USD/CAD Price Forecast: Trades lower near 1.3850 after retreating from nine-day EMA

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

USD/CAD finds Initial resistance at the nine-day EMA around 1.3890.

The 14-day RSI is positioned above the 30 level, suggesting a continuation of short-term corrective bounce.

The pair may find primary support at the six-month low of 1.3781.

The USD/CAD pair retraces its gains from the previous session, trading around 1.3850 during the European session on Thursday. Daily chart technical analysis highlights a prevailing bearish trend, with the pair continuing its descent within a well-defined descending channel.

Additionally, the USD/CAD pair remains below the nine-day Exponential Moving Average (EMA), reflecting weak short-term momentum. Meanwhile, the 14-day Relative Strength Index (RSI) is positioned above the 30 level, suggesting a continuation of short-term corrective bounce. However, with the RSI still holding below the 50 mark, the broader bearish outlook persists.

On the downside, the USD/CAD pair may retest the six-month low of 1.3781, last seen on April 21. A decisive break below this level would strengthen the bearish outlook, potentially guiding the pair toward the lower boundary of the descending channel near the 1.3550 zone, with further support around 1.3419 — its lowest level since February 2024.

Initial resistance for USD/CAD is seen at the nine-day EMA around 1.3890, followed by the upper boundary of the descending channel near 1.3970. A breakout above this channel could indicate a shift toward a bullish bias, potentially opening the door for a move toward the 50-day EMA at 1.4144. Further upside could target the next major resistance at 1.4793 — the lowest level recorded since April 2003.

USD/CAD: Daily Chart

Canadian Dollar PRICE Today

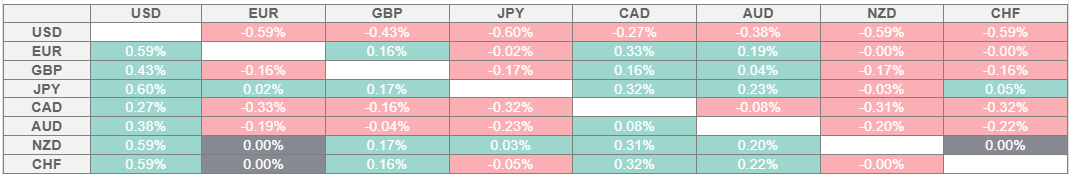

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.