EUR/USD soars on upbeat Eurozone preliminary PMI data

- EUR/USD raises sharply to near 1.0500 as upbeat Eurozone preliminary PMI data for January has strengthened the Euro.

- The ECB is widely anticipated to cut its Deposit Facility rate by 25 bps to 2.75% on Thursday.

- Trump’s call on immediate rate cuts and his soft tone for China have weighed heavily on the US Dollar.

EUR/USD rallies to near the psychological resistance of 1.0500 in Friday’s European session as the Hamburg Commercial Bank (HCOB) reported that the Eurozone preliminary Composite Purchasing Managers Index (PMI) grew in January after shrinking in the last two months. Flash HCOB PMI report, compiled by S&P Global, showed that overall business activity expanded. The Composite PMI rose to 50.2 from 49.6 in November. Economists expected the PMI to continue to decline but at a slower pace to 49.7.

“The kick-off to the new year is mildly encouraging. The private sector is back in cautious growth mode after two months of shrinking. The drag from the manufacturing sector has eased a bit, while the services sector continues to grow moderately. Germany played a major role in improving the eurozone economy, with the composite index jumping back into expansionary territory. In contrast, France's economy remained in contraction,” Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said.

The report also showed robust labor demand and new business in the services sector. Meanwhile, the manufacturing sector continues to experience layoffs and declining new orders.

Upbeat Eurozone PMI has improved the appeal of the Euro (EUR) in the near term but is unlikely to fix its weak broader outlook on the back of firm European Central Bank (ECB) dovish bets. The ECB is all set to cut its Deposit Facility rate by 25 basis points (bps) to 2.75% on Thursday and would continue to follow the process in the next three policy meetings as officials are confident that inflationary pressures will sustainably return to the desired rate of 2%.

Daily digest market movers: EUR/USD surges as USD’s risk-premium diminishes

- EUR/USD strengthens as the US Dollar (USD) risk-premium has diminished significantly. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, is down near 0.6% on Friday and posts a fresh five-week low near 107.45. The USD’s risk-premium has eased significantly as United States (US) President Donald Trump has signaled that he could reach a deal with China without using tariffs.

- The Dollar has gained almost 10% since October, partly due to market expectations that President Trump would impose lethal tariffs on its trading partners soon after returning to the White House. During the election campaign, Trump commented that if he won, he would impose 60% tariffs on China and 25% on other North American economies.

- President Trump said in an interview with Fox News on Thursday that he had a friendly conversation with Chinese leader Xi Jinping and could reach a deal over trade practices. Trump added that he would rather not use tariffs against China but called tariffs a "tremendous power," Reuters report.

- In addition to Trump’s assumption of tariff relaxation on China, his endorsement of immediate interest rate cuts in his comments at the World Economic Forum (WEF) in Davos on Thursday has also sent the US Dollar on the back foot.

- Going forward, the major trigger for the US Dollar will be the Federal Reserve’s (Fed) monetary policy, which will be announced on Wednesday. The Fed is almost certain to keep interest rates unchanged in the range of 4.25%-4.50%. Investors will pay close attention to Fed Chair Jerome Powell’s conference to determine whether officials agree with President Trump's views.

- In Friday’s session, investors will focus on the preliminary US S&P Global PMI data for January, which will be published at 14:45 GMT.

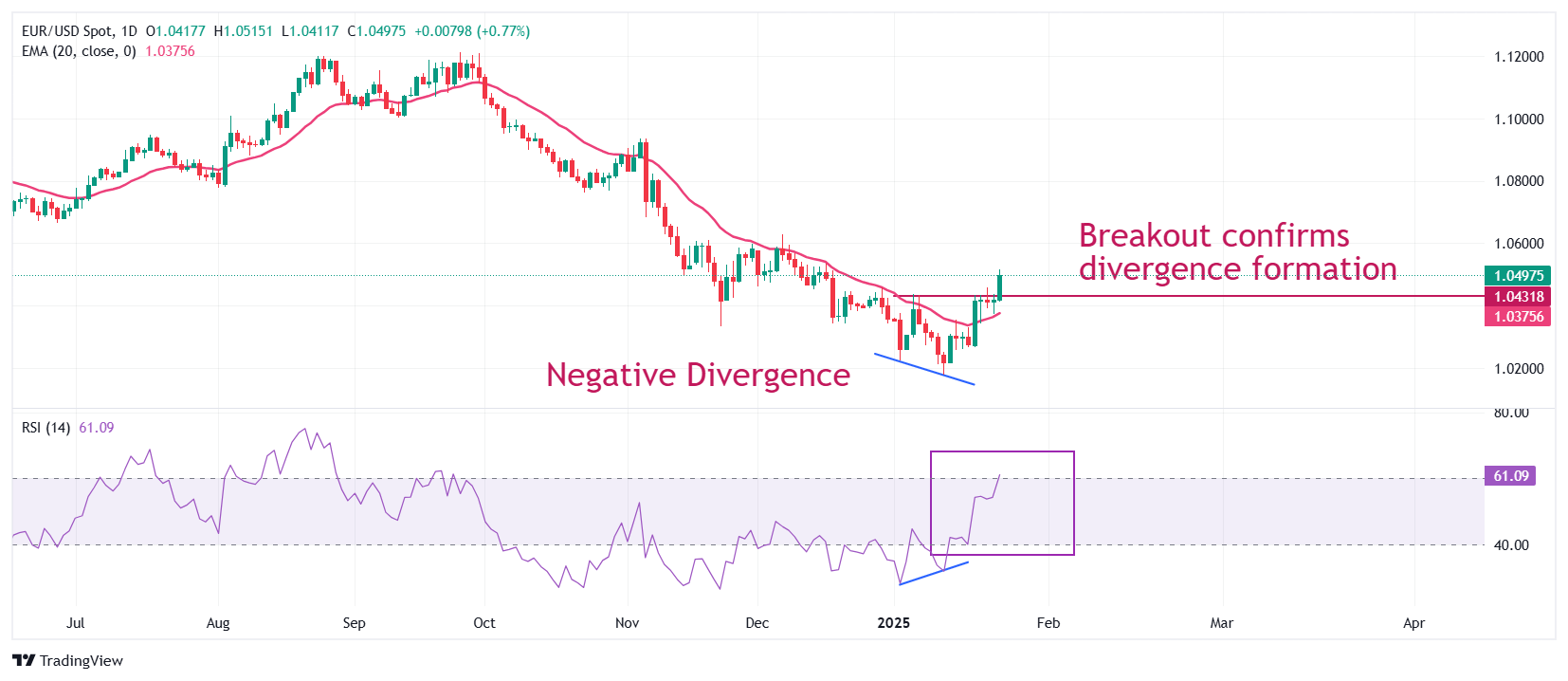

Technical Analysis: EUR/USD refreshes monthly high near 1.0500

EUR/USD posts a fresh monthly high near 1.0500 on Friday. The major currency pair strengthens after breaking above the 50-day Exponential Moving Average (EMA), which trades around 1.0456, on Monday. The pair has continued attracting bids since declining to an over-two-year low of 1.0175 on January 13.

The pair has entered the path of a bullish reversal after a breakout of the January 6 high of 1.0430, which has confirmed a divergence in the asset’s price and the 14-day Relative Strength Index (RSI). On January 13, the RSI formed a higher low, while the pair made lower lows.

Looking down, the January 20 low of 1.0266 will be the key support zone for the pair. Conversely, the December 6 high of 1.0630 will be the key barrier for the Euro bulls.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.