Ripple Price Forecast: XRP eyes breakout as risk-on sentiment and retail demand return

- XRP approaches $2.70, mirroring steady risk-on sentiment in the broader cryptocurrency market.

- Demand for XRP derivatives increases as Open Interest breaks above $4.5 billion.

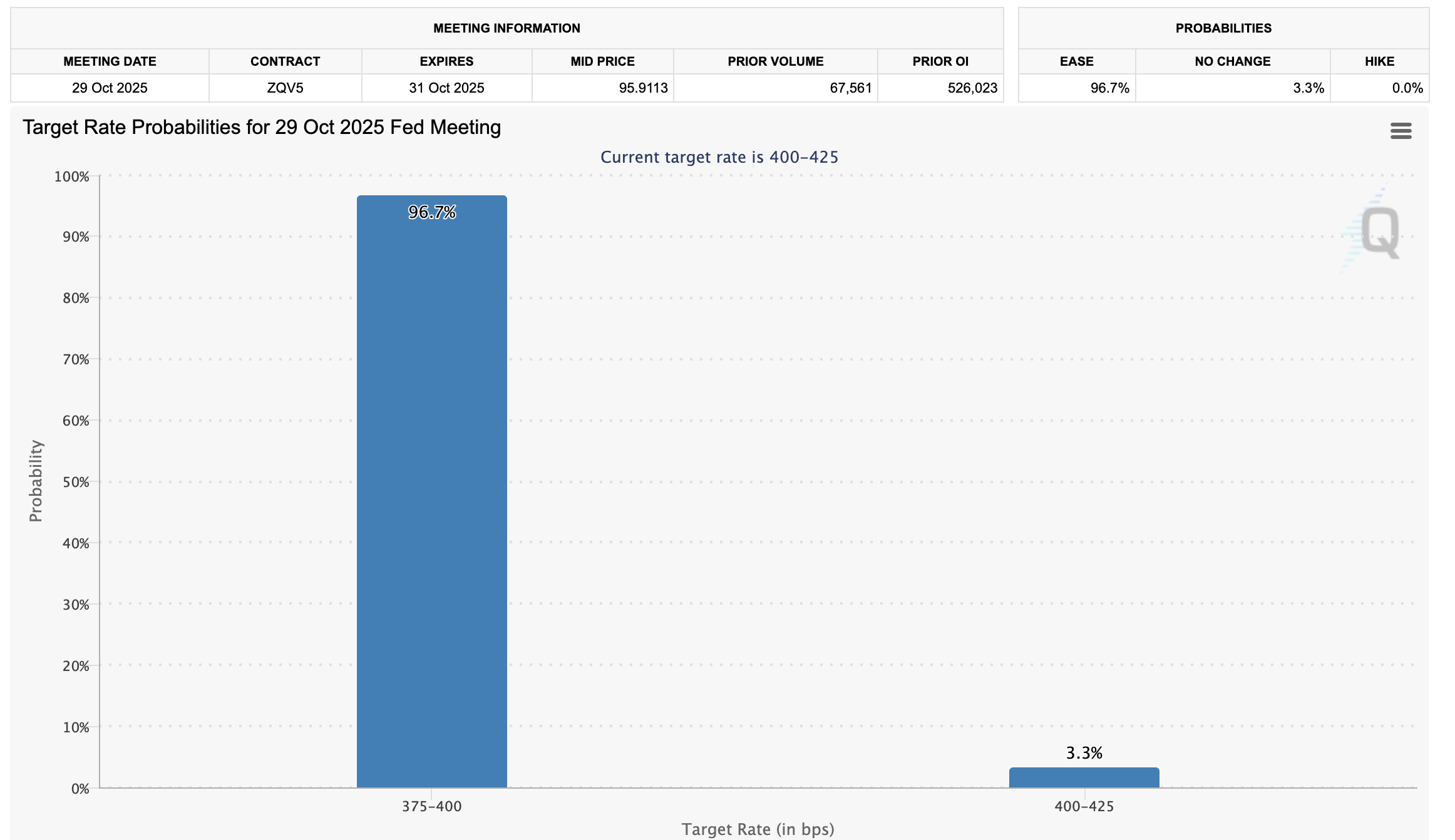

- The Federal Reserve is expected to cut interest rates by 25 basis points on Wednesday, potentially benefiting riskier assets such as XRP.

Ripple (XRP) edges higher in tandem with crypto majors such as Bitcoin (BTC) and Ethereum (ETH), trading above $2.65 at the time of writing on Tuesday. Interest in the cross-border remittance token has steadied over the past week, encouraging investors to consider emerging opportunities following the infamous October 10 deleveraging event.

XRP momentum builds on growing retail demand

Retail interest in XRP is gaining momentum, as evidenced by the futures Open Interest (XRP), which averages $4.51 billion on Tuesday. According to CoinGlass data, OI, which tracks the notional value of outstanding futures contracts, plunged to $3.49 billion on October 19, the lowest level since late April, as risk-off sentiment spread across the cryptocurrency market amid broader macroeconomic uncertainty and the trade stand-off between the US and China.

The increase in OI suggests that risk appetite is returning among retail traders, which may continue to support the current recovery.

