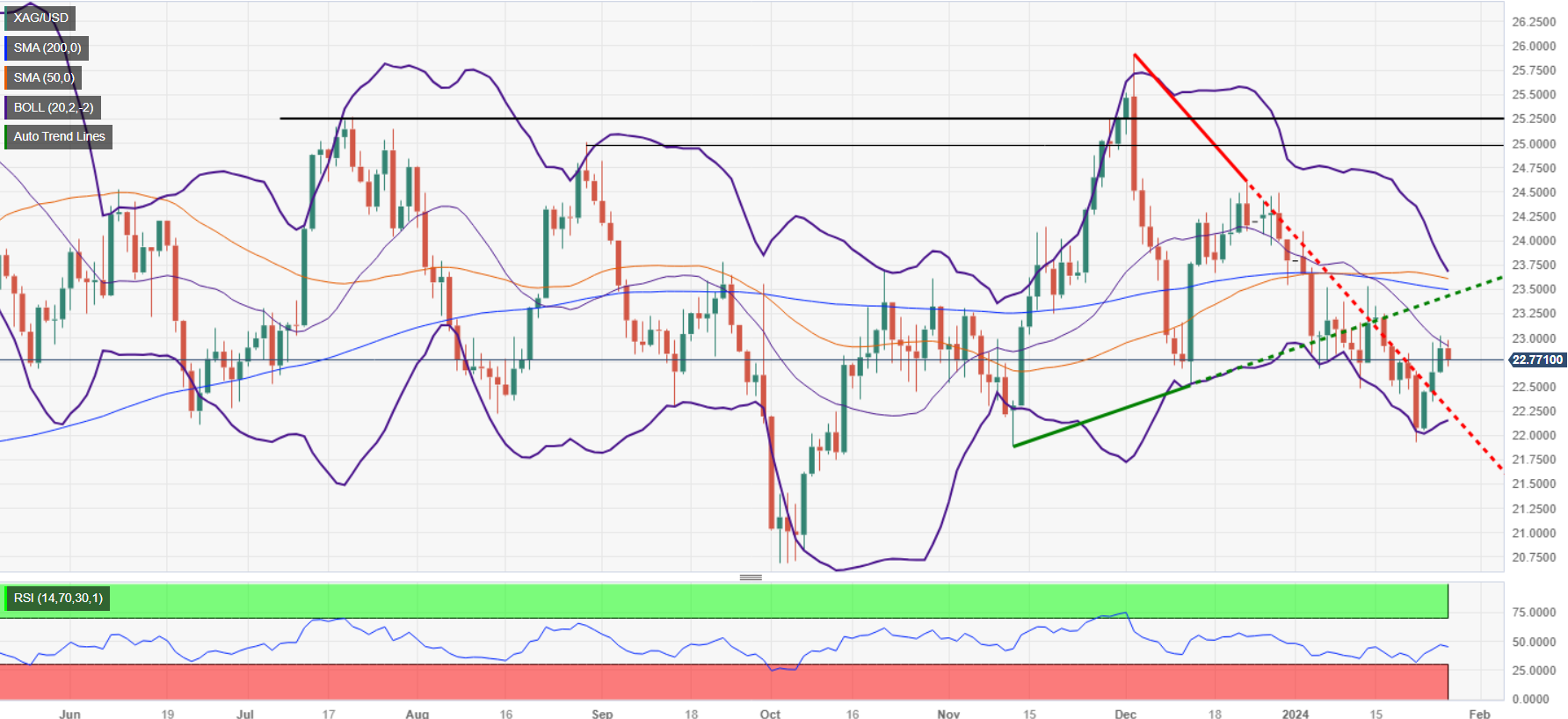

Silver Price Analysis: XAG/USD slips below $23.00

- Silver prices dip, unable to hold above key $23.00 level, indicating a possible ongoing downtrend.

- Break below major supports like 200, 50, and 100-day DMAs strengthens bearish outlook for silver.

- Buyer resistance seen at $23.00 and 100-DMA ($23.15); fall below $22.51 may lead to $22.00, $21.93 supports.

Silver price retreated late in the North American session after hitting a daily high of $22.97, though buyers' failure to reclaim the $23.00 exacerbated the grey metal’s fall to current spot prices. Therefore, the XAG/USD exchanges hands at $22.73, down 0.59%.

After printing three straight positive days, Silver retraced below $23.00, resuming its ongoing downtrend and forming a ‘bearish after sellers dragged prices below key support levels, like the 200, 50, and 100-day moving averages (DMAs). Even though XAG/USD is edging low, as a ‘bearish harami’ chart pattern emerges, it still needs to surpass (again) December’s 13 swing low of $22.51 to challenge the $22.00 figure. The next demand area below that level would be January’s 55 low at $21.93.

On the flip side, buyers are eyeing the $23.00 handle and the 100-DMA at $23.15 as immediate resistance levels in the near term. Once those levels are cleared, the next resistance emerges at the 200-DMA at $23.48.

XAG/USD Price Action – Daily Chart

XAG/USD Technical Levels