One of the first steps to becoming a successful CFDs trader is understanding all the industry terminologies. It’s the surest way to avoid mistakes that can cost you money. Two phrases you are likely to hear often are “going long” and “short selling.” What do they mean?

These phrases are imports from the conventional stock market. However, their meanings in CFDs trading are slightly different. We’ll cover the details in this article.

Going Long in CFDs Trading Explained

『Going Long 』

When a CFD trader goes long on an asset, it means that they are buying the asset in hopes that its value will appreciate within their desired timeframe or until the asset price reaches a predetermined level.

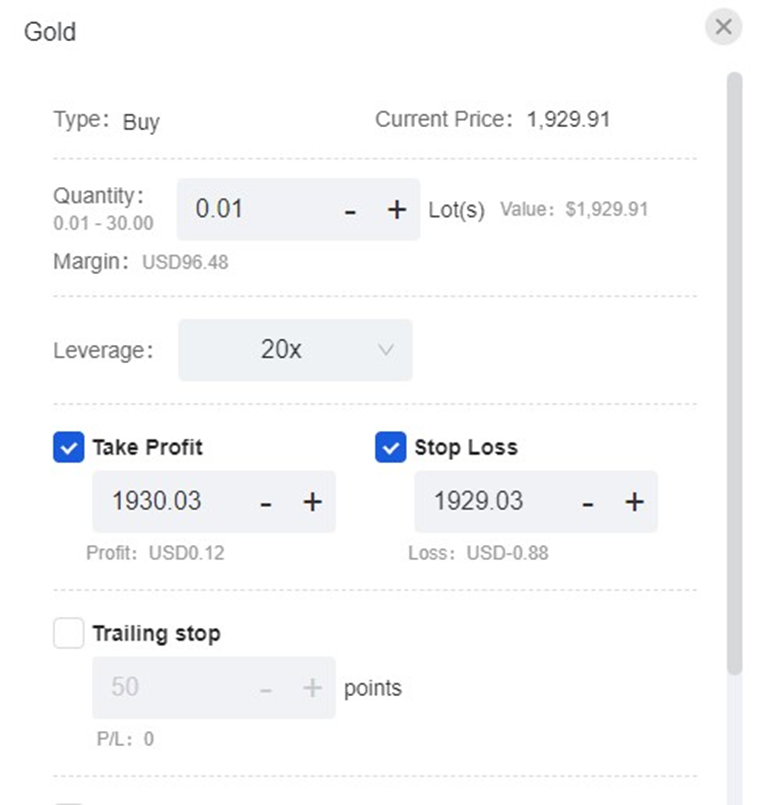

So, to go long on Gold CFDs, for example, you have to navigate to the asset’s page on your trading platform and select “Buy” as you can see in the image below:

In the next window, which is the order details window, you can choose the size of your position, how much leverage you’d love to work with (up to 20x), your profit target, and your loss limit.

(Sources: Mitrade platform)

So, if you expect Gold’s value to rise by $20 from the prices above over the coming weeks or months, you can go long and set your “Take Profit” $20 above the current market price, which should be 1950.00.

If you do not wish to hold the position if Gold price crashes more than 10%, you can set your “Stop Loss”below the current price at around 1736.00.

Short Selling or Going Short in CFDs Trading

『Going Short 』

When a CFD trader goes short on an asset, it means they are selling the asset in hopes that its value will decline to a specific level or over a specific period.

Going back to our example on Gold above, you simply have to click on “Sell” to go short:

(Sources: Mitrade platform)

The order window for short selling is the same as for going long but with a slight difference. Your “Take Profit” order in a short trade must be below the current market price, while the “Stop Loss” order must be above the current market price.

However, you should keep in mind that for experienced traders, the take profit and stop loss levels are not arbitrary numbers. They choose the levels based on a tried and tested trading strategy with predetermined entries and exits.

Of course, you can hold a long or short position without having a fixed profit target or a loss limit. The flexibility of CFDs trading mean that you can easily close your trade at any time as long as the market is open.

Should You Go Long or Short Sell?

The decision to go long or short on any asset depends on your trading strategy. For assets like Gold, some traders have found success with going long and holding it for the long term. However, success with such a strategy hinges a great deal on knowing when to enter the position and when to exit.

