Forex Today: There is no stopping of Gold as Fed independence comes into question

- International Oil Prices Retreat Rapidly; G-7 to Discuss Emergency Oil Reserve Release

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- Crypto’s Great Recovery: Is the Post-Conflict Surge a Sustainable Rally or a Sophisticated Bull Trap?

- Gold slumps to near $5,050 on oil-driven inflation fears, stronger US Dollar

- WTI recovers to near $86.50 as Strait of Hormuz remains closed

Here is what you need to know on Tuesday, April 22:

Gold continues to shine as the go-to safe-haven asset as markets grow increasingly concerned about the US Federal Reserve's (Fed) independence and an economic downturn because of President Donald Trump's new trade regime. The European Commission will publish preliminary Consumer Confidence data for April later in the day. The US economic calendar will not feature any high-tier data releases but investors will keep a close eye on comments from Fed policymakers.

US Dollar PRICE This week

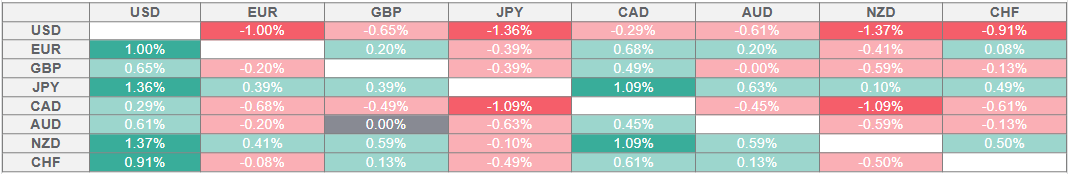

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

In a social media post published on Monday, Trump accused Fed Chairman Jerome Powell of lowering interest rates in late 2024 for political reasons and called him "Mr. Too Late."

"Preemptive cuts in interest rates are being called for by many. With energy costs way down, food prices (including Biden’s egg disaster!) substantially lower, and most other 'things' trending down, there is virtually no inflation," Trump said on Truth social and added:

"With these costs trending so nicely downward, just what I predicted they would do, there can almost be no inflation, but there can be a slowing of the economy unless Mr. Too Late, a major loser, lowers interest rates, now. Europe has already 'lowered' seven times."

The US Dollar (USD) Index fell about 1% on Monday and Wall Street's main indexes lost over 2%. Early Tuesday, the USD Index holds steady below 98.50, while US stock index futures trade in positive territory.

After gaining nearly 3% on Monday, Gold extended its rally and set a new record high at $3,500 before correcting lower. At the time of press, XAU/USD was trading at around $3,470, rising more than 1% on a daily basis.

EUR/USD benefited from the broad-based selling pressure surrounding the USD and touched a multi-year high above 1.1570 on Monday. The pair stays in a consolidation phase at around 1.1500 in the European session on Tuesday.

GBP/USD posted gains for the tenth consecutive trading day on Monday and set a new 2025-high above 1.3400. The pair stays relatively quiet in the European session on Tuesday and fluctuates in a narrow channel at around 1.3380.

In its quarterly review of regional economic conditions across the country, the Japanese government maintained its overall economic assessment but warned of increasing downside risks due to US trade policies. After losing nearly 1% on Monday, USD/JPY continues to push lower toward 140.00 and trades at its lowest level since September.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.