USD/CAD Price Forecast: Support appears at 1.3850 with potential corrective rebounds

- Gold Price Forecast: XAU/USD falls below $5,050 as traders await US jobs data

- Bitcoin Flirts With ‘Undervalued’ As MVRV Slides Toward 1

- Gold climbs to $5,050 as Fed-driven USD weakness offsets positive risk tone ahead of US NFP

- Is the Crypto Rally Dead? Why Bernstein Still Predicts a $150K Bitcoin Peak Despite Waller’s Warnings

- Silver Price Forecast: XAG/USD rebounds above $76.50 after sharp drop, eyes on US CPI data

- Today’s Market Recap: AI Panic Intensifies, Global Assets Fall Broadly

USD/CAD may find support near the six-month low of 1.3828, recorded on Monday.

The 14-day RSI indicates oversold conditions, pointing to the possibility of a short-term rebound.

Initial resistance is positioned at the nine-day EMA around 1.4025, followed by the descending channel’s upper boundary.

The USD/CAD pair extends its decline for the fifth consecutive session, hovering around 1.3860 during European trading on Tuesday. Daily chart technical analysis highlights a dominant bearish trend, with the pair trending lower within a descending channel formation.

Additionally, the USD/CAD pair remains below the nine-day Exponential Moving Average (EMA), signaling weak short-term price momentum. Meanwhile, the 14-day Relative Strength Index (RSI) stays below the 30 level, suggesting the bearish bias is in play but also indicating oversold conditions. This opens the door for potential short-term corrective rebounds.

On the downside, USD/CAD may retest the six-month low of 1.3828, marked on Monday, which coincides with the lower boundary of the descending channel near the 1.3770 level. A decisive break below this channel could reinforce the bearish bias and pave the way for a move toward the 1.3419 area — its lowest point since February 2024.

Initial resistance is seen at the nine-day EMA around 1.4025, followed by the upper boundary of the descending channel near 1.4150. A breakout above this channel could shift the bias to bullish, potentially driving the USD/CAD pair toward the 50-day EMA at 1.4230. Beyond that, further resistance is located at the two-month high of 1.4543, set on March 4.

USD/CAD: Daily Chart

Canadian Dollar PRICE Today

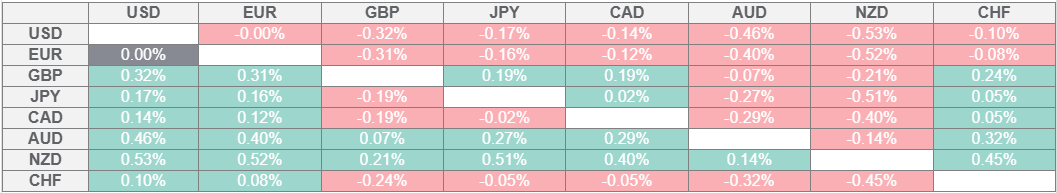

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.