NZD/USD Price Forecast: Poise for fresh rally towards 0.6100

- NZD/USD refreshes six-and-a-half month high near 0.6030 ahead of the RBNZ policy meeting on Wednesday.

- The RBNZ will likely cut its Official Cash Rate (OCR) by 25 bps to 3.25%.

- US President Trump suspends 50% tariffs on the EU until July 9.

The NZD/USD pair posts a fresh six-and-a-half-month high near 0.6030 against the US Dollar (USD) at the start of the week. The Kiwi pair strengthens as the New Zealand (NZD) outperforms across the board ahead of the Reserve Bank of New Zealand’s (RBNZ) interest rate decision, which will be announced on Wednesday.

New Zealand Dollar PRICE Today

The table below shows the percentage change of New Zealand Dollar (NZD) against listed major currencies today. New Zealand Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.11% | -0.24% | 0.26% | -0.05% | -0.24% | -0.46% | 0.15% | |

| EUR | 0.11% | -0.13% | 0.44% | 0.06% | -0.12% | -0.34% | 0.27% | |

| GBP | 0.24% | 0.13% | 0.23% | 0.19% | 0.00% | -0.22% | 0.41% | |

| JPY | -0.26% | -0.44% | -0.23% | -0.33% | -0.53% | -0.80% | -0.14% | |

| CAD | 0.05% | -0.06% | -0.19% | 0.33% | -0.17% | -0.40% | 0.22% | |

| AUD | 0.24% | 0.12% | -0.01% | 0.53% | 0.17% | -0.27% | 0.41% | |

| NZD | 0.46% | 0.34% | 0.22% | 0.80% | 0.40% | 0.27% | 0.63% | |

| CHF | -0.15% | -0.27% | -0.41% | 0.14% | -0.22% | -0.41% | -0.63% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the New Zealand Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent NZD (base)/USD (quote).

The RBNZ is expected to lower interest rates by 25 basis points (bps) to 3.25%. This would be the sixth straight interest rate cut by the RBNZ in its current monetary expansion cycle, which it started in the August policy meeting last year.

Meanwhile, the US Dollar’s (USD) underperformance has also strengthened the Kiwi pair. The US Dollar claws majority of its initial losses during the day. Still, the US Dollar Index (DXY) trades slightly lower around 99.00.

The US Dollar has been on the backfoot as concerns over its safe-haven status have renewed after United States (US) President Donald Trump suspended his decision to impose 50% flat tariffs on the European Union (EU) until July 9, which he threatened on Friday.

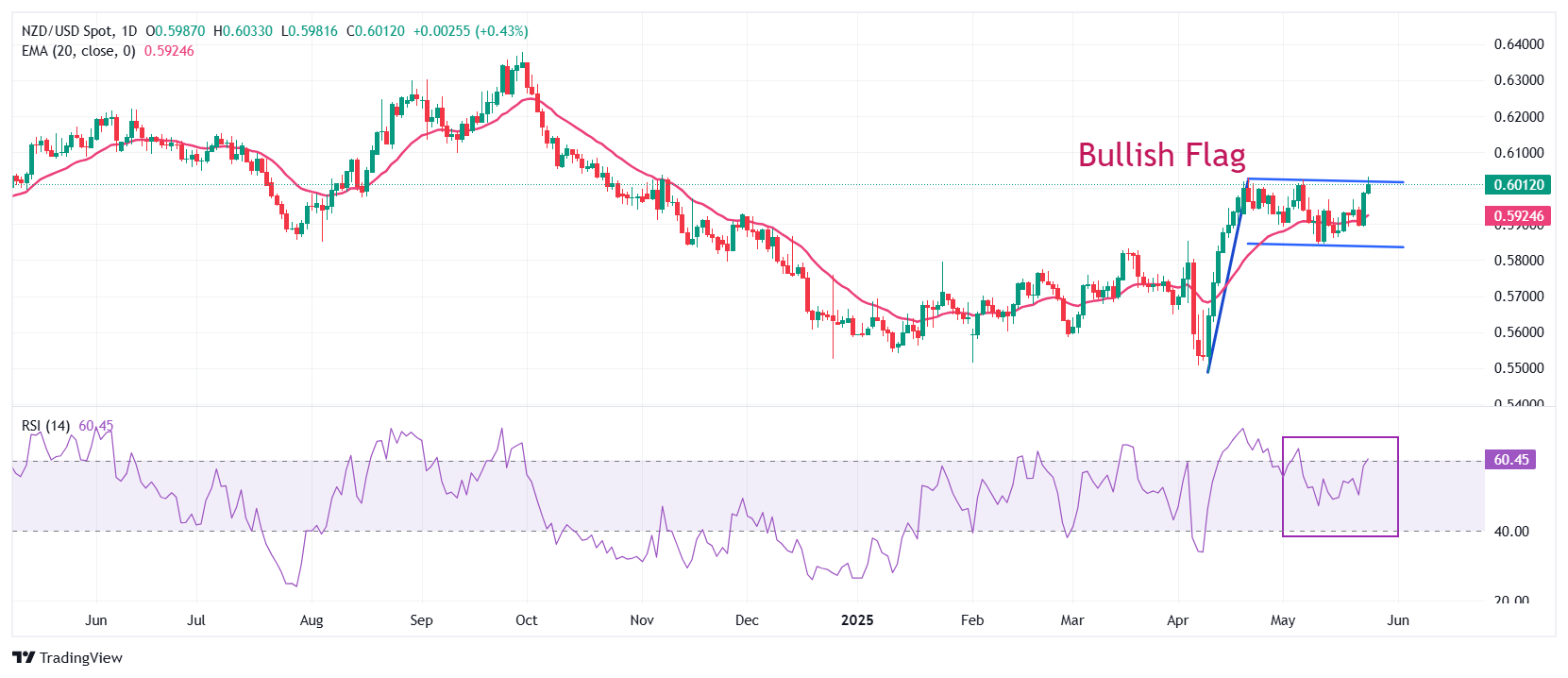

NZD/USD strives to break the Bullish Flag formation on the upside. Historically, the chart pattern resumes its strong rally after a breakout of the consolidation. The near-term trend of the pair is bullish as the 20-day Exponential Moving Average (EMA) slopes higher around 0.5925.

The 14-day Relative Strength Index (RSI) breaks above 60.00. Bulls would come into action if the RSI holds above the 60.00 level.

The Kiwi pair is expected to rise towards the September 11 low of 0.6100 and the October 9 high of 0.6145 after breaking above the intraday high around 0.6030.

In an alternate scenario, a downside move below the May 12 low of 0.5846 will expose it to the round-level support of 0.5800, followed by the April 10 high of 0.5767.

NZD/USD daily chart

Economic Indicator

RBNZ Interest Rate Decision

The Reserve Bank of New Zealand (RBNZ) announces its interest rate decision after its seven scheduled annual policy meetings. If the RBNZ is hawkish and sees inflationary pressures rising, it raises the Official Cash Rate (OCR) to bring inflation down. This is positive for the New Zealand Dollar (NZD) since higher interest rates attract more capital inflows. Likewise, if it reaches the view that inflation is too low it lowers the OCR, which tends to weaken NZD.

Read more.Next release: Wed May 28, 2025 02:00

Frequency: Irregular

Consensus: 3.25%

Previous: 3.5%

Source: Reserve Bank of New Zealand

The Reserve Bank of New Zealand (RBNZ) holds monetary policy meetings seven times a year, announcing their decision on interest rates and the economic assessments that influenced their decision. The central bank offers clues on the economic outlook and future policy path, which are of high relevance for the NZD valuation. Positive economic developments and upbeat outlook could lead the RBNZ to tighten the policy by hiking interest rates, which tends to be NZD bullish. The policy announcements are usually followed by interim Governor Christian Hawkesby's press conference.