Forex Today: US Dollar stays under pressure on last day of H1

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Monday, June 30:

The US Dollar (USD) Index, which tracks the USD's performance against a basket of six major currencies, continues to push lower on the last day of June after losing more than 1.5% in the previous week. The economic calendar will feature inflation data from Germany and Dallas Fed Manufacturing Index from the US. Several policymakers from major central bankers will be delivering speeches throughout the day as well.

US Dollar PRICE This month

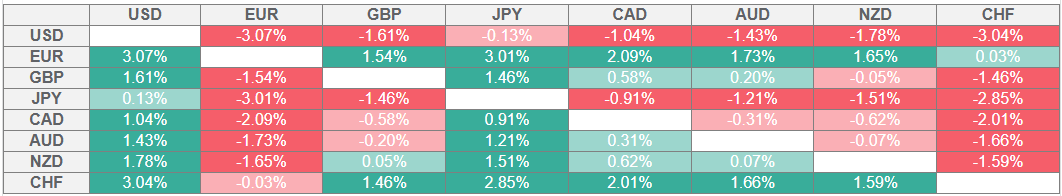

The table below shows the percentage change of US Dollar (USD) against listed major currencies this month. US Dollar was the weakest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

US Treasury Secretary Scott Bessent said over the weekend that the drop in the USD this year is normal variance, adding that the US still has a strong USD policy. Since the beginning of 2025, the USD Index is down about 12% and it was last seen trading at its weakest level since March 2022 at around 97.00. Meanwhile, US stock index futures gain between 0.4% and 0.6% in the European morning on Monday, reflecting a risk-positive market atmosphere.

The UK government announced in a press release on Monday that the UK-US trade deal has officially come into force. UK car manufacturers can now export to the US under a reduced 10% tariff quota and the UK aerospace sector will have 10% tariffs on goods like engines and aircraft parts removed. Following the previous week's rally, GBP/USD stays relatively quiet and moves sideways slightly above 1.3700.

EUR/USD clings to small daily gains above 1.1700 in the European morning on Monday. European Central Bank (ECB) President Christine Lagarde will deliver an introductory speech at the opening reception and dinner of the ECB Forum on Central Banking 2025 in Sintra, Portugal.

USD/JPY stays under bearish pressure and trades below 144.00 in the European session on Monday. Japan's top trade negotiator, Ryosei Akazawa, said on Monday that he will continue working with the United States (US) to reach an agreement while defending national interest.

Following Friday's sharp decline, Gold started the week on the back foot and touched its weakest level since late May below $3,250 before staging a rebound toward $3,300.

Canada's Finance Ministry said in a statement early Monday that they will rescind digital services tax to advance broader trade negotiations with the US and noted that Canada's PM Mark Carney and President Donald Trump agreed that parties will resume negotiations to agree on a deal by July 21. USD/CAD edges slightly lower at the beginning of the week and trades at around 1.3660.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.