USD/CHF holds losses ahead of the Swiss Real Retail Sales and SVME Purchasing Managers' Index data due on Tuesday.

President Trump complained to Fed Chair Jerome Powell, criticizing him for being “too late” in implementing rate cuts.

Traders are awaiting upcoming US labor data to gain fresh insights into the Fed interest rate decision in July.

USD/CHF extends its losing streak for the seventh consecutive session, hitting fresh lows not seen since September 2011, trading around 0.7920 during the Asian hours on Tuesday. The pair remains subdued ahead of the Real Retail Sales and SVME Purchasing Managers' Index (PMI) data release from Switzerland.

Switzerland’s KOF Leading Indicator declined to 96.1 in June from 98.6 in May. The readings came in below market forecasts of 99.3, marking the lowest reading since October 2023 amid negative developments, particularly in the manufacturing sector.

Meanwhile, the Swiss Franc (CHF) faces challenges due to weakening safe-haven demand, driven by the fragile ceasefire between Israel and Iran appears to be holding. Moreover, Iran has adopted a firm stance against the International Atomic Energy Agency (IAEA), with the country’s Foreign Minister Abbas Araghchi summarily dismissing its chief Rafael Grossi’s request to inspect nuclear facilities bombed by Israel and the United States during the conflict.

The USD/CHF pair continues to lose ground as the US Dollar (USD) faces challenges due to growing concerns over the Federal Reserve's (Fed) interest rate outlook. US President Donald Trump has formally raised complaints about high interest rates to Federal Reserve (Fed) Chair Jerome Powell, criticizing Powell as being “too late.” This renewed pressure, along with the tariff-driven impacts on near-term core inflation, makes it difficult for the US Federal Reserve (Fed) to move forward with rate cuts.

Traders are likely to gain fresh impetus on the Fed's monetary policy stance for the July decision by observing the upcoming US employment data during the week. The US June ISM Manufacturing Purchasing Managers Index (PMI) data is due later on Tuesday.

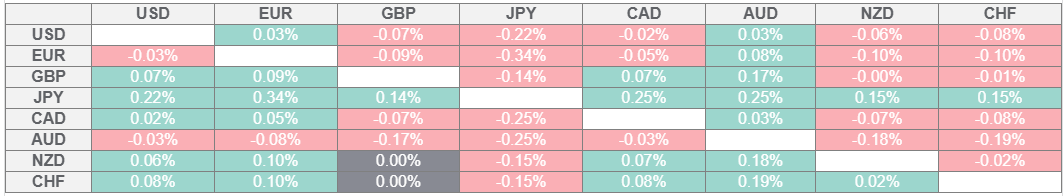

Swiss Franc PRICE Today

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies today. Swiss Franc was the strongest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Swiss Franc from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CHF (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.