GBP/USD Price Analysis: Recovers above 1.2700 amid soft US Dollar

- GBP/USD bounces back off weekly lows around 1.2680.

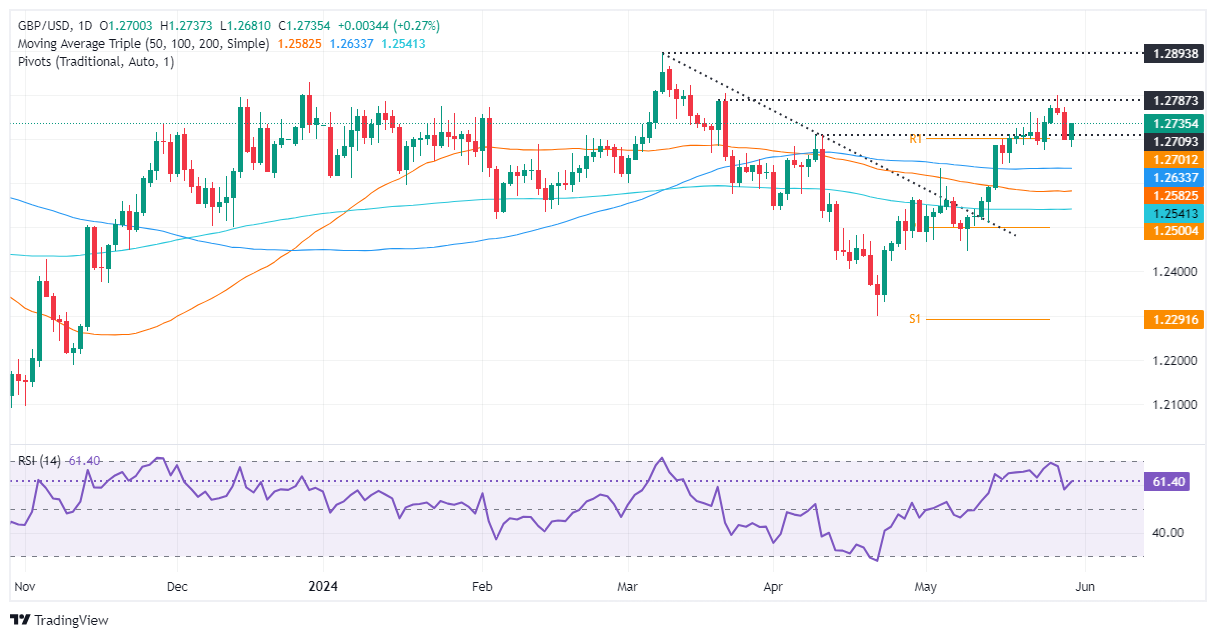

- Technical outlook shows neutral to upward bias, with key resistance at 1.2803.

- Critical support levels include May 24 low at 1.2674 and the 50-DMA at 1.2581.

The Pound Sterling recovered some ground against the US Dollar on Thursday, as US Treasury yields are sliding, undermining the Greenback. Consequently, the GBP/USD bounced off weekly lows, reached 1.2680, and traded at 1.2728, gaining 0.20%.

GBP/USD Price Analysis: Technical outlook

The daily chart suggests the GBP/USD is neutral to upward bias, but the buyer's failure to crack the March 21 daily high at 1.2803 opened the door for a pullback. Although momentum remains bullish, as shown by the Relative Strength Index (RSI), buying pressure begins to fade after testing 1.2800.

For a bullish continuation, the GBP/USD needs to surpass 1.2803. That would sponsor a rally to the year-to-date (YTD) high of 1.2893, followed by 1.2900. Overhead resistance lies ahead, with 1.3000 seen as a crucial resistance.

Conversely, if sellers move in decisively and push the major below 1.2700, further losses lie ahead. Key support levels would be tested. Initially, the May 24 low of 1.2674, followed by the 1.2600 mark. Down below, the 50-day moving average (DMA) at 1.2581 awaits.

GBP/USD Price Action – Daily Chart