Bitcoin Retraces Below $120,000: Is Coinbase Selling To Blame?

Bitcoin has seen a retrace back below the $120,000 level as data shows the Coinbase Premium Gap has dropped into the negative zone.

Bitcoin Coinbase Premium Gap Has Plummeted Into The Red Region

In a new post on X, CryptoQuant community analyst Maartunn has talked about the latest trend in the Bitcoin Coinbase Premium Gap. This indicator measures the difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair).

The former cryptocurrency exchange is popularly used by American investors, especially the large institutional entities, while the latter is the destination of the global investors. As such, the Coinbase Premium Gap tells us about how the buying or selling behaviors differ between US-based and foreign whales.

When the metric has a positive value, it means the cryptocurrency is going for a higher price on Coinbase than Binance. Such a trend suggests the users of the former are applying a higher buying pressure or lower selling pressure as compared to the traders of the latter.

On the other hand, the indicator registering a negative value implies the American investors may be selling more relative to global investors, which has brought the price on Coinbase lower than on Binance.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the past day:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap was above the zero mark when BTC’s recovery run to the $122,000 level occurred, indicating that US-based whales were buying and helping fuel the surge.

While BTC was at its high, however, the indicator’s value saw a sharp reversal and plunged into the negative zone. What has followed these red levels in the metric is a retrace for the coin to prices below $120,000.

Thus, it seems the trend in the Coinbase Premium Gap foreshadowed the price action. This pattern is something that has been witnessed a lot since the start of 2024, as American institutional entities have been in the driving seat.

Given the price action of the past day, it seems the influence of these investors remains strong, so the Bitcoin Coinbase Premium Gap could be worth keeping an eye on, as where it will go next may also carry hints about the cryptocurrency’s future trajectory.

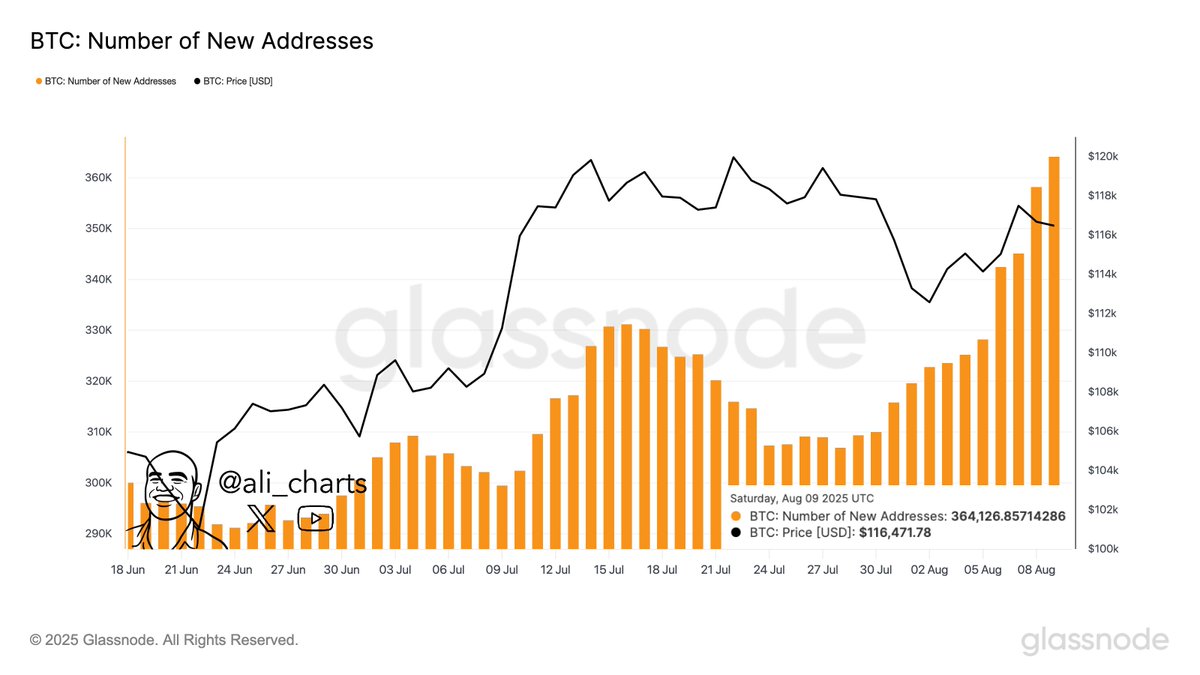

In some other news, address generation on the BTC network has reached its highest level in a year, as analyst Ali Martinez has pointed out in an X post.

From the chart, it’s apparent that the daily total number of new addresses on the Bitcoin blockchain has spiked to a high of 364,126.

BTC Price

At the time of writing, Bitcoin is trading around $119,300, up around 5% over the past week.