EUR/JPY rises above 157.00, shrugs off poor ZEW report

- EUR/JPY ignores weaker-than-expected ZEW data from the Eurozone and Germany, buoyed by USD/JPY strength.

- Positive US Retail Sales figures drive the USD/JPY higher, despite no clear indications of the Fed’s rate cut size ahead of the FOMC meeting.

- ECB Member Simkus dismisses a rate cut in October, while analysts speculate the BoJ could raise rates to 0.50% by year’s end.

The EUR/JPY trades in the green, up by 0.48%, shrugging off worse-than-expected ZEW data from the Eurozone (EU) and Germany. The recovery of the USD/JPY pair boosted the pair. At the time of writing, the cross-pair trades at 157.28 after touching a low of 156.05.

EUR/JPY climbs to 157.28 as strong US Retail Sales data weighs on Japanese Yen

Data from the United States (US) underpinned the USD/JPY after Retail Sales exceeded estimates of -0.2% contraction, expanded by 0.1% MoM in August. Although the data is positive, failed to provide hints on the size of the Federal Reserve rate cut on Wednesday.

Markets reacted positively to the announcement as Wall Street extended its gains, and the Greenback recovered ahead of the Federal Open Market Committee (FOMC) decision.

In addition, the EU ZEW Survey of Expectations dipped to an eleven-month low, from 17.9 to 9.3 in September, marking the third consecutive month of deterioration amid ongoing uncertainty about the economic outlook and monetary policy direction.

In the meantime, European Central Bank (ECB) Member Gediminas Simkus said the economy is developing as foreseen and disregarded a rate cut in October.

On the Japanese Yen front, the Bank of Japan (BoJ) will hold its latest monetary policy meeting. The consensus suggests the BoJ will stay put, yet analysts at Standard Chartered suggest that rates could reach 0.50% by year’s end.

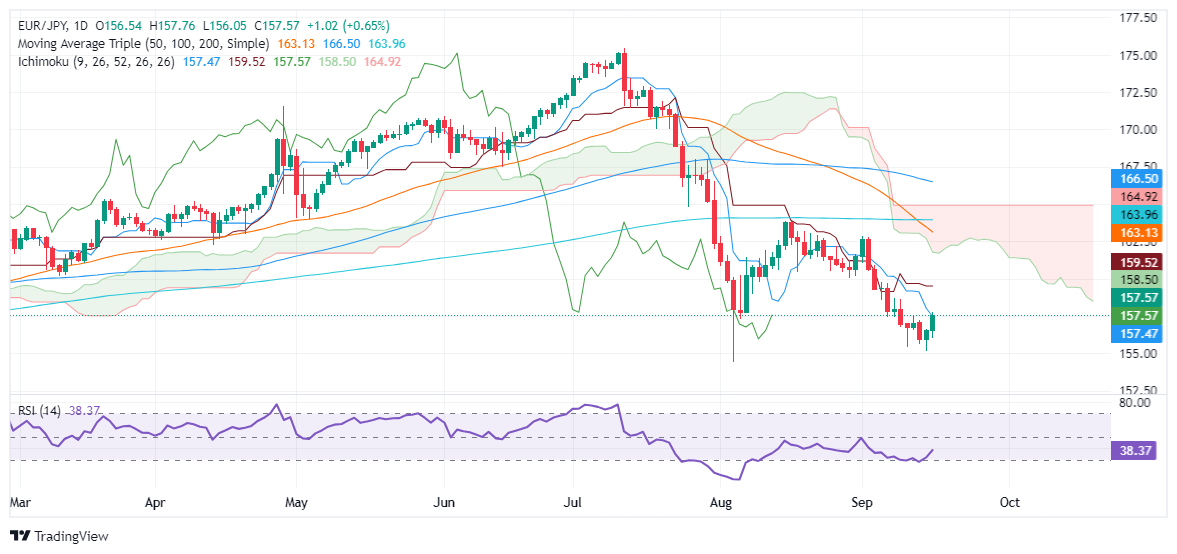

EUR/JPY Price Forecast: Technical outlook

Given the fundamental backdrop, the FOMC’s meeting could weigh on both countries. If the Fed’s decision triggers a risk-off environment, look for further downside on the EUR/JPY pair.

However, as of writing, the cross has cleared the Tenkan-Sen at 157.46. It aims to challenge the Senkou Spa A at 158.49, but first, traders should reclaim 158.00. If those levels are cleared, the next stop would be the Kijun-Sen at 159.51.

On further weakness, the EUR/JPY could retest the latest trough at 155.14, the September 16 daily low.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.08% | 0.15% | 0.74% | 0.01% | -0.18% | 0.13% | 0.23% | |

| EUR | -0.08% | 0.07% | 0.63% | -0.10% | -0.28% | 0.05% | 0.16% | |

| GBP | -0.15% | -0.07% | 0.58% | -0.13% | -0.35% | -0.01% | 0.06% | |

| JPY | -0.74% | -0.63% | -0.58% | -0.72% | -0.91% | -0.60% | -0.52% | |

| CAD | -0.01% | 0.10% | 0.13% | 0.72% | -0.19% | 0.13% | 0.20% | |

| AUD | 0.18% | 0.28% | 0.35% | 0.91% | 0.19% | 0.31% | 0.39% | |

| NZD | -0.13% | -0.05% | 0.01% | 0.60% | -0.13% | -0.31% | 0.07% | |

| CHF | -0.23% | -0.16% | -0.06% | 0.52% | -0.20% | -0.39% | -0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).