Forex Today: BoJ’s hawkish twist lifts Japanese Yen, focus shifts to Trump-Xi call

Here is what you need to know on Friday, September 19:

Markets take the positive lead from Wall Street overnight early Friday, driven by news that Nvidia will invest $5 billion in Intel to jointly develop AI Infrastructure and PC chips.

Further, upbeat US data on Thursday alleviated concerns over the economic outlook, adding to the risk-on market profile.

Data on Thursday showed that Initial claims for state unemployment benefits decreased 33,000 to a seasonally adjusted 231,000 for the week ended September 13, partially reversing a surge in the prior week to the highest level since October 2021.

The Philadelphia Federal Reserve Manufacturing Index surged to 23.2 in September, a significant leap from the estimated rebound of 2.3.

Traders also cheer the renewed US-China trade optimism after US President Donald Trump noted that he can do an extension to the trade truce with Chinese President Xi Jinping when the leaders speak over a call on Friday.

These fundamental drivers help the US Dollar (USD) sustain its recovery, fuelled by the US Federal Reserve’s (Fed) cautious interest rate cut on Wednesday. The USD Index is posting small gains, as of writing, trading near 97.50.

US Dollar Price Today

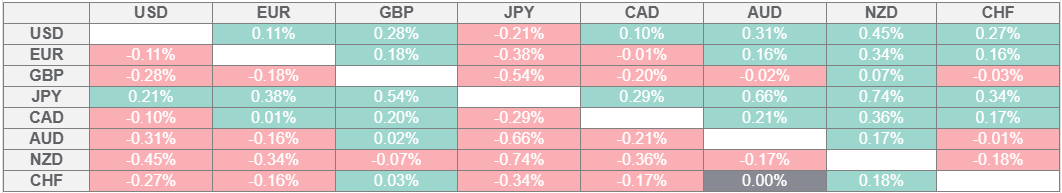

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

However, the top performer amongst the G10 currencies so far remains the Japanese Yen (JPY), courtesy of the Bank of Japan’s (BoJ) hawkish rates on hold decision. The BoJ board members voted 7-2 to keep the policy rate steady at 0.5% and announced the sale of exchange-traded funds (ETF).

The two hawkish dissents lifted the Japanese Yen (JPY), weighing heavily on the USD/JPY pair, which currently trades near 147.50, awaiting BoJ Governor Kazuo Ueda’s press conference.

GBP/USD drops toward 1.3500, extending its correction from over two-month highs of 1.3726 reached earlier in the week. Above forecasts UK Retal Sales data for August failed to inspire Pound Sterling buyers.

EUR/USD is holding losses below 1.1800 amid a broadly firmer USD, eyeing speeches from a slew of European Central Bank (ECB) policymakers.

USD/CAD is keeping its range at around 1.3800, divided between USD strength and lower Oil prices.

Gold is attempting a bounce from three-day lows, testing offers above the $3,650 level. The Trump-Xi call and the end-of-the-week flows could influence the Gold price action later in the day.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.