ADA and AVAX share bearish outlooks after the SEC delays ETFs

- International Oil Prices Retreat Rapidly; G-7 to Discuss Emergency Oil Reserve Release

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- Crypto’s Great Recovery: Is the Post-Conflict Surge a Sustainable Rally or a Sophisticated Bull Trap?

- WTI recovers to near $86.50 as Strait of Hormuz remains closed

- Gold slumps to near $5,050 on oil-driven inflation fears, stronger US Dollar

The US SEC decided to take additional days to resolve on AVAX and ADA ETF applications.

Avalanche and Cardano technical outlooks suggest a potential trendline breakdown as bullish momentum declines.

Whale activity reveals rising support for Cardano, while confidence in Avalanche drops.

Cardano (ADA) and Avalanche (AVAX) are down 5% to 8% in the last 24 hours, respectively, at press time on Friday, in the aftermath of the US Securities and Exchange Commission (SEC) delaying the decission over the Cardano and Avalanche Exchange Traded Funds (ETFs) filings on Wednesday. Despite the ADA and AVAX technical outlook suggesting downside risk, Cardano’s increased whale activity muddles the sentiment with a hope for a bounce back.

SEC delays Grayscale Avalanche Trust and Bitwise 10 Crypto Index Fund

In a release note on Wednesday, the SEC announced a delay of 45 days to take decisive action on Nasdaq’s request to list and trade Grayscale Cardano Trust as an ETF. This shifts the deadline to July 15 from May 31.

Similarly, the commission decided to delay the Bitwise 10 Crypto Index Fund by 60 days, postponing the deadline to July 31 from June 1.

Cardano and Avalanche print strikingly similar price action

Cardano and Avalanche are down by almost 14% over the last seven days, indicating a pullback phase in motion. ADA tests a crucial support trendline on the daily chart as it forms the third consecutive bearish candle.

The previous lows on April 16 at $0.59 and May 6 at $0.64 form a short-term support trendline where the intraday candle struggles to hold above the waters. A daily closing below the trendline could lead to an extended decline to the next support level at $0.64.

ADA/USDT daily price chart. Source: Tradingview

A bounce back in Cardano could face overhead resistance at $0.84, a peak formed on May 10.

Similarly, AVAX tests a short-term support trendline formed by the previous lows on April 7 at $14.66 and May 7 at $19.09. Avalanche trades at $21.80, experiencing an intraday loss of over 2% at press time, with the daily candle struggling above the support trendline.

A closing below the trendline could plunge AVAX to $19.09, the next support level.

AVAX/USDT daily price chart. Source: Tradingview

On the flip side, a reversal in Avalanche from the trendline could challenge the supply zone at $25.61.

The momentum indicators suggest a significant drop in bullish momentum in Cardano and Avalanche. The Moving Average Convergence/Divergence (MACD) and its signal line are approaching the centre line after a recent bearish crossover. Furthermore, the Relative Strength Index (RSI) steps under the halfway line in both altcoins, reflecting a gradual increase in bearish momentum.

Whales prefer Cardano over Avalanche in the short term

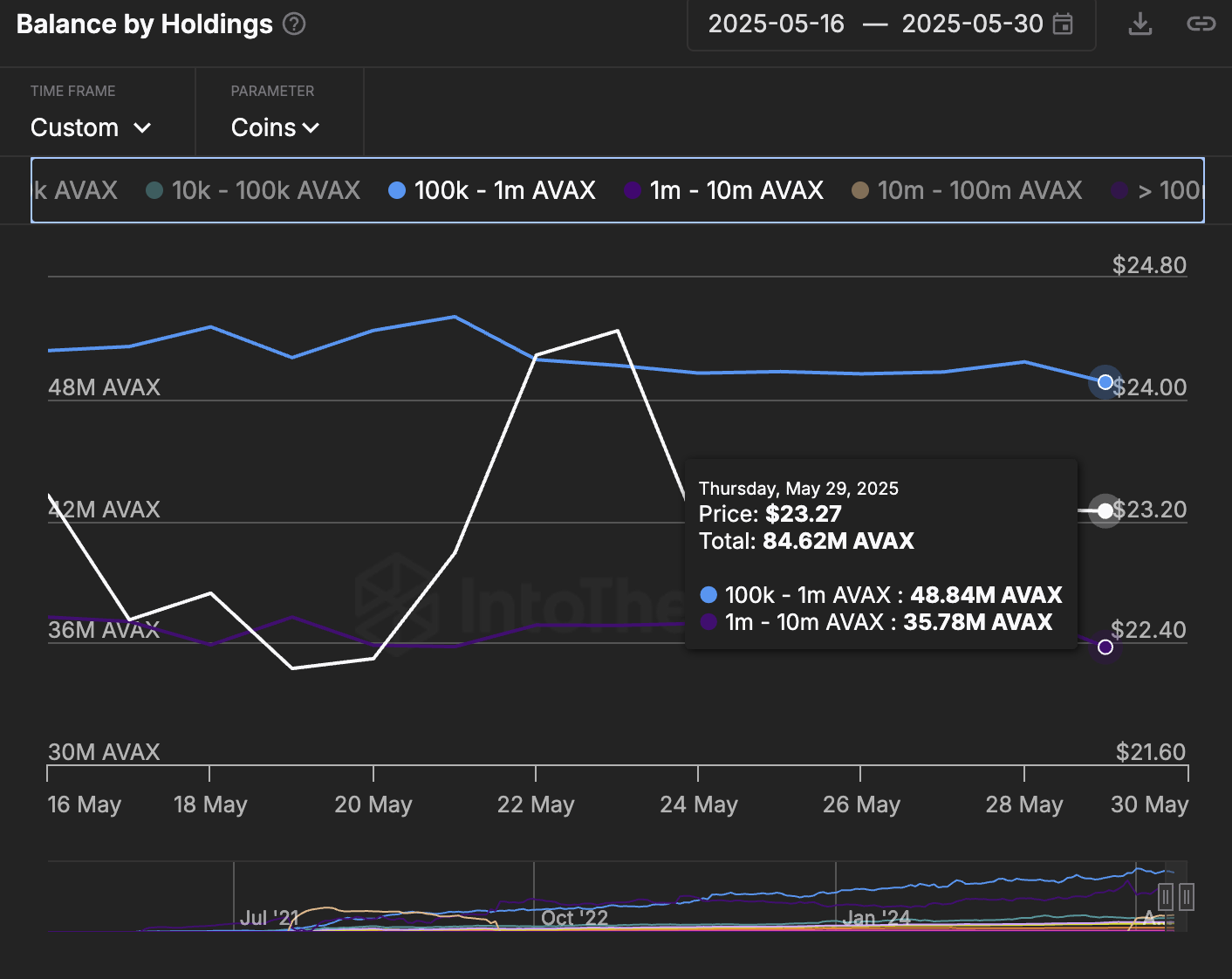

According to IntoTheBlock’s balance by holdings data, large Avalanche investors are dumping AVAX tokens over the last two weeks. Investors with 100K to 10 million AVAX tokens offloaded 3.03 million, reducing their holdings to 84.62 million.

Balance by Holdings. Source: IntoTheBlock

However, confidence in Cardano grows as Santiment's data reveals that whale holdings with 10 million to 100 million ADA tokens have witnessed an inflow of 220 million ADA tokens, resulting in a 36.16% rise.

[11-1748593027816.22.34, 30 May, 2025].png)

Cardano Supply Distribution Chart. Source: Santiment

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.