Here is what you need to know on Tuesday, May 20:

The Reserve Bank of Australia (RBA) and the People's Bank of China (PBoC) announced rate cuts early Tuesday, as anticipated. Meanwhile, the US Dollar (USD) struggles to stay resilient against its rivals as markets remain risk-averse. Statistics Canada will publish Consumer Price Index (CPI) data for April later in the day. Additionally, investors will continue to scrutinize comments from central bank officials.

US Dollar PRICE This week

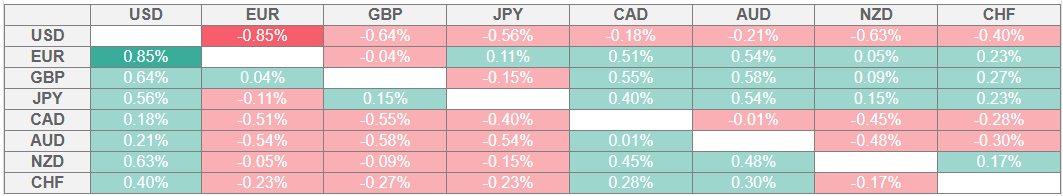

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The PBoC cut its Loan Prime Rates (LPRs) on Tuesday. The one-year LPR was cut from 3.1% to 3.00%, while the five-year LPR was cut from 3.60% to 3.50%. In the meantime, China accused the United States (US) of undermining the two countries’ preliminary trade agreement late Monday after the US issued an industry warning against using Chinese chips that singled out Huawei. US stock index futures were last seen losing between 0.3% and 0.5%, while the USD Index was down 0.15% at around 100.20.

The RBA lowered the Official Cash Rate (OCR) by 25 basis points (bps) to 3.85% from 4.1% following the conclusion of its May monetary policy meeting. In the policy statement, the RBA noted that the escalation of the global trade conflict was a key downside risk to the economy. While commenting on the policy outlook, RBA Governor Michele Bullock noted that more adjustments to the policy were possible and added that they have discussed whether to opt for a 25 or a 50 bps cut. After rising more than 0.8% on Monday, AUD/USD stays on the back foot early Tuesday and was last seen losing 0.5% on the day at around 0.6420.

USD/CAD trades in a tight channel near 1.3950 in the European morning on Tuesday. Annual inflation Canada, as measured by the change in the CPI, is forecast to decline to 1.6% in April from 2.3% in March.

EUR/USD stays in a consolidation phase near 1.1250 after rising about 0.7% on Monday. The European Commission will publish preliminary Consumer Confidence Index data for May later in the day.

USD/JPY registered losses for the fifth consecutive trading day on Monday. The pair continues to edge lower and trades slightly below 144.50. Japan’s Finance Minister Shunichi Kato said on Tuesday that he expects any talks with US Treasury Secretary Scott Bessent this week to be based on foreign exchange.

Gold ended the day marginally higher on Monday. XAU/USD struggles to preserve its bullish momentum and retreats toward $3,200 early Tuesday.

GBP/USD holds its ground and trades above 1.3350 after rising 0.6% on Monday. The UK's Office for National Statistics will publish April CPI data early Wednesday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.