USD/TRY keeps the range bound trade around 32.20 post-CBRT

- The Turkish lira depreciates slightly around 32.20 vs. the Dollar.

- The CBRT kept the One-Week Repo Rate unchanged at 50.0%.

- The central bank sees a disinflationary scenario in H2 2024.

The Turkish lira maintains its consolidative phase well in place on Thursday, hovering around the low-32.00s in the wake of the CBRT’s interest rate decision.

USD/TRY faces extra consolidation in the near term

So far, there have been no changes to the side-lined theme around the Turkish currency, which has remained trapped within the 32.00–32.60 range since mid-March.

On Thursday, the Turkish central bank (CBRT) maintained its One-Week Repo Rate unchanged at 50.00%, as broadly anticipated.

The CBRT stated that its decision on rates came after taking into account the delayed impacts of monetary tightening, adding that it is closely monitoring the effects on credit conditions and domestic demand.

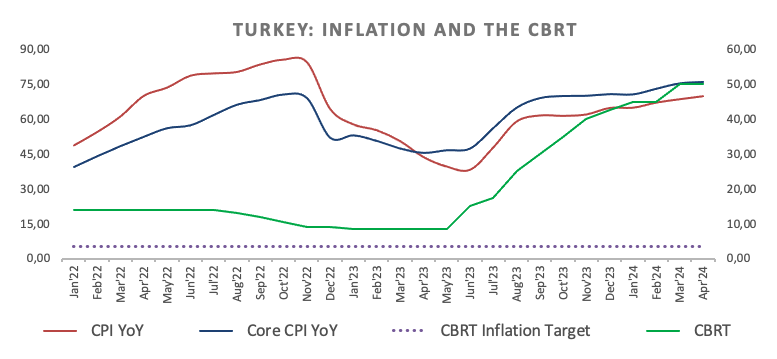

In the statement, the bank emphasized its vigilance regarding inflation risks, citing a "limited decline in the underlying trend of monthly inflation in April."

In addition, the bank also indicated that it would tighten its policy stance if a significant and persistent increase in inflation was anticipated.

Moving forward, market expectations see a nearly 72 bps increase at the bank’s next gathering on June 27.

It is worth noting that headline inflation in Türkiye rose by 69.80 in the year to April.

USD/TRY key levels to watch

So far, the pair is advancing 0.10% to 32.1950 and faces the next up barrier at the all-time high of 32.6461 (April 19). On the flip side, a break below the weekly low of 31.9722 (April 29) would expose another weekly bottom of 31.7390 (March 21) and finally the temporary 100-day SMA of 31.4788.