Bitcoin Price Forecast: BTC steadies near $113,000 as traders brace for Fed rate decision, Big Tech earnings

- Bitcoin price holds around $113,000 on Wednesday, finding support near a previously broken ascending trendline.

- Market volatility could spike as the Fed is set to deliver a 25 bps rate cut and Big Tech earnings loom.

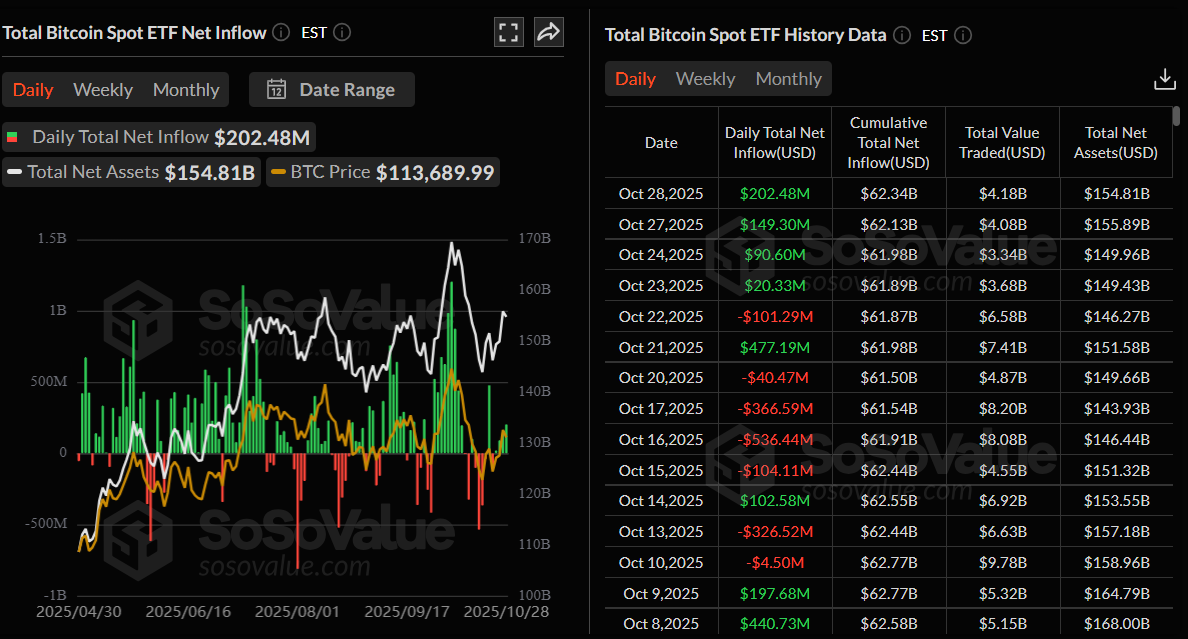

- US-listed spot Bitcoin ETFs recorded $202.48 million in inflows on Tuesday, extending a four-day streak of gains since last week.

Bitcoin (BTC) remains steady near $113,000 at the time of writing on Wednesday, as traders adopt a cautious stance ahead of key macro and corporate catalysts. The US Federal Reserve (Fed) is expected to announce its interest rate decision, and major tech giants — Microsoft, Alphabet, Meta, Apple, and Amazon — are set to report earnings, which could bring fresh volatility to both traditional and crypto markets. Meanwhile, US-listed spot Bitcoin Exchange Traded Funds (ETFs) continue to show strong demand, recording $202.48 million in inflows on Tuesday, extending a four-day positive streak.