For example, here’s a cursory look at Gold’s 10-year history:

(Sources: Mitrade platform)

It shows that holding a long position since September 2011 would not have yielded any significant profits as the current value of the asset is almost the same as it was in 2011. That’s also assuming that you have enough margin for your position to survive the nearly 8,000 pips swing downwards in the four years between 2011 and 2015.

However, if your long-term strategy got you into a long trade on Gold in November 2015, and you bought a single standard contract, you’d have a near 100% return on your trade if you’re still holding the position till date. With leverage, that could be up to 2000% in returns.

On the flip side, some intraday or shorter-term traders can make those returns going long and selling short multiple times in a week, month, or year.

This analysis on Gold also plays out on any asset or tradable instrument you’d like to look at.

Therefore, there’s no one-size-fits-all answer to the question. The best traders have strategies that let them know the right time to go long and the right to go short. As we mentioned above, the strategy will also show them the right time to exit their position with a profit or with a loss.

Direct market access | Deal on rising and falling market | 24-hour trading | Limit and stop-loss for every trade

The Key Differences Between Going Long and Short Selling

As we mentioned at the beginning, the terms going long and short selling are imported from the stock market. But there are significant differences in their application in the two trading industries.

Going Long

In the stock market, going long means buying a company’s stock if you believe its fundamentals are sound. You’ll then hold the stock in hopes that the value of the company’s share price will continue to rise.

When the value has risen to an appealing level, you’ll sell the stock and claim your profits. Until you sell the stock, it will remain an asset to your name. You’ll hold a stake in the company, no matter how little.

Going long in the CFD market is simply a contract with your broker showing that you expect the value of the tradable instrument to keep rising over a specific period or until it reaches your desired profit level. Like the stock market, you’ll only make money on a long position when you exit the position at a price higher than your entry level. However, unlike the stock market, you don’t need to “sell” to exit your long. You only need to close the position.

You should also keep in mind that you don’t own the instrument when you go long in CFD trading. So, even if you decide to go long on Amazon or Google shares, it doesn’t mean you’re now a shareholder in these companies. You’re only trying to make a profit off their price movement.

Short Selling

Short selling in the stock market is a complex arrangement. You can take a short position if you believe the underlying fundamentals for a company signify an impending decline in the price of its stock. To achieve this, you must first borrow the number of shares you’re looking to trade from someone else, usually a broker, and then sell it to a willing buyer on the market who will pay you cash.

If the share price goes on to decline like you envisaged, you can buy back the number of shares you borrowed from the broker to offset your debt. The price difference is your profit. If the share price continues to soar instead of declining, you’ll have to add your own money to make up for the shortfall before you can buy back the shares and repay your broker.

In CFDs trading, you don’t need to borrow any assets from the broker. The only thing you can borrow is more margin by way of leverage. You simply enter a sell position on the asset if you believe it is headed south.

If your analysis is true, the asset price will fall to your profit target. Otherwise, you will only lose a portion of your capital. How much loss you’ll shoulder in that scenario depends on the position of your stop loss level, how far the asset price rose against you, and the level of leverage you took on (if any).

How to Going Long or Short Selling in CFD Trading

Every CFD trader wants to be successful on any positions they take on the market. However, there’s no hard and fast rule to achieving those results. The most successful traders are those that have a strategy that guides them into a long or short position with a higher probability of success.

So, to be successful going long, you have to be reasonably certain that the asset’s value will rise within the timeline you’re looking at or rise long enough to reach your expected target. “Reasonably certain” is the term here because there are no guarantees in trading.

Still, you're more likely to be successful going long if your strategy or underlying fundamentals support that position. For example, a trader going long off a back-tested and proven Moving Average Crossover system will have a higher chance of succeeding after a specific time window than one only trading off their gut feeling.

The situation is the same for short selling or going short. You are unlikely to be successful selling Amazon CFDs if the economy and the retail sector are booming. Conversely, you are more likely to be successful if you sell the CFDs when there is a global recession or when Amazon is under fire in countries that are crucial to its revenue stream.

Bottom Line

When you hear “going long” in CFDs trading, it means buying and holding onto an asset as you wait for the value or price to increase. On the other hand, “short selling” means selling the asset in hopes that the value will plummet.

However, blindly going long or short selling may not result in you succeeding in CFDs trading. To increase your probability of success, you may need a sound strategy that increases the probability of your expectations coming to pass.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.