EUR/JPY Price Analysis: Surges past 163.00 and hits new YTD high

- EUR/JPY climbs, leveraged by JPY's broad decline on Japan's cooling economy and inflation forecasts.

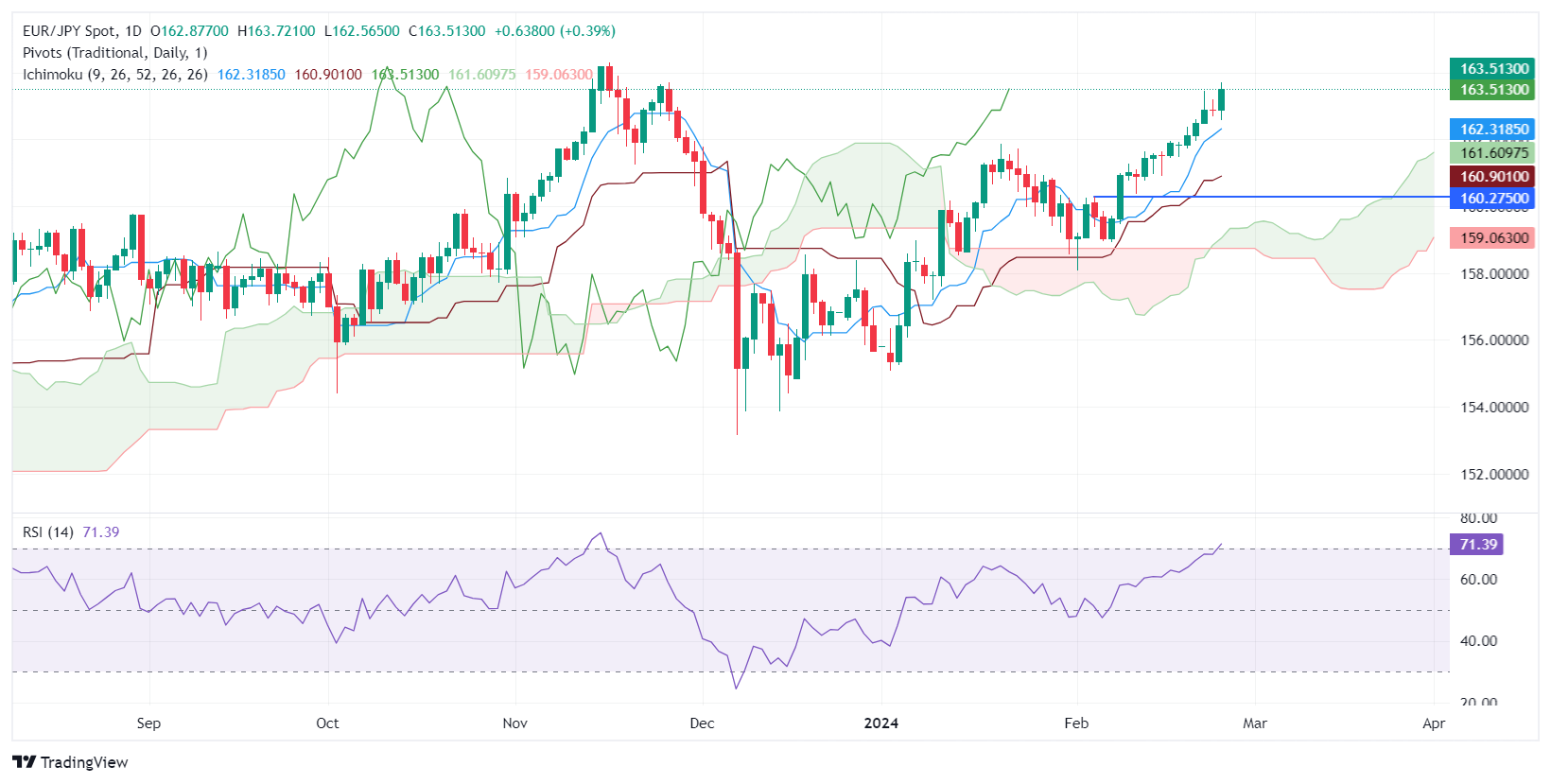

- Technical momentum suggests a test of the 164.00 level, with potential resistance at November's peak.

- Initial support at 163.00, with further downside targets including Tenkan-Sen and Senkou Span A levels.

The EUR/JPY advances sharply and regains the 163.00 figure as traders capitalize on the broad Japanese Yen (JPY) weakness. The latest fundamental news from Japan is that its economy is cooling, while inflation is expected to get below the Bank of Japan's (BoJ) 2% goal on its core figures. At the time of writing, the pair exchanged hands at 163.55, up 0.42%.

From a technical perspective, EUR/JPY rose to a new year-to-date (YTD) high at 163.72, though the exchange rate retreated somewhat amid fears that Japanese authorities might intervene in the Forex markets. Given the backdrop, the uptrend remains intact, and the pair could challenge the 164.00 figure in the near term. A breach of that level would expose the November 16 high at 164.31, followed by the 165.00 mark.

On the flip side, the EUR/JPY first support would be the 163.00 figure. If sellers push the spot price below Monday’s low of 162.56, look for a deeper pullback past the Tenkan-Sen at 162.31 as bears eye the Senkou Span A at 161.61 before the Kijun-Sen at 160.90.

EUR/JPY Price Action – Daily Chart