Bitcoin could face volatility after the Fed rate decision

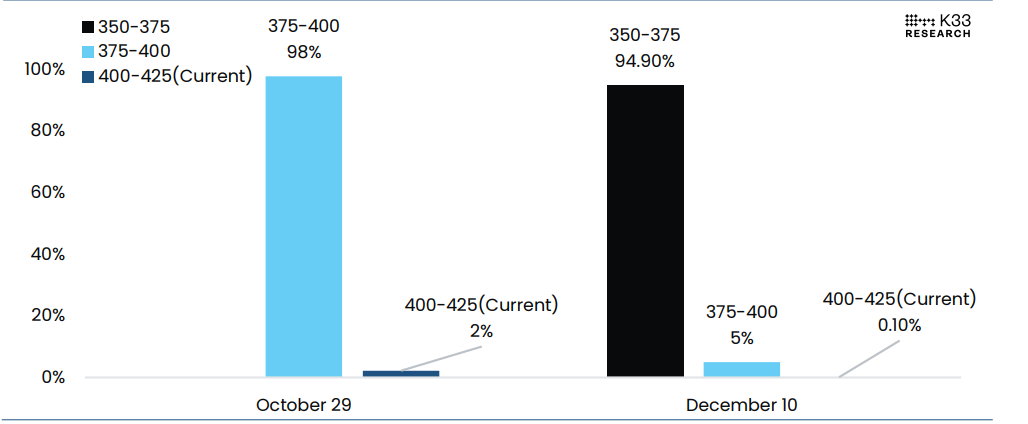

The Federal Open Market Committee (FOMC) is expected to deliver a 25 basis points (bps) interest rate cut at the end of a two-day meeting on Wednesday, bringing the federal funds rate to the 3.75%–4.00% range, as the Federal Reserve (Fed) seeks to cushion slowing growth and rising labor-market concerns.

Policymakers are also likely to discuss adjustments to quantitative tightening (QT), with a growing consensus that balance-sheet runoff could be slowed or paused to preserve market liquidity and avoid unintended tightening.

The Fed's rate decision on Wednesday could bring fresh volatility to riskier assets such as Bitcoin. However, the prolonged US government shutdown, for the 13th time on Tuesday, underscored a deadlock in Congress and delayed key inflation and employment reports, leaving the Fed with limited visibility into real-time economic conditions.

A K33 analyst reports that, “this data gap adds uncertainty to the Fed’s forward guidance. No dot plot interest rate forecast will be delivered at this meeting, but a focus on the uncertainty ahead due to limited data may become a dominant theme during the press conference.”

For now, the market is pricing a 98% chance of a 25-bps cut on Wednesday and a 94.9% chance of another 25-bps cut following the December 10 FOMC meeting.

Big Tech earnings reports could inject considerable volatility into markets

Apart from the Fed interest rate decision, the big Tech earnings reports, including Microsoft, Alphabet, and Meta, will be released on Wednesday, whereas Apple and Amazon will report Q3 earnings on Thursday. These five companies reflect nearly a quarter of the S&P 500's market value and could have a clear directional market-moving effect.

The K33 Research reported that on net, analyst expectations tilt moderately bullish, with markets broadly anticipating continued top-line and earnings growth fueled by AI and cloud momentum, though tempered by selective caution on margins, capex intensity, and macro sensitivity.

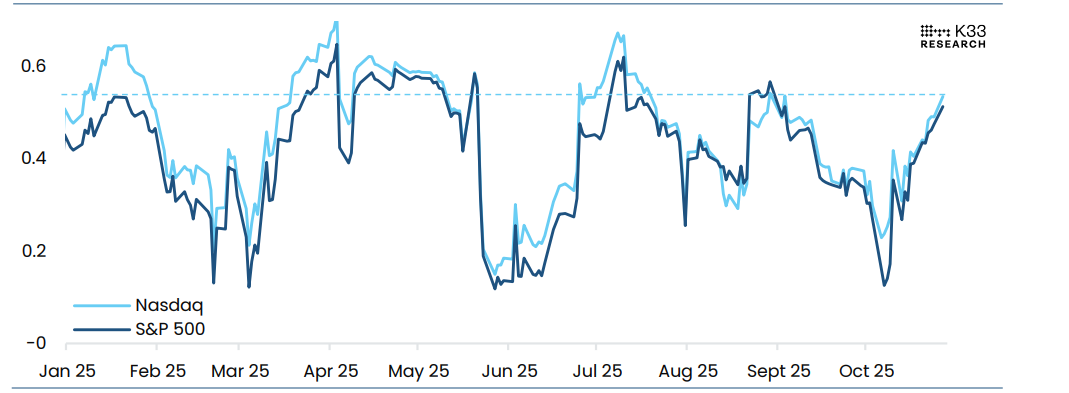

The graph below shows that the correlation between BTC and US equities has been rising lately. The 30-day correlation between BTC and the Nasdaq have risen to 0.53, the highest level since late August. With elevated correlations, earnings and the FOMC are poised to significantly influence BTC's direction.

