the indicator continues to rise. The MFI indicator is near the midline, signaling that investor risk appetite is rising ahead of the Fed's monetary policy meeting.

Key areas of interest for traders are the 50-day EMA at $4,116, the supply area at $4,253, which was previously tested on Monday, and the descending trendline on the same daily chart, which has been in place since Ethereum reached a new all-time high of $4,956 in late August.

ETH/USDT daily chart

As for XRP, the price is fluctuating between the 200-day EMA support at $2.61 and the 50-day EMA resistance at $2.68. The 100-day EMA sits slightly above this level at $2.73.

XRP/USDT daily chart

Key indicators, including the MACD and the RSI, back XRP's short-term bullish outlook. The MACD issued a buy signal on Friday, prompting investors to increase their exposure. Similarly, the RSI rising to 50 suggests that bullish momentum is increasing amid a potential breakout above the 50-day EMA and the 100-day EMA resistance levels.

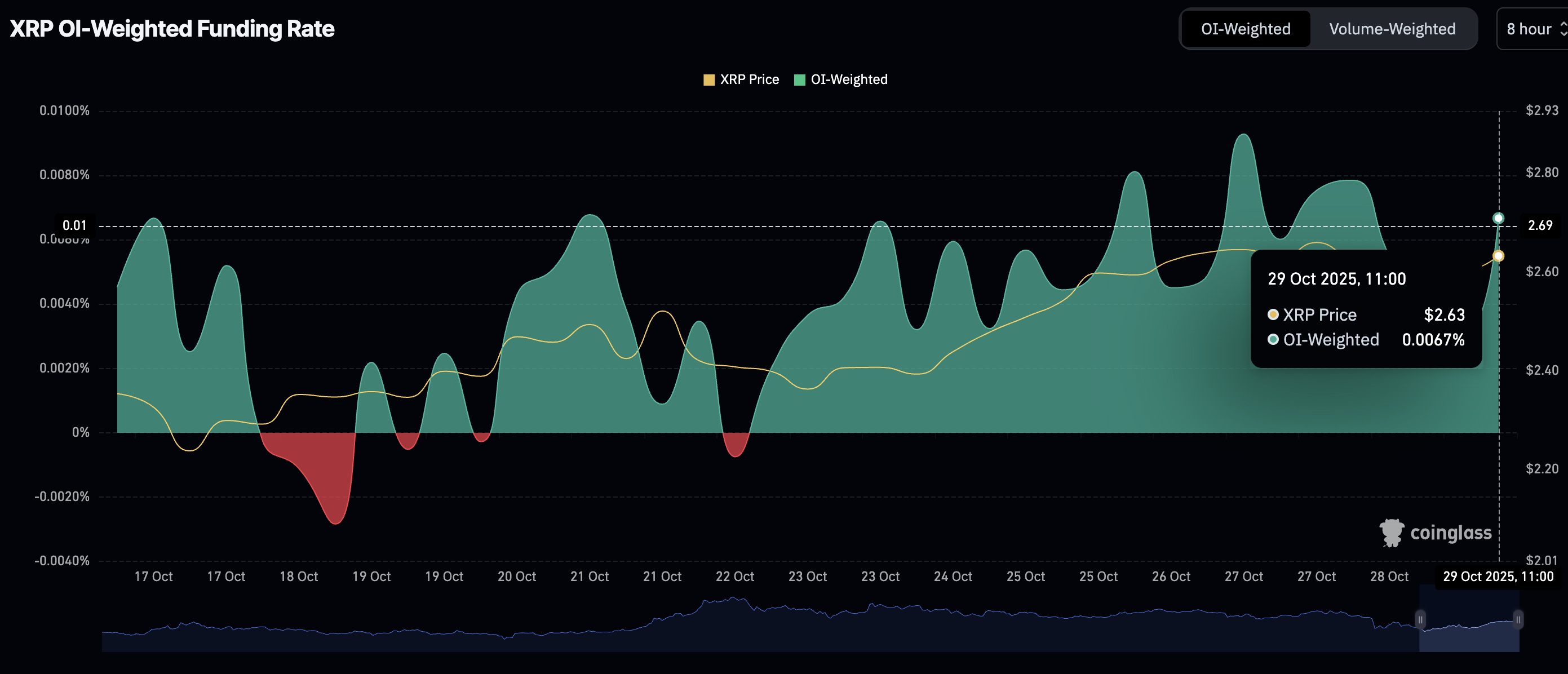

Meanwhile, a sharp rebound in the Open Interest-weighted funding rate to 0.0067% on Wednesday from 0.0030% on Tuesday shows that traders are increasingly piling into long positions.

XRP OI-Weighted Funding Rate | Source: CoinGlass

The OI weighted funding rate tracks the level of trader interest in XRP. A sustained increase signals that traders are confident about rejoining the market and seeking opportunities ahead of the Fed's monetary policy.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.