Pi Network Upgrades: Can They Lead Price Recovery?

Pi Network (PI) is entering a pivotal stage with the release of Pi Node Linux and preparations for the upcoming protocol upgrade to version 23.

Yet, paradoxically, Pi Coin is trading just a few percentage points above its all-time low, leaving investors both worried and hopeful for a sharp rebound.

Infrastructure Version Upgrades

Pi Network has officially introduced a Linux Node and plans to upgrade the protocol from version 19 to 23.

“There will also be an upcoming rollout of protocol upgrades that begins with Testnet1 this week, and continue with Testnet2 and Mainnet upgrades into the next few weeks, which may potentially require planned outages of the blockchain services.” The announcement stated.

The Pi Node Linux enables operators—especially service providers and exchanges that rely on Linux environments—to run standardized node software. This replaces the need for customized builds. Operators can manage protocol updates or enable Pi’s auto-update feature, reducing node configuration discrepancies and strengthening network stability.

For the community, while Linux support doesn’t directly translate into immediate Node rewards, it lowers entry barriers. This enables developers and technically skilled users to contribute to the ecosystem.

In parallel, Pi announced a multi-phase protocol upgrade, starting with Testnet1 in the coming weeks. Testnet2 will follow. Then, Mainnet will move the entire ecosystem to version 23—a Pi-modified variant of Stellar Protocol v23. Pi plans to embed KYC authority at the protocol layer, gradually delegating verification authority to trusted organizations.

The team said more than 14.82 million users have completed KYC and migrated to Mainnet. This is a critical milestone to unlock integrations requiring identity verification.

Price Goes Down In Mixed Signals

From a market standpoint, macro pressures and Bitcoin’s volatility drag PI into a risky zone.

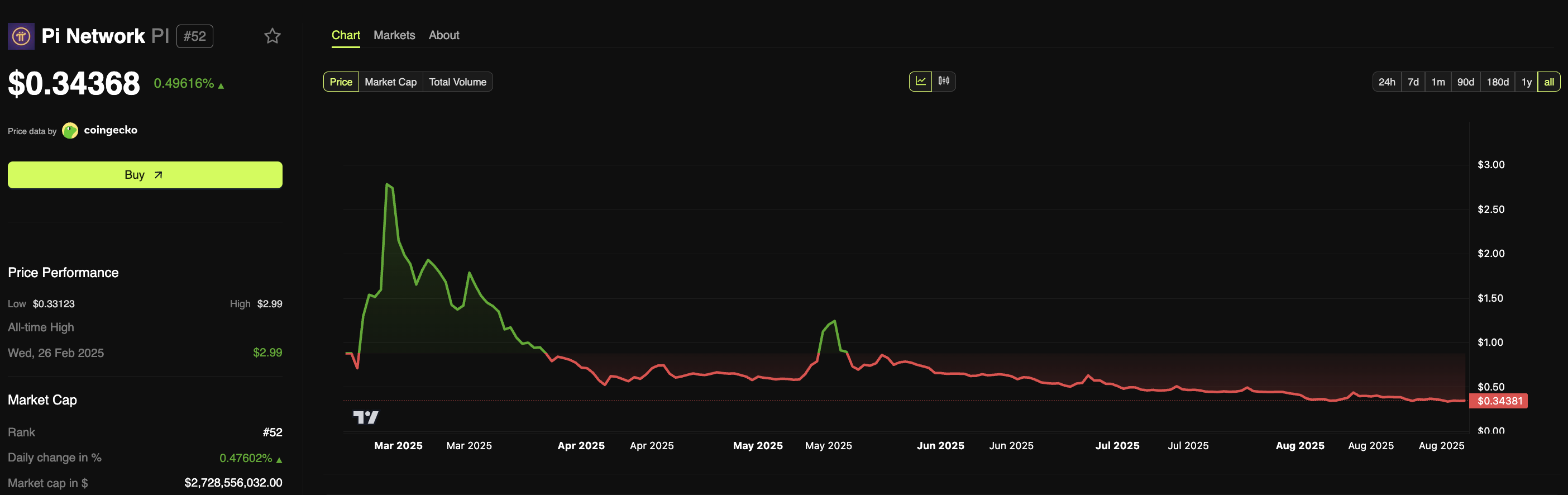

Real-time data shows PI trading around $0.34 on the market side, just above the all-time low of $0.3312 (August 26, 2025). This thin margin could easily break if bearish sentiment intensifies. Considering that the most recent all-time high was recorded at $2.99 last February, this shows how months of steady decline have erased most of this year’s earlier gains.

PI near ATL. Source: BeInCrypto

PI near ATL. Source: BeInCrypto

Technical signals remain mixed. Some analyses highlight bullish divergence on momentum indicators, suggesting a potential 40% rebound if PI can reclaim resistance zones. However, this scenario depends heavily on fresh buying interest and broader market conditions. On the flip side, another report warns that Bitcoin could drive PI to new lows due to the increasingly tight correlation with BTC. If Bitcoin weakens, the risk of PI breaking below its historical support becomes very real.

In summary, Pi is simultaneously strengthening its infrastructure and testing price bottoms. Levels near ATL are always tempting for risk-seeking investors, but strict risk management—clear stop-losses, position sizing, and waiting for trend confirmation—is essential.

For builders, the release of Pi Node Linux and the v23 upgrade marks a timely opportunity to experiment with early integrations, especially as KYC moves to the protocol layer. This differentiator may become an advantage once institutional capital returns.