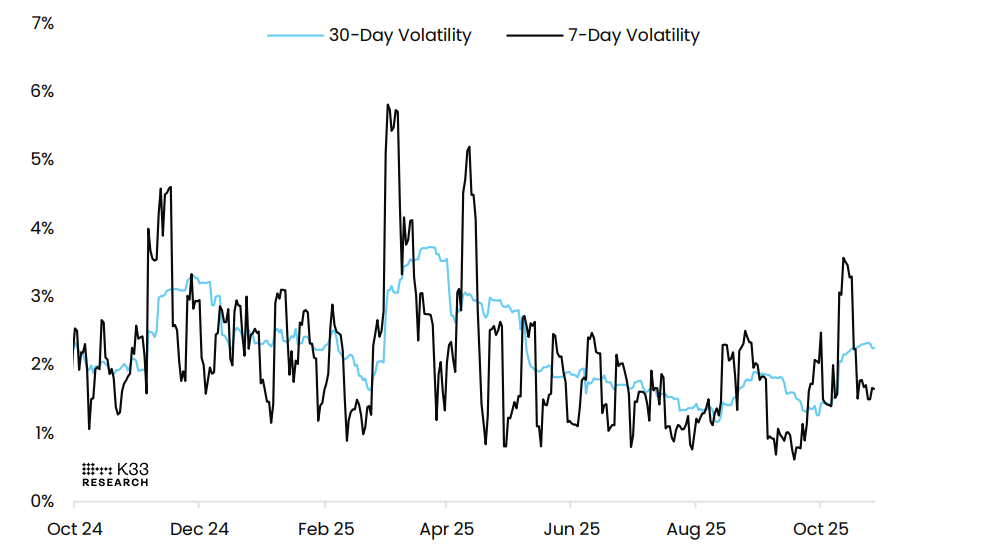

Looking at Bitcoin’s volatility chart reveals the current market dynamics. While Bitcoin’s 7-day average volatility has eased to 1.6% from 1.8%, intraday swings remain significant. On October 21, BTC surged 5% and retraced the entire move within the same 24-hour period — a rare occurrence that signals constrained liquidity and typically appears near price extremes. Notably, such gain-and-reversal patterns haven’t been observed since the early April tariff tantrum, roughly 193 days ago. Traders should be cautious of upcoming volatility.

Institutional demand continues to strengthen

US-listed spot ETF flows continue to strengthen so far this week. According to SoSoValue data, spot Bitcoin ETFs recorded inflows of $202.48 million on Tuesday, extending a four-day streak of positive flows since last week. If these inflows continue and intensify, BTC could further extend its ongoing recovery.

In addition, Strive, a Bitcoin treasury and asset management company, announced on Tuesday that it has acquired 72 BTC, bringing its total holdings to 5,958 BTC, reflecting consistent corporate demand and confidence in the largest cryptocurrency by market capitalization.

Bitcoin Price Forecast: BTC finds support around key level

Bitcoin price was rejected from the 78.6% Fibonacci retracement level, drawn from the April 7 low of $74,508 to the October 6 all-time high of $126,199, at $115,137 on Monday, and declined slightly the next day, falling below the 50-day Exponential Moving Average (EMA) at $113,336. At the time of writing on Wednesday, BTC is holding around $113,100, finding support around an ascending trendline.

If BTC finds support around the ascending trendline, recovers, and closes above $115,137, it could extend the rally toward the key psychological level at $120,000.

The Relative Strength Index (RSI) on the daily chart hovers around the neutral 50 level, indicating a lack of momentum and indecision among traders. However, the Moving Average Convergence Divergence (MACD) showed a bullish crossover on Sunday, which still holds, supporting the bullish thesis.

BTC/USDT daily chart

On the other hand, if BTC continues its correction, it could extend the decline toward the 61.8% Fibonacci retracement level at $106,453.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.