XRP Open Interest | Source: CoinGlass

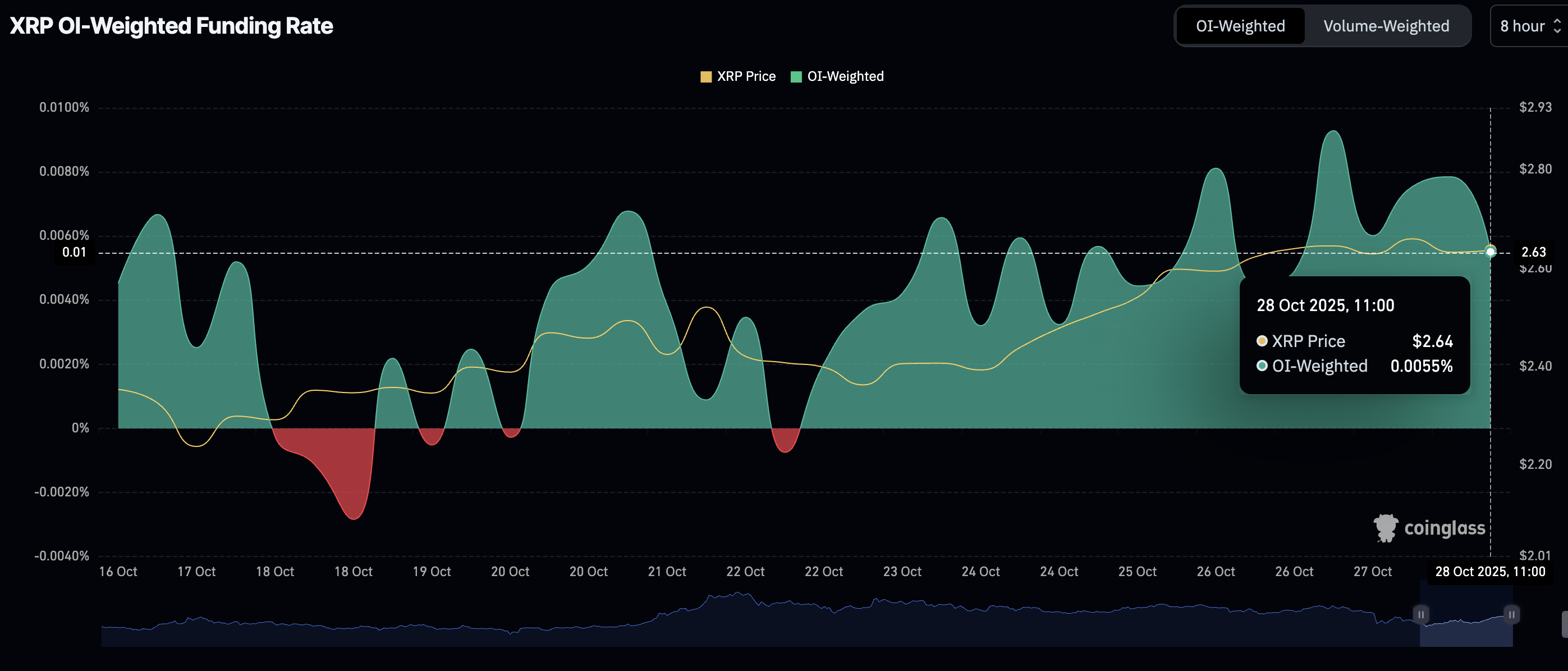

Still, caution is advised, as the OI-Weighted Funding Rate has declined, averaging 0.0055% on Tuesday, down from 0.0093% the previous day. This shows that the increase in the futures OI to $4.51 billion falls short of strengthening investor confidence in XRP’s recovery. In other words, traders are increasingly piling into short positions, possibly anticipating another sweep at the key critical $2.18 support, last tested on October 17.

XRP OI-Weighted Funding Rate metric | Source: CoinGlass

Technical outlook: XRP uptrend lags amid profit-taking

XRP is holding above the 200-period Exponential Moving Average (EMA) at $2.65, with its upside capped below the supply area of $2.69 on the 4-hour chart. A descending trendline sits marginally below the 200-period EMA, providing additional support.

The downward-trending Relative Strength Index (RSI), currently at 62, is signaling a weakening of bullish momentum amid potential profit-taking. A steady decline in the RSI would suggest a top-heavy technical structure.

The Money Flow Index (MFI), which tracks the amount of money entering or leaving XRP, holds at 61, down from the overbought region. If this downtrend persists, it would result in a daily close below the 200-period EMA, significantly increasing profit-taking.

XRP/USDT 4-hour chart

The 50-period EMA and the 100-period EMA converge at around $2.55, forming a confluence support. Other key levels of interest for traders are $2.32, last tested on Wednesday, and $2.18, tested on October 17, if the decline accelerates.

However, XRP could extend its recovery above the immediate $2.70 hurdle if sentiment continues to improve this week, underpinned by the US Federal Reserve (Fed) decision on interest rates. Experts surveyed by the CME Group believe there is a 96.7% chance the Fed will cut rates by 25 basis points, bringing the benchmark to a range of 3.75% to 4.00%.

FedWatch tool | Source: CME Group

Interest rate cuts benefit riskier assets such as XRP, particularly if investors diversify their portfolios. The move also gestures that the central bank is loosening its monetary policy, allowing money to flow into the economy.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.