Top 3 meme coins Dogecoin, Shiba Inu and Pepe: Over 45% investors profitable, memes extend gains

- Dogecoin, Shiba Inu and Pepe extend gains slightly on Thursday, September 12.

- Between 45% and 70% of wallet addresses holding the three meme coins are profitable at the current price levels.

- 60% to 70% of the meme coins are held by large holders, investors who have access to over 1% of the circulating supply.

Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) are the top three meme coins by market capitalization that extended gains slightly on Thursday. DOGE, SHIB and PEPE added 1.43%, 1.43% and 2.49% to their value on the day, respectively.

The three meme coins have noted concentration by large wallet investors, who have access to over 1% of the circulating supply.

Dogecoin, Shiba Inu and Pepe yield profits for over 45% wallet addresses

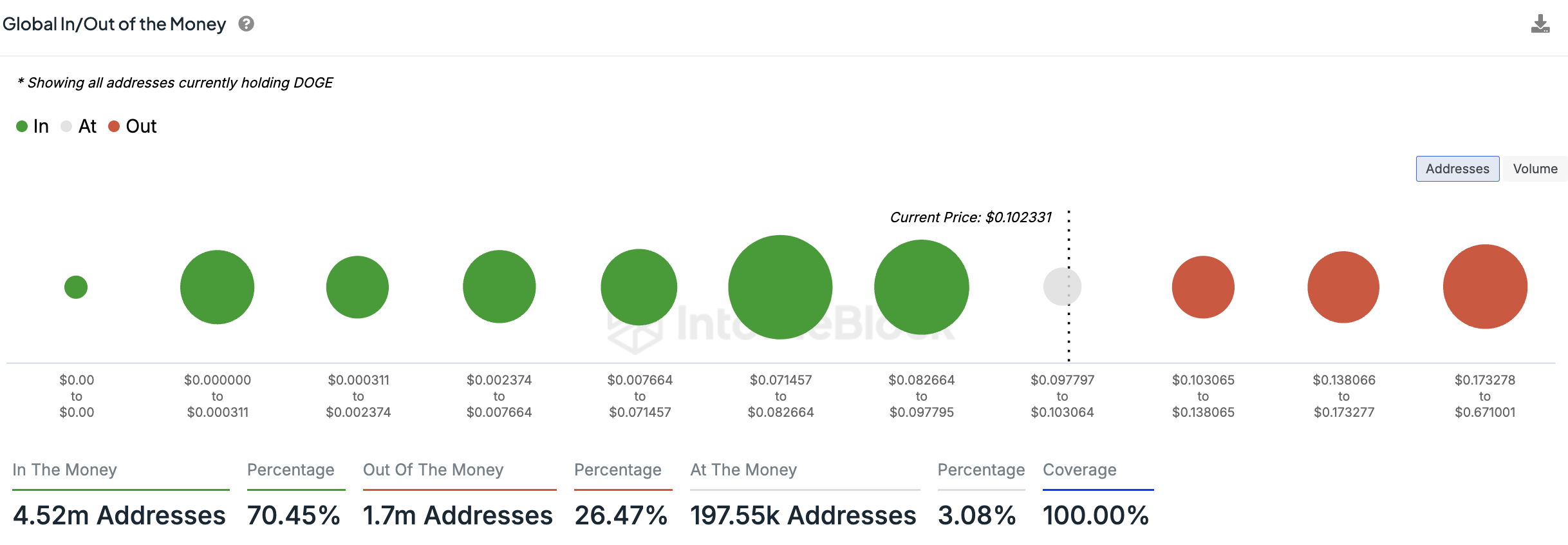

Data from crypto intelligence platform IntoTheBlock shows that between 45% and 70% of wallet addresses holding the three meme coins are profitable at the current price level. 4.52 million wallet addresses holding DOGE are profitable, as the meme coin trades at $0.1023.

DOGE wallet addresses profitability

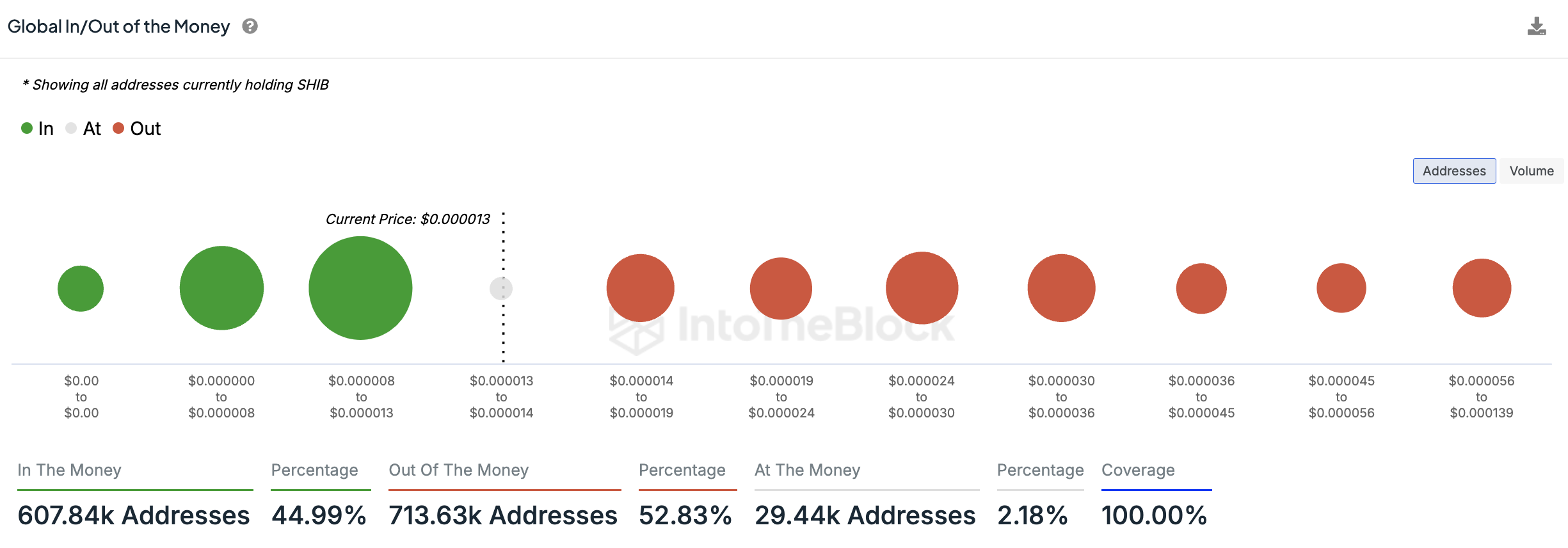

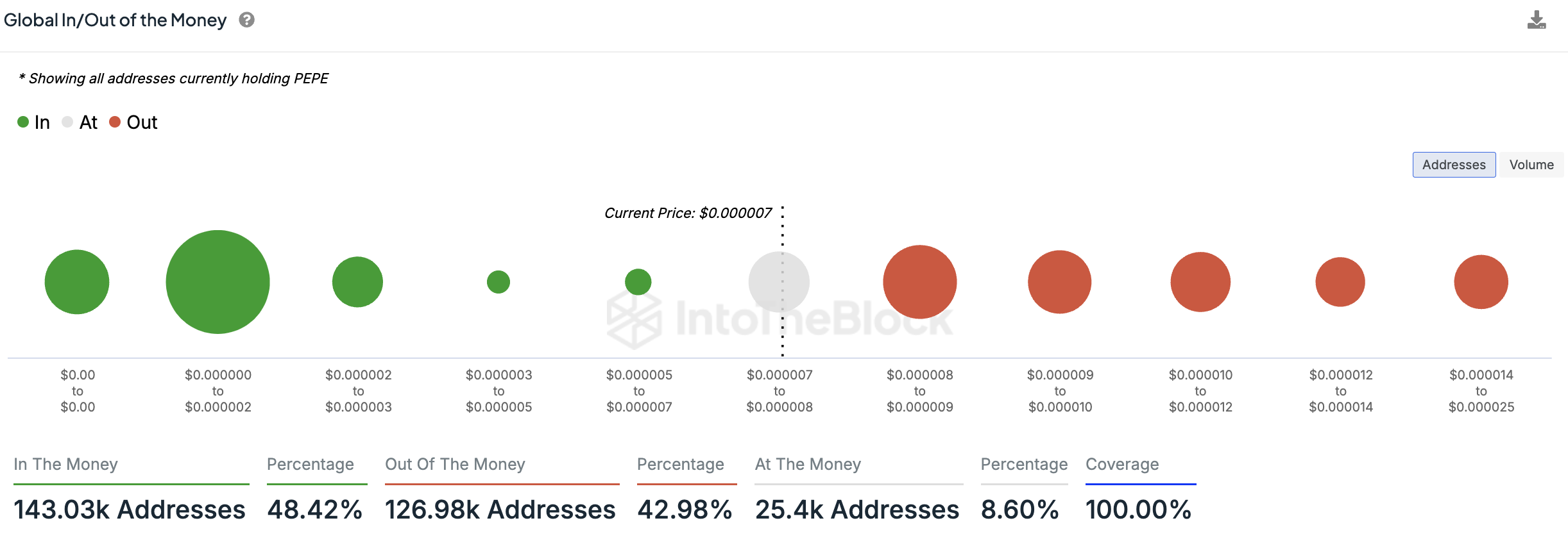

607,840 wallet addresses holding Shiba Inu are profitable at $0.000013 and 143,030 wallet addresses holding Pepe are profitable at $0.000007.

Shiba Inu wallet addresses profitability

Pepe wallet addresses profitability

All three meme coins note a concentration by large wallet investors, 62% of DOGE is held by wallet addresses that control over 1% of the asset’s circulating supply. In the case of SHIB and PEPE, the number is 73%, per IntoTheBlock data.

Typically, concentration of an asset in high-profile wallets reduces the asset’s liquidity and limits the amount of tokens available for transactions on exchanges. Concentration in whale wallets heightens price volatility for the asset.

Santiment data shows that Market Value to Realized Value (MVRV) ratio for Dogecoin and Shiba Inu is negative on the 30-day timeframe. This implies that the two largest meme coins are currently undervalued.