Forex Today: US Dollar consolidates gains ahead of key inflation data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Tuesday, May 13:

The US Dollar (USD) retreats slightly in the European morning on Tuesday after posting impressive gains against its rivals to start the week. The European economic calendar will feature ZEW Survey - Economic Sentiment data for Germany and the Eurozone. In the second half of the day, April Consumer Price Index (CPI) data from the US will be watched closely.

US Dollar PRICE This week

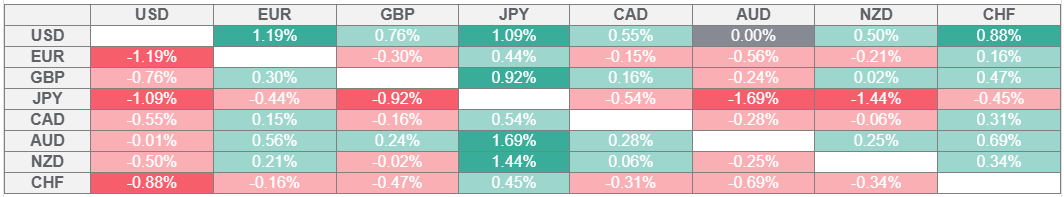

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD Index gathered bullish momentum and climbed to its highest level in a month near 102.00 on Monday as markets cheered the news of the US and China reaching a deal to pause reciprocal tariff rates for 90 days and to significantly lower them. Wall Street's main indexes shot higher after the opening bell and Nasdaq Composite rose 4% on the day. In the European morning on Tuesday, the USD Index stays in a consolidation phase at around 101.50, while US stock index futures lose between 0.2% and 0.35%.

The improving risk mood made it difficult for Gold to find demand on Monday. XAU/USD remained under heavy bearish pressure throughout the day and fell more than 2.5%. Early Tuesday, the pair stages a rebound and trades above $3,250.

EUR/USD turned south in the European session on Monday and ended up losing more than 1% on a daily basis. The pair recovers slightly in the European morning and trades slightly above 1.1100.

USD/JPY gained more than 2% on Monday and advanced to its strongest level since early April above 148.60. The pair corrects lower and trades below 148.00 to begin the European session. Bank of Japan (BoJ) Deputy Governor Shinichi Uchida said on Tuesday that there are both upside and downside risks from US tariffs on Japan’s prices.

GBP/USD holds steady at around 1.3200 to start the European session on Tuesday. The UK's Office for National Statistics reported earlier in the day that the ILO Unemployment Rate edged higher to 4.5% in the three months to March from 4.4% in February, as expected. Other details of the report showed that the Claimant Count Rate remained unchanged at 4.5% in this period, while the wage inflation, as measured by the changed in the Average Earnings Excluding Bonus, declined to 5.6% from 5.9%.

After losing more than 0.6% on Monday, AUD/USD gains traction on Tuesday and trades in positive territory above 0.6400. The data from Australia showed earlier in the day that the Westpac Consumer Confidence improved to 2.2% in May from -6% in April.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.