Meme coin madness likely to return as Bitcoin price quashes April dip

- Top market capitalization-sized meme coins are rallying after Bitcoin price recovered above $67,000 on Thursday.

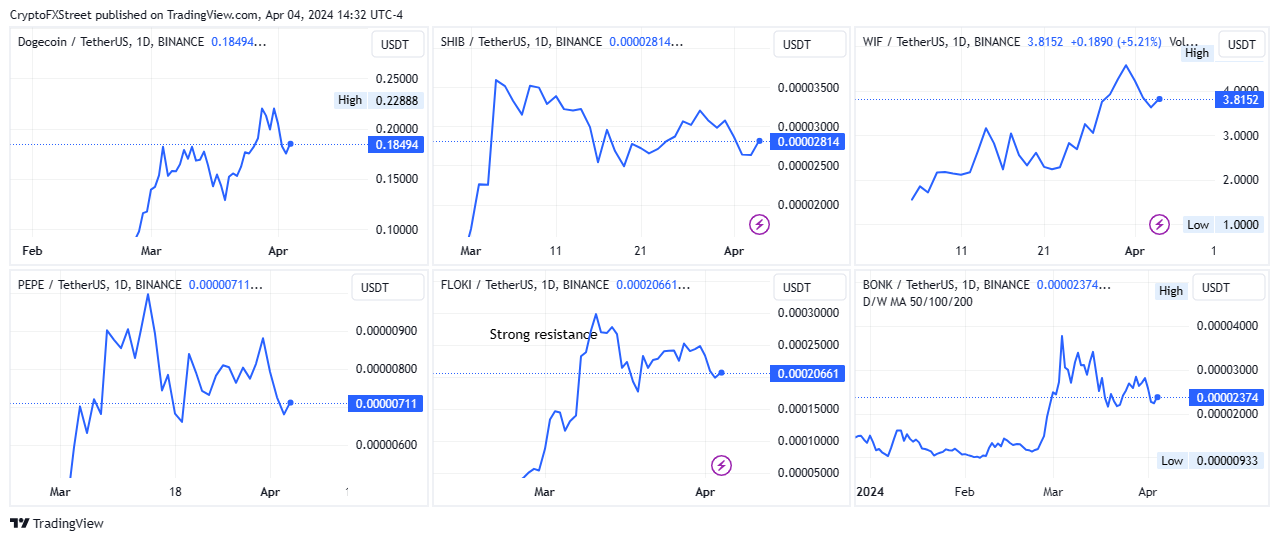

- DOGE, SHIB, WIF, PEPE, FLOKI and BONK are rallying with Shiba Inu meriting biggest gainer so far.

- Meme coin madness could return if BTC overtakes $69,000 as market capitalization rises 5%.

Meme coins have a tendency to take cues from the Bitcoin (BTC) price, unlike cat-themed tokens. It comes amid strong correlation between BTC and meme coins, with investors using this relationship as some sort of cheat sheet to anticipate a rally inShiba Inu (SHIB) and Dogecoin (DOGE) prices especially.

Also Read: Cat-themed tokens seesaw against Bitcoin price as sector market cap nears $2 billion

Meme coins engage in rally

Meme coins are rallying, especially the ones with large market capitalizations as they share a strong correlation with BTC price. Dogecoin (DOGE) price is up 6%, while Shiba Inu (SHIB) price is up nearly 8%. Dogwifhat (WIF), Pepe (PEPE), and Bonk Inu (BONK) prices are not so far behind in gains, standing an average of 4% up on the day.

DOGE/USDT 1-day chart, SHIB/USDT –day chart, WIF/USDT 1-day chart, PEPE/USDT 1-day chart, BONK/USDT 1-day chart

Notably, WIF was able to dethrone PEPE from the meme coin top three on market capitalization metrics. The total market capitalization of meme coins is upwards of $60.83 billion, signifying up to 5% in gains.

The rally seen in meme coins follows Bitcoin price flipping the $67,000 threshold into support. If Bitcoin price makes a decisive move above $69,000, it would encourage more buy orders, with the capital overflows like to rotate into meme coins and kickstart the expected meme coin madness. A flip of $69,000 into support would indicate that sentiment is shifting to bullish.

An October 2023 report by WazirX detailed three reasons why meme coins tend to rally with Bitcoin.

- Meme coins are very popular among retail investors who are drawn to the sector tokens’ fun and exciting nature. When the market is broadly bullish, this type of investor tends to be drawn to meme coins, leading to growing demand.

- This sector’s tokens have fair market capitalizations, which means even a relatively small capital inflow can have a significant impact on the price of a meme coin. “A sudden surge in investment can trigger significant price surges.”

- Meme coins make for communities that are defined by high engagement. Increased activity inspires enthusiasm and demand.

Meme coins tend to benefit from the bullish trend seen with Bitcoin price. Fortune indicates that when meme coins pump alongside BTC, it is often an indication that the “crypto bubble is back.”

At the time of writing, Bitcoin price is $68,466, recording upwards of 3.5% in daily gains.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.