Here is what you need to know on Monday, July 21:

Risk flows return to markets at the beginning of the week as investors assess the latest headlines surrounding the United States' trade policy. The economic calendar will not offer any high-tier data releases on Monday and the Federal Reserve will remain in the blackout period ahead of the July 29-30 policy meeting.

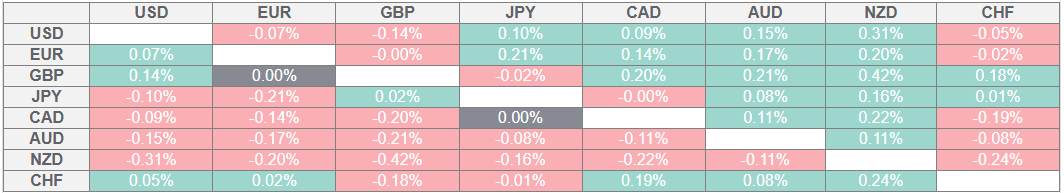

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The Financial Times reported late Friday that US President Donald escalated his demands to the European Union (EU) and that he was looking at a minimum tariff of 15% to 20% in a trade deal. On Sunday, US Commerce Secretary Howard Lutnick noted that he was confident that they will reach an agreement with the EU. He also said that some small trading partners, such as “the Latin American countries, the Caribbean countries, many countries in Africa,” would face a baseline tariff of 10%. US stock index futures rise about 0.3% in the European session on Monday, reflecting the improving market mood. Meanwhile, the US Dollar (USD) Index stays in negative territory below 98.50 after posting weekly gains for the second consecutive time last week.

USD/JPY started the week with a bearish gap but managed to recover above 148.00. Japanese Prime Minister Shigeru Ishiba's ruling coalition has lost its majority in the upper house in Sunday's election. While the vote does not directly determine whether Ishiba's government will fail, it adds political pressure to the leader, who had already lost control of the more powerful lower house in October.

The People’s Bank of China (PBOC), China's central bank, announced early Monday that it left the one-year and five-year Loan Prime Rates (LPRs) LPRs unchanged at 3.00% and 3.50%, respectively. AUD/USD stays relatively quiet to start the week and fluctuates in a tight channel slightly above 0.6500.

The data from New Zealand showed in the early Asian session that the Consumer Price Index (CPI) rose by 2.7% on a yearly basis in the second quarter. This reading followed the 2.5% increase recorded in the first quarter but came in slightly below the market expectation of 2.8%. NZD/USD edges lower and trades in negative territory near 0.5950.

After posting small gains on Friday, EUR/USD holds its ground early Monday and clings to modest gains, slightly below 1.1650.

GBP/USD stages a rebound toward 1.3450 after closing the third consecutive week in negative territory.

Gold failed to make a decisive move in either direction last week to close virtually unchanged at $3,350. XAU/USD gains traction in the European morning on Monday and trades above $3,360.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.