SocialFi tokens rally as crypto influencers bring back Friend.tech

- SocialFi tokens have seen a resurgence in prices on Monday as crypto traders revive the Friend.tech hype.

- Friend.tech v2 launch is coming up after April 20, feeding the SocialFi narrative among market participants.

- SocialFi tokens Theta Token, Cheelee and Galxe prices climb on Monday.

SocialFi tokens Theta Token (THETA), Cheelee (CHEEL), and Galxe (GAL) prices climbed on Monday as Friend.tech, a blockchain-based social network, is making a comeback as crypto experts and influencers discuss the platform across social media platforms like X.

SocialFi tokens see resurgence among market participants

Tokens related to Social Finance (SocialFi) projects gained value. SocialFi users create, control and own a social media platform by combining the tokenization of social influence with decentralization. SocialFi tokens offer rewards to content creators and consumers.

Among top SocialFi tokens, THETA, CHEEL and GAL have started climbing on Monday. These asset prices are up between 2% and 4%. THETA, CHEEL and GAL prices are up 3.65%, 3.08% and 2.52%, respectively. Other SocialFi tokens such as LimeWire (LMWR) and DreamMachineToken (DMT) are up 6.8% and 6.3% on the day, respectively.

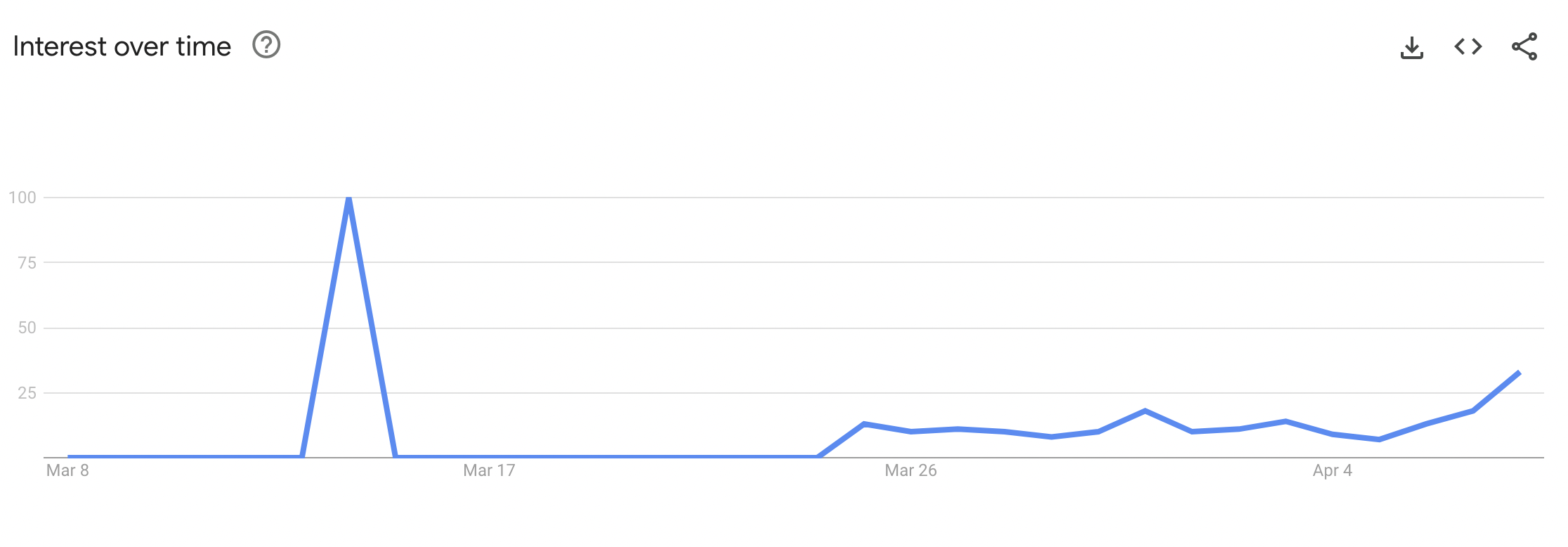

The increase in these tokens’ price can be partially attributed to the rising popularity of Friend.tech, whose mentions on X have increased in the past day. Google Search trends data also shows a consistent increase in searches for the term “Friend.tech” since March 25. The protocol is set to launch V2 after 420, or April 20 in the US.

Interest over time in the term: Friend.tech

Crypto experts behind the X handle @CryptoLimbo_ and @WClementeIII discuss the resurgence of SocialFi and the Friend.tech hype in the sector. Experts believe the SocialFi narrative could garner as much traction as meme coins did earlier in the bull market.

Talks of Friendtech all over my feed again!

— Limbo (@CryptoLimbo_) April 8, 2024

I told you multiple times that SocialFi hype will strike again.

Betting on $BBL too!

Following the rally in meme coins in the past four weeks, capital is likely rotating to sectors like SocialFi amidst the Bitcoin price rally to $72,400 on Monday.