Litecoin price could suffer further decline as whales take profits in large volumes

- Litecoin price is down 6% on the day, alongside large volume profit-taking by LTC holders.

- Litecoin has seen higher transaction volume than usual in the past month, with whales moving LTC holdings back into circulation.

- LTC holders await a Spot ETF approval for the altcoin.

Litecoin (LTC) has noted a spike in whale transactions valued at $100,000 and higher, alongside spikes in profit-taking in the past week. LTC whales have injected their holdings into circulation, according to on-chain metrics on Santiment.

These developments support a thesis of further correction in Litecoin since profit-taking occurs alongside LTC price decline.

Litecoin price is in a downward trend, observing a 6% loss on the day.

Litecoin ahead of the altcoin pack with significantly higher transaction volume

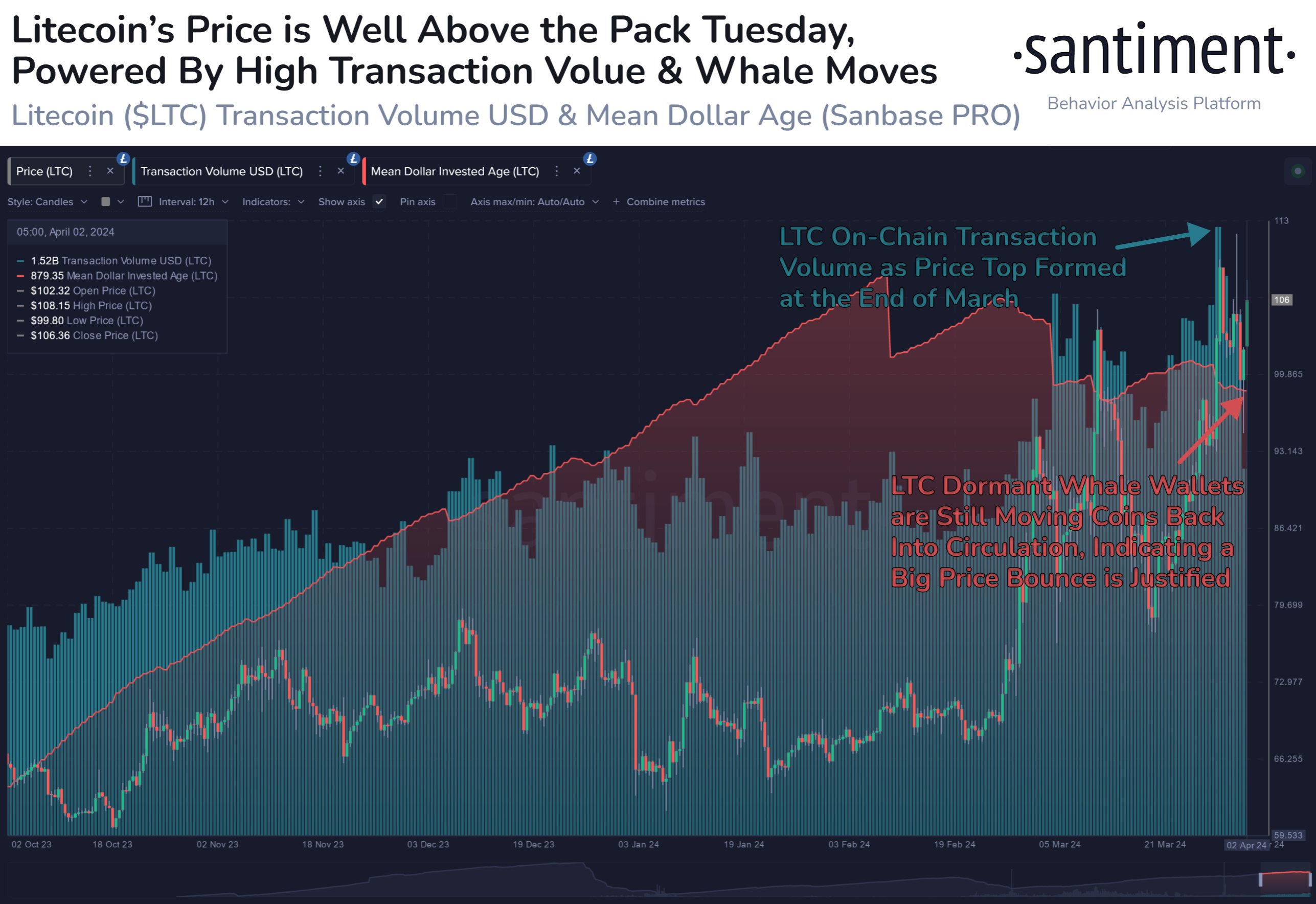

Data from crypto intelligence tracker Santiment shows that Litecoin has noted higher transaction volume than usual throughout the past month. The average of Litecoin investments is “younger,” meaning whales are moving LTC holdings back into circulation.

Litecoin whale activity, on-chain transaction volume

Whale transactions valued at $100,000 and higher noted spikes throughout March 2024, with the largest one on March 29 (1,532 transactions). Interestingly, when combined with LTC price and another on-chain metric, Network Realized Profit/Loss, it becomes evident that whales were likely engaged in taking profits as LTC price climbed to a local top of $109.24 on March 29.

Since the local LTC price top, Litecoin price has suffered a correction, while whale transactions and profit-taking have considerably declined, signaling a loss of interest among traders. There is a likelihood of further correction in Litecoin if whales engage in more profit-taking on their LTC holdings.

%20[16.13.06,%2003%20Apr,%202024]-638477458620021192.png)

Litecoin whale transaction count, network realized profit/loss

Another catalyst that is likely to influence LTC price is a Spot Litecoin ETF approval by the US Securities and Exchange Commission (SEC). Crypto expert Scott Melker discussed the probability of a Spot LTC ETF approval in a recent episode of “The Alpha Show.”

Is This Throwback Coin Next in Line For a Spot ETF Approval!? - Looking at Litecoin $LTC | The Alpha Show @litecoin @joevezz https://t.co/pxVSftQNMQ

— The Wolf Of All Streets (@scottmelker) April 3, 2024

Litecoin price in a state of decline

LTC price is down nearly 7% in the past day and the altcoin is in a downward trend. LTC price is down nearly 12% from its year-to-date peak of $112.73 on April 1. At the time of writing, LTC price is $99.88 on Binance. A key psychological level for the altcoin is $100, which has acted as resistance for nearly eight months since July 2023.