Forex Today: US Dollar stays offered as focus shifts to PPI inflation data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Thursday, June 12:

Risk sentiment remains sour early Thursday as investors' take account of the latest trade headlines while holding their nerves ahead of the US Bureau of Labor Statistics’ (BLS) Producer Price Index (CPI) data for May and another US Treasury 10-year note auction.

The selling interest around the US Dollar (USD) remains unabated, with the Greenback hitting the lowest level in two months against its currency rivals near 98.25.

Despite easing US-China trade tensions, lingering uncertainties over US President Donald Trump’s tariffs against major trading partners continue to unnerve markets.

Trump said late Wednesday that he was open to extending a July 8 deadline for completing trade talks with countries.

Further, escalating Middle East geopolitical tensions contribute to the dour mood.

CBS News senior White House reporter Jennifer Jacobs reported that United States (US) officials have been told Israel is fully ready to launch an operation into Iran.

“US anticipates Iran could retaliate on certain US sites in Iraq,” Jacobs added.

This comes as US President Trump's Middle East envoy Steve Witkoff is still planning to meet with Iran for a sixth round of talks on the country's nuclear program on Sunday.

Meanwhile, the USD also feels the pain of the softer US inflation data for May. The US Consumer Price Index i(CPI) increased 0.1% for the month, putting the annual inflation rate at 2.4%. Both prints undermined expectations of 0.2% and 2.5% respectively.

Softer-than-expected US CPI data solidified the bets for a US Federal Reserve (Fed) interest rate cut in September.

CME Group’s FedWatch tool now shows markets' pricing in about a 62% probability of 25 basis points (bps) rate cut versus 52% seen pre-data release.

US Dollar PRICE Today

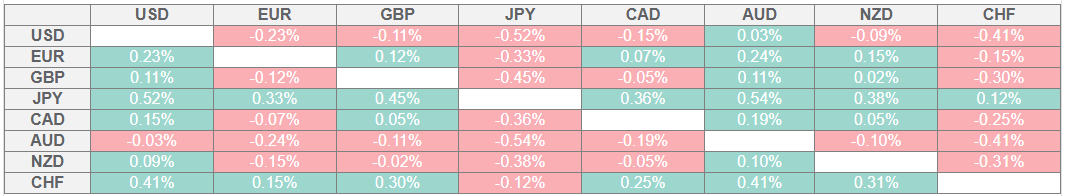

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

EUR/USD hangs close to seven-week highs above 1.1500 in the European morning on Thursday, building on Wednesday’s 0.50% gain.

GBP/USD drops back toward 1.3550 after facing rejection again near 1.3600. The Pound Sterling was hit by a bigger-than-expected contraction in the UK economy in April.

Data showed on Thursday that the UK Gross Domestic Product (GDP) dropped by 0.3% in April, following a 0.2% growth in March and against a 0.1% decline expected. The monthly Industrial Production and Manufacturing Production data also fell short of market expectations in the same period.

USD/JPY holds losses near 144.00, undermined by increasing haven demand for the Japanese Yen (JPY). The pair also remains pressured by the persistent weakness surrounding the US currency.

Gold price extends its upbeat momentum into the second consecutive day, hitting fresh weekly highs near $3,380.

WTI pulls back nearly 1% from 10-week highs of $67.82, reached in response to the Iran-Israel headlines.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.