Forex Today: Markets stabilize as trading volume thins out on Easter Friday

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

Here is what you need to know on Friday, April 18:

Major currency pairs stay quiet on Friday as trading volumes thin out, with major markets remaining closed in observance of the Easter Holiday. The economic calendar will not offer any high-tier data releases, paving the way for subdued market action heading into the weekend.

US Dollar PRICE This month

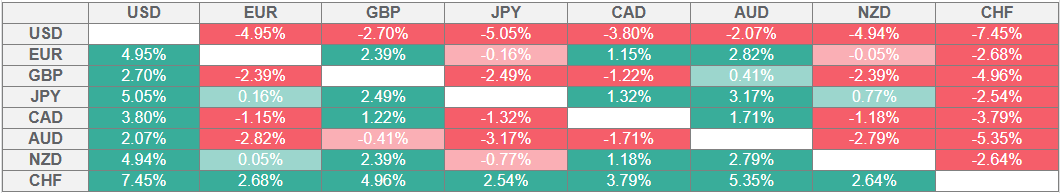

The table below shows the percentage change of US Dollar (USD) against listed major currencies this month. US Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The European Central Bank (ECB) announced on Thursday that it lowered key rates by 25 basis points (bps) following the April policy meeting, as widely anticipated. In the post-meeting press conference, ECB President Christine Lagarde refrained from hinting at the next policy move but acknowledged that the Eurozone's economic outlook is clouded by uncertainty. EUR/USD edged lower following the ECB event and ended the day in negative territory. Early Friday, the pair fluctuates in a tight channel above 1.1350.

The data from the US showed on Thursday that weekly Initial Jobless Claims declined to 215,000 from 224,000 in the previous week. Meanwhile, US President Donald Trump said on Thursday that China has reached out to his administration to talk on tariffs and added that he think they will make a deal with China. The US Dollar (USD) Index closed marginally higher and stabilized at around 99.50 early Friday.

After gaining more than 3% on Wednesday, Gold continued to push higher in the Asian session on Thursday and reached a new record-high of $3,357. In the second half of the day, XAU/USD corrected lower, possibly because of profit-taking, and settled at $3,327 for the week.

GBP/USD closed in positive territory on Thursday and stretched higher toward 1.3280 before entering a consolidation phase.

USD/JPY trades in a narrow band below 142.50 on Friday and remains on track to post losses for the third consecutive week. Bank of Japan Governor Kazuo Ueda repeated on Friday that they will keep raising interest rates if underlying inflation accelerates toward the 2% target